The durian business segment has become an outstandingly profitable investment for Dak Lak Rubber Investment Joint Stock Company (UPCoM: DRI), compared to other crops such as rubber or cashew.

Dak Lak farmers harvest durian - Photo: THE THE

Dak Lak Rubber Joint Stock Company (Dakruco), the enterprise that owns more than 60% of DRI's capital, has just announced its business plan for 2025.

In 2025, DRI expects to harvest 640 tons of durian, with an average yield of about 62kg per tree. The company has about 30 hectares of Dak Lak Rubber Company Limited in Laos (Daklaoruco).

Dakruco's management board predicts that the cost price per kilogram of durian next year will be VND30,596 and per ton, this fruit can be sold for more than VND50 million.

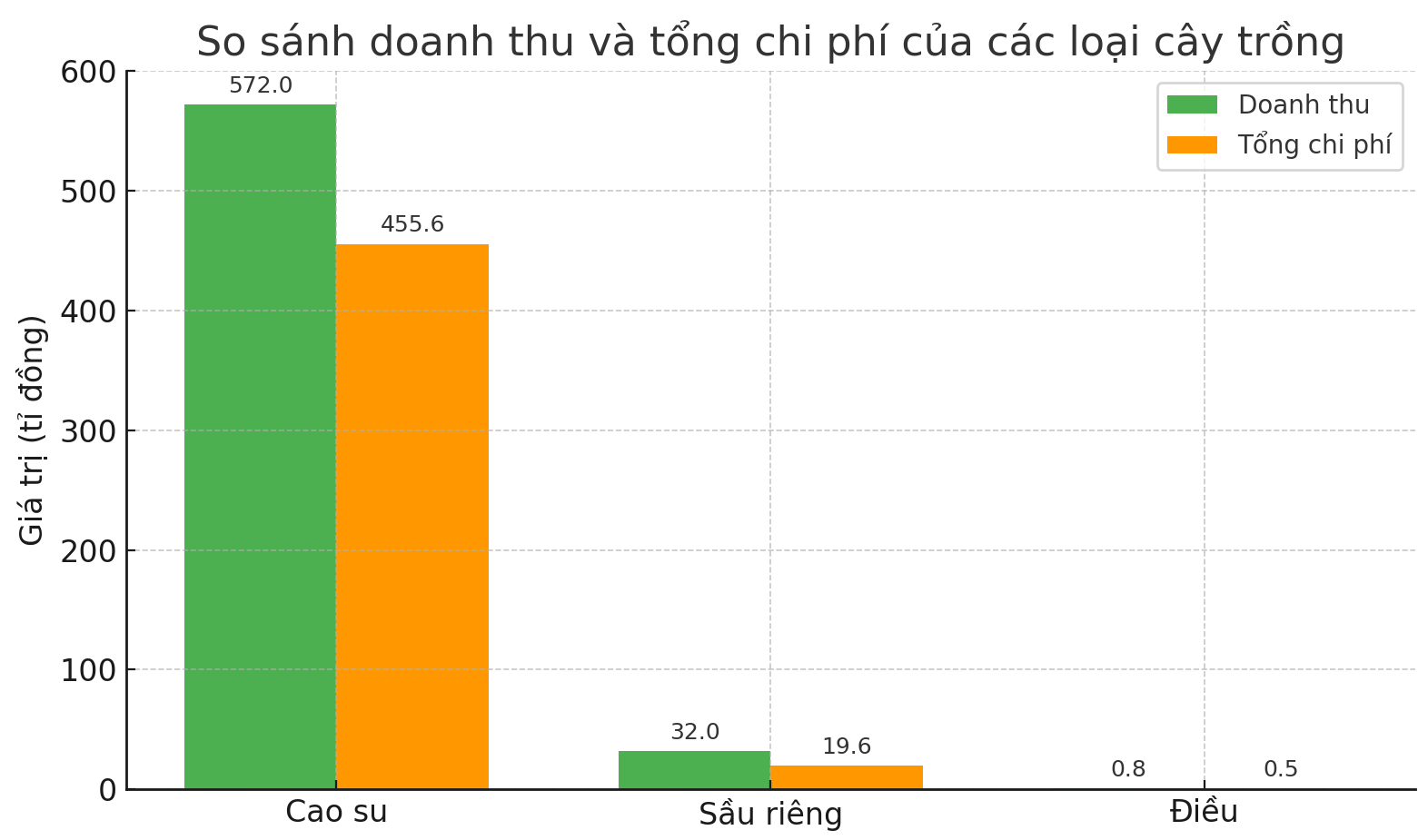

DRI's durian sales revenue in 2025 is expected to reach more than 32 billion VND, while the total cost is only about 19.6 billion VND.

Laos is currently the largest foreign investment market for Vietnamese enterprises.

According to the Lao Ministry of Planning and Investment, there are about 417 investment projects from Vietnam in Laos, with a total approved value of more than 4.9 billion USD.

Of which, about 680 million USD are investment projects in the agricultural sector.

According to the 2023 annual report, DRI's durian orchards are planted with the Dona variety and will start harvesting from 2024, with an estimated annual output of about 300 tons.

Although it is the "youngest" product contributing to the company's overall business results, durian is already a product that brings high profits to DRI.

In Q3-2024, this fruit brought in about 12.4% of net revenue but contributed up to 20% of gross profit for the company.

Last quarter, durian brought in nearly 17.7 billion VND in revenue for the company, while the cost price was only about 5.5 billion VND; equivalent to when collecting 100 VND from durian, the company made a profit of nearly 70 VND.

In addition, rubber latex revenue in the period reached 125 billion VND, while the cost of goods sold was nearly 78.8 billion VND. That means when collecting 100 VND from rubber, the company makes a profit of nearly 37 VND, much lower than the durian segment.

Meanwhile, the banana growing segment did not bring business efficiency. The company lost 43 million VND from banana products in the third quarter of 2024, with revenue in the period reaching 472.6 million VND, and the cost of goods sold was 9% higher.

According to the 2023 annual report, DRI's board of directors said the company had demolished more than 10,000 banana trees to create growing space for durian orchards.

DRI's revenue and total cost plan (rounded) for crops in 2025 - Source: DAKRUCO

According to the General Department of Customs, in the first 11 months of this year, Vietnam's durian exports reached about 3.1 billion USD, an increase of 44% over the same period last year.

This fruit is expected to account for nearly half of the country's total fruit and vegetable export turnover this year.

In 2025, DRI's total revenue is expected to reach nearly 613 billion VND (mainly from the rubber segment) and after-tax profit of nearly 110 billion VND.

The company's rubber exploitation area next year is expected to be more than 8,200 hectares, with an average yield of about 1.65 tons/hectare.

Dakruco's management estimates DRI's cost of production per ton of finished rubber next year at $1,350 and the average latex price at around $1,695 per ton.

Dakruco continues to implement the plan to reduce ownership ratio at DRI.

Most recently, Dakruco issued a resolution to sell more than 18.1 million DRI shares, by order matching and/or negotiation on the stock exchange, with a starting price of VND14,300/share.

The transaction is expected to take place from December 19, 2024 to January 17, 2025. If the transaction is completed as planned, Dakruco will only own about 36% of DRI's capital.

Source: https://tuoitre.vn/trong-sau-rieng-o-lao-mang-ve-lai-cao-cho-cao-su-dak-lak-20241228123601731.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)