Focus on ETF portfolio restructuring season: Funds estimated to sell 48.2 million MWG shares

As predicted by many securities companies, MWG shares were officially removed from the VN Diamond portfolio basket due to not meeting the P/E ratio requirements. It is estimated that funds sold 48.2 million MWG shares in this portfolio restructuring.

The Ho Chi Minh City Stock Exchange (HoSE) officially announced the results of the index portfolio review for the first quarter of 2024. The new indexes will take effect from May 6 and related ETFs will restructure their portfolios by the deadline of May 3.

Accordingly, the new index portfolio will include 18 stocks, including 10 stocks in the financial sector and 8 stocks other than the financial sector. In addition, 10 stocks in the financial sector will be subject to a capitalization ratio limit of 40%, according to HoSE regulations.

According to calculations by the Center for Analysis & Investment Consulting of SSI Securities Corporation, there are currently 3 ETFs using the VN Diamond index as a reference, including DCVFMVN DIAMOND, MAFM VNDIAMOND and BVFVN DIAMOND with a total net asset value of about VND 15,748 billion as of April 15, 2024. The DCVFMVN Diamond fund alone currently has a total asset value of about VND 15,294 billion. The total fund asset value decreased by 11.4% compared to the beginning of the year, of which the net capital withdrawal value was VND 4,229 billion and NAV increased by 19.5% compared to the beginning of the year.

SSI Research estimates that the fund will sell 48.2 million MWG shares from its portfolio. On the other hand, funds are estimated to buy about 472,000 BMP shares when this stock is selected for the portfolio basket. In addition, some stocks are estimated to be significantly purchased by the fund due to increased proportion such as VRE (15 million shares), HDB (13.6 million shares) and GMD (9.6 million shares).

Meanwhile, the VN30 portfolio has no changes in composition this period. Currently, there are 4 ETFs using the index as a reference, including DCVFMVN30, SSIAM VN30, MAFM VN30, and KIM Growth VN30 with total estimated assets of VND8,432 billion.

The DCVFMVN30 fund alone currently has a total asset value of about VND 7,253 billion. The total asset value of the fund has decreased by -3.7% compared to the beginning of 2024, NAV increased by 8.5% compared to the beginning of the year, and the net capital withdrawal value is VND 968 billion since the beginning of the year.

The VN FinLead Index also has no changes in composition. The current index portfolio has 20 stocks. As of April 15, 2024, the SSIAM VNFIN Lead ETF Fund has a total asset value of about VND 1,534 billion. Specifically, the total asset value of the fund has decreased by 33.4% compared to the beginning of 2024, NAV increased by 14.2% compared to the beginning of the year, the fund has been withdrawn by VND 1,050 billion since the beginning of the year.

|

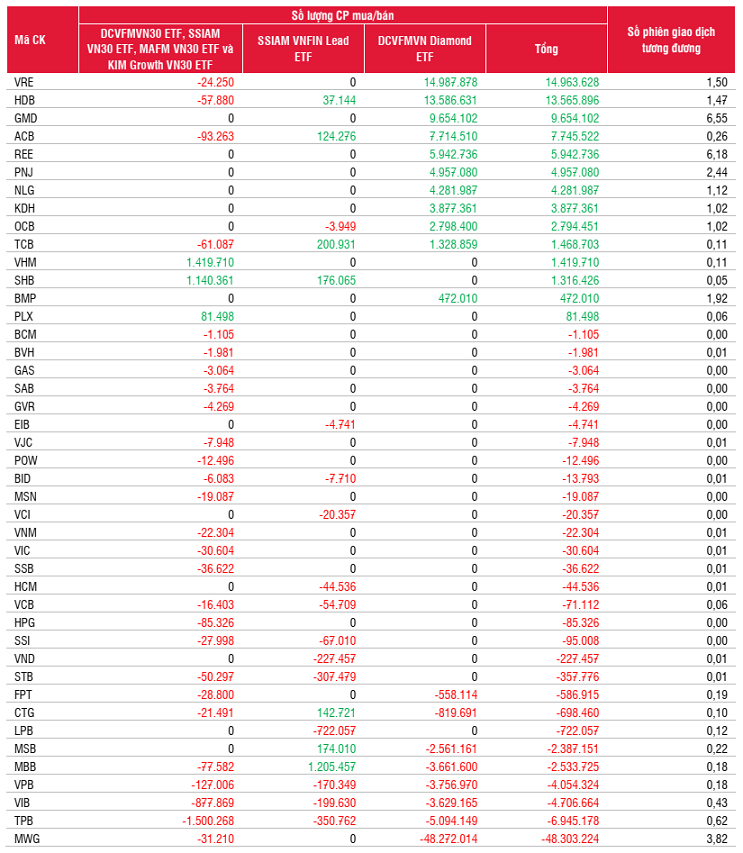

| List of stocks bought/sold the most during the restructuring period of ETF portfolios related to VN Diamond and HoSE-Index. |

According to data as of April 15, 2024, summarizing changes in the number of shares bought and sold by ETF funds related to VN30, SSIAM VNFIN Lead ETF fund and DCVFMVN Diamond ETF fund, MWG shares are the focus when they are at the top of the list of funds sold during this restructuring period. Next are a series of bank stocks including TPB (-6.9 million shares), VIB (-4.7 million shares), VPB (-4 million shares), MBB (2.5 million shares) ...

Meanwhile, it is estimated that there is still large buying power during the restructuring period, concentrated in VRE (nearly 15 million shares), HDB (13.6 million shares), GMD (9.6 million shares) or ACB (7.7 million shares).

MWG stock selling pressure may be less intense

Responding to shareholders' questions about the possibility of MWG shares being removed from the VN Diamond index at the 2024 Annual General Meeting of Shareholders held on the afternoon of April 13, Mr. Nguyen Duc Tai, Chairman of the Board of Directors of MWG, said that Mobile World's business results for the 2022-2023 period were not good, so MWG shares no longer meet the criteria to be included in the index baskets, which is the strategy of each fund.

“If we do well, funds will be interested in adding us to their portfolios. If we do poorly, funds will remove us, which is a normal decision. I believe that Mobile World will return to efficiency this year, everything will improve, and perhaps funds will consider buying MWG shares,” Mr. Nguyen Duc Tai shared with shareholders.

Compared to November when the DCVFM Diamond ETF held about 60 million MWG shares, the selling pressure from the ETF's portfolio restructuring was somewhat less intense as the number of shares had decreased significantly.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)