Reporter: Currently, the Tax sector is promoting the application of AI to control electronic invoices and manage risks. In your opinion, how effective has this been?

MISA General Director Le Hong Quang: When AI is applied to management, the results are certainly huge, especially in the field of risk management. In fact, each year, millions of invoices are issued by businesses and business households. If controlled manually, detecting violations and fraud will take a lot of time and it is easy to miss abnormalities. Meanwhile, AI helps solve this problem effectively.

The AI system can automatically analyze invoice data in real time, identify suspicious points, detect signs of fraud such as: businesses with low revenue but issuing a large number of high-value invoices; invoices issued by businesses with a history of tax violations; businesses with unusual transactions in terms of time, frequency, invoice value, etc.

Previously, tax officials had to manually check and compare each data to detect violations. But with AI, the system can screen millions of invoices in just a few seconds, helping tax authorities promptly issue warnings and take appropriate inspection measures. This not only helps prevent invoice fraud from the beginning but also contributes to reducing state budget losses, creating a more transparent business environment.

In addition, AI can also support taxpayers, helping them declare and fulfill their tax obligations more conveniently. Virtual assistant tools using AI can guide tax declarations and answer tax policies automatically, helping businesses comply with regulations more easily without having to waste time waiting for responses from tax officials.

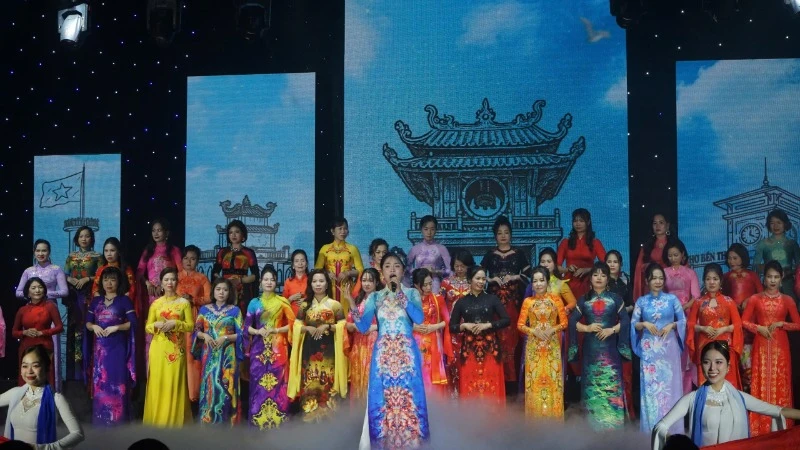

|

Mr. Le Hong Quang, General Director of MISA Joint Stock Company. |

Reporter: For AI to be most effective in tax management, what conditions are needed, sir?

MISA General Director Le Hong Quang: For AI to truly become an effective tool in tax management, we need to focus on three important factors:

First, perfect the digital data infrastructure. AI only works effectively when there is a complete, accurate and interconnected data system between tax, customs, banking and other relevant agencies. Currently, the tax sector has an electronic invoice system, but it needs to continue to expand connectivity and data synchronization capabilities so that AI can analyze and identify risks better.

Second, have the right investment mechanism. AI is not a technology that can be deployed alone but requires a long-term investment strategy. Some AI tools can be used for free, but for specialized applications such as tax risk analysis, fraud detection, investing in modern AI systems is necessary.

Currently, many countries have integrated AI into their national tax systems to control invoices, forecast revenue and monitor compliance. Vietnam is also moving in this direction and fortunately, Resolution No. 57-NQ/TW, dated December 22, 2024 of the Politburo on breakthroughs in science, technology, innovation and national digital transformation has created favorable conditions for the digital transformation process and the application of AI in state management. The important issue is to develop an AI implementation roadmap that is suitable for Vietnam's budget and tax management characteristics.

Third, in terms of human factors, it is necessary to strengthen training and improve the capacity of tax officials. AI can replace some repetitive tasks, but humans still play an important role in analyzing, making decisions and controlling AI. Therefore, tax officials need to be trained to use AI effectively, know how to exploit data and coordinate with AI to optimize management processes.

Reporter: One concern is that AI could reduce the role of humans in the tax industry. What is your view on this?

MISA General Director Le Hong Quang: Currently, ministries and branches are streamlining according to Resolution No. 18-NQ/TW of the 12th Central Executive Committee on continuing to innovate and streamline the political system's apparatus to be lean, effective and efficient, leading to changes in the scale of operations from the central ministry and branch level to the local management apparatus. In the context of a limited number of civil servants but an increasing workload, digital transformation and AI application become increasingly important.

It is true that AI can replace humans in some repetitive, manual tasks. But that does not mean that AI will put people out of work. Instead, AI helps people focus on more important tasks.

In the Finance industry, first of all, there needs to be AI tools to support civil servants in each specific task. Currently, with the development of technology, we have mentioned AI assistants a lot. If each civil servant has a specialized AI assistant to help them do their work, the productivity and quality of work will double.

For example, instead of having to check each invoice manually, tax officials can use AI to detect risks, then focus on in-depth analysis and make decisions. Thus, AI does not replace but supports tax officials to work more effectively.

Furthermore, AI also opens up many new career opportunities. As technology develops, the Tax industry will need data experts, AI engineers, risk analysts, etc. These jobs not only help improve labor productivity but also create more value for the finance - tax industry.

However, AI investment needs to depend on the application level. There are free applications, but there are also paid applications that require a larger budget investment. For government agencies, AI investment will need an appropriate budget to solve the industry's big problems.

In fact, in the era of global digitalization, science, technology and innovation are not only the driving force but also the key for Vietnam to develop. Resolution No. 57-NQ/TW of the Politburo clearly affirmed: Science, technology, innovation and digital transformation are "top priority breakthroughs" in the country's new growth model. This is an important foundation, creating favorable conditions for State agencies in the process of applying AI to digital transformation, especially in sectors such as finance, tax and budget management...

And of course, tax workers should be prepared by equipping themselves with knowledge, skills and especially learning how to master AI. Only by mastering AI can we create a superior advantage, improve work efficiency and not worry about being "outdone" by this wave of technology.

Reporter: Thank you very much!

Source: https://nhandan.vn/ung-dung-ai-trong-quan-ly-tax-va-kiem-soat-rui-ro-post864975.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)