The EUR continued to decline against major currencies in the G10 group - the group of 10 most traded currencies in the world.

|

| The euro faces multiple challenges ahead of the US election. Consumers shop at a supermarket in Berlin, Germany. (Source: Xinhua) |

In the trading session on October 22, the EUR exchange rate fell below the important level of 1.08 USD/EUR. Observers predict that the common European currency will likely continue to weaken in the coming time.

The euro's decline came after the International Monetary Fund (IMF) downgraded its economic growth forecast for the Eurozone.

The euro fell more than 3% against the dollar last month, falling below $1.08 - its lowest level since August 2.

The currency also weakened against the British Pound, Swiss Franc and AUD, seeing declines of 0.77%, 1.47% and 1.54% respectively over the same period.

Below-target inflation, a weakening economy and political uncertainty have contributed to the weakness of the EUR.

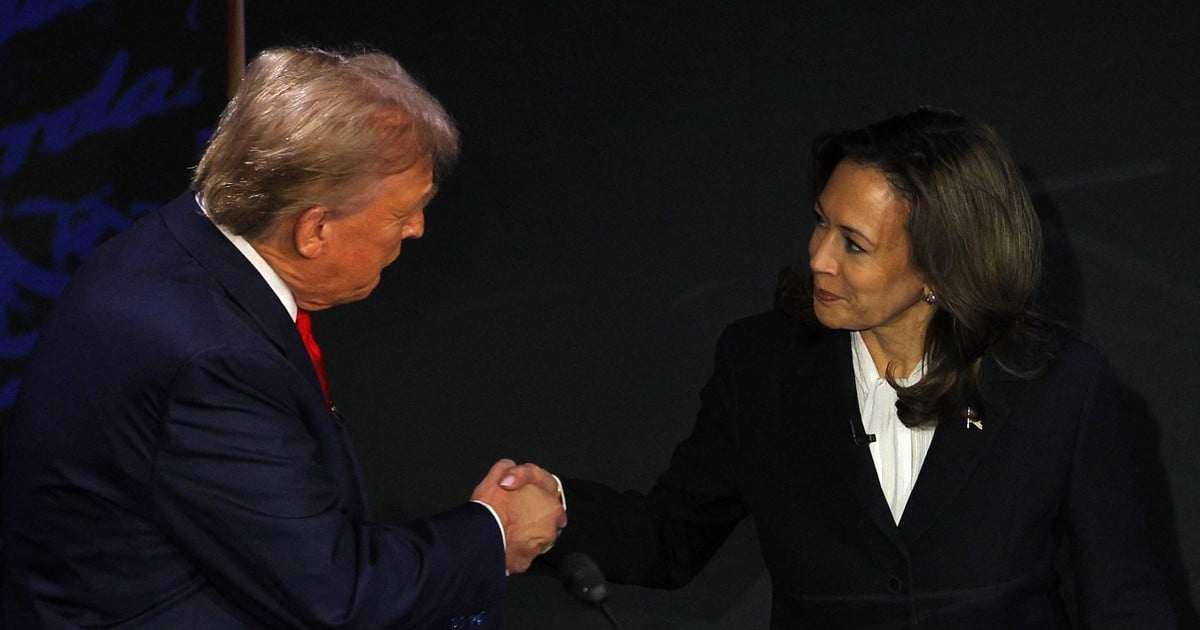

Traditionally, the US election plays a major role in shaping currency market trends. As such, global market trends will be heavily influenced by the US presidential election on November 5, with markets now betting more on a possible victory for former President Donald Trump.

Similar to the trend in 2016, the US dollar strengthened during Mr. Trump's presidency, mainly due to the US-China trade war.

This time, the situation could become more serious as Mr. Trump announced that he would impose tariffs on Europe and other countries, raising concerns about a second trade war.

"The European economy, already hit by 10% tariffs from the US and a sluggish economic outlook in China, is facing an increasing risk of recession," said Dilin Wu, research strategist at Pepperstone.

If this happens, the European Central Bank (ECB) may be forced to cut interest rates more sharply to keep the EUR low and maintain export competitiveness.

Analysts from Deutsche Bank AG, JPMorgan Private Bank and ING Groep NV all warned that the euro risks falling to parity with the dollar if Donald Trump is re-elected.

Economists believe that Mr. Trump's proposed 60% tariff on Chinese goods, along with a 10% tariff on imports from other countries, will put pressure on prices in the United States, forcing the Federal Reserve (Fed) to raise interest rates again.

These expectations have underpinned the strength of the US dollar, further supported by positive US economic data.

Eurozone inflation fell below the ECB's 2% target, at 1.8% in September 2024, leading the ECB to cut interest rates for the third time this year.

At the annual meeting of the IMF and World Bank (WB) on October 22, ECB President Christine Lagarde reaffirmed that the process of reducing inflation is still ongoing, but noted that the pace of reduction still depends on upcoming economic data.

The IMF has cut its growth forecast for the eurozone, predicting the region's economy will grow by 1.2% in 2025, down 0.3 percentage points from its estimate in July 2024. Weakness in German and Italian industries is seen as the biggest cause of the slowdown.

Source: https://baoquocte.vn/bau-cu-my-2024-thi-truong-goi-ten-ong-trump-eur-tut-doc-da-suy-yeu-chua-dung-o-do-291339.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)