At the recent online conference of the banking industry, the State Bank of Vietnam said it is revising the VND120,000 billion preferential loan package for the development of social housing and workers' housing in a more preferential direction. Because, after more than 1 year of implementation, this package has only disbursed less than 1%, about VND1,144 billion.

Further interest rate reduction for home buyers

On June 20, speaking with a reporter from Nguoi Lao Dong Newspaper, Permanent Deputy Governor of the State Bank Dao Minh Tu confirmed that the agency is studying to amend some contents of this credit package and will soon submit it to the Government for approval.

According to Mr. Tu, the State Bank plans to increase the size of the loan package by encouraging more commercial banks to participate along with the 4 banks (Vietcombank, BIDV, Agribank, Vietinbank) that have been implementing it for over a year. At the same time, the preferential interest rate will be increased so that borrowers will enjoy an interest rate of about 5%/year, 3 percentage points lower than the average medium and long-term loan interest rate of the 4 banks Vietcombank, BIDV, Agribank, Vietinbank.

However, according to Mr. Tu, borrowers will only enjoy this incentive for the first 5 years, after which the incentive will gradually decrease and will end after 10 years so that borrowers do not rely on it. Enterprises (DN) doing social housing will keep the incentive rate reduced by 1.5-2 percentage points compared to the normal loan interest rate.

"The remaining issue is for relevant ministries and sectors to focus on resolving other barriers, especially expanding the subjects eligible to buy social housing so that a large number of people can access this credit package," said Mr. Tu.

The VND120,000 billion preferential loan package for social housing development is a program that four state-owned commercial banks voluntarily mobilized capital to implement from April 2023, with interest rates 1.5-2 percentage points lower than normal loan interest rates. This credit package was disbursed with the expectation of contributing to realizing the goal of building 1 million social housing units by 2030.

However, after one year of implementation, in addition to the four state-owned commercial banks, two more private commercial banks have joined, TPBank and VPBank, with an amount of VND5,000 billion each, but the disbursement result is less than 1%, or about VND1,144 billion. Of this, about VND1,100 billion is for investors in 11 projects, the rest are home buyers.

The State Bank explained that the reason for the slow disbursement was due to complicated regulations on beneficiaries, making it difficult for people to borrow preferential loans. Meanwhile, Minister of Construction Nguyen Thanh Nghi pointed out that the reason was due to the limited announcement of the list of social housing projects eligible for loans. Currently, there are still 59 projects that have started construction but have not been included in the list of eligible loans of localities.

In addition, some investors do not meet credit conditions, such as not ensuring credit balance conditions; not having other assets to mortgage (social housing projects are exempt from land use fees so they are not eligible for mortgage); or have borrowed from other credit institutions.

In addition, the Ministry of Construction also found that although the State Bank has lowered interest rates twice, to 8% for investors and 7.5% for home buyers, these rates are still high, and the preferential period is short, within 3-5 years, so "it has not really attracted borrowers".

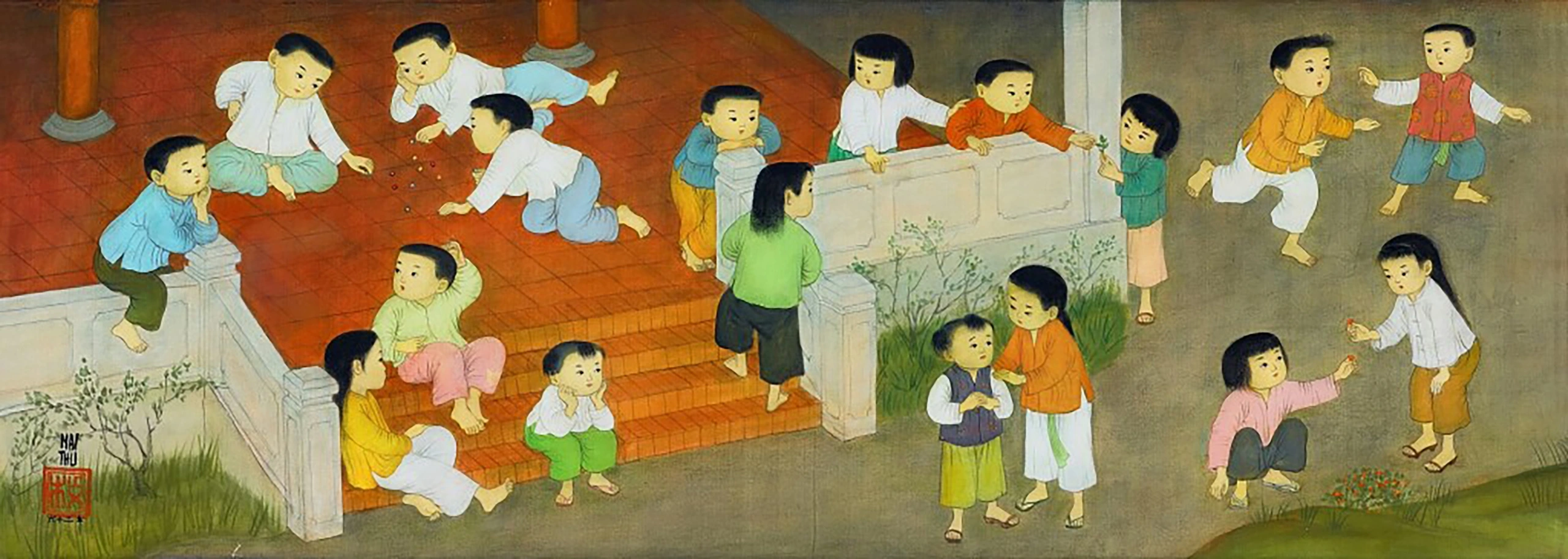

Le Thanh social housing apartment building, Binh Tan district, Ho Chi Minh City. Photo: TAN THANH

Proposal to add loan objects

To resolve these problems, Minister Nguyen Thanh Nghi said that at the end of April 2024, the Ministry of Construction issued guidelines on determining the list of projects, subjects, conditions and criteria for preferential loans. Some procedures have been cut down such as conditions on compensation for site clearance and construction permits, helping investors to soon announce their loan list to access the VND 120,000 billion credit package.

In addition, the Ministry of Construction also requested that enterprises proactively review the subjects and conditions, and register with the People's Committees of provinces and centrally-run cities to be announced in the list of preferential loans from the 120,000 billion VND support package.

From the perspective of enterprises, Mr. Nguyen Hong Luong, Chairman of the Board of Directors of Ho Chi Minh City Social Housing Development Investment Joint Stock Company, said that in order to promote the effectiveness of the VND120,000 billion credit package, agencies related to licensing must actively support enterprises in building social housing. "We only need to consider using public land in accordance with planning, allowing enterprises to negotiate compensation for site clearance and relocation to create a clean land fund.

It is important that big cities like Ho Chi Minh City, Hanoi, Da Nang, etc. should allow enterprises to include the land clearance fee in the product price even if the land price has not been determined. Accordingly, enterprises are allowed to account for no more than 10 million VND/m2 of compensated land, and construction costs are allocated within about 1 million VND/m2 of construction floor, which will help social housing prices be more suitable to the needs and capabilities of low-income people," said Mr. Luong.

Meanwhile, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, proposed to consider expanding the loan package to two more subjects: buyers of commercial housing priced at VND3.5 billion/unit or less and landlords who can borrow to build new or renovate and upgrade boarding houses for workers and laborers to rent.

Because according to Mr. Chau, in essence this is not a preferential social housing credit package but only a commercial credit package, with interest rates 1.5 - 2 percentage points lower than commercial lending rates, for investors and home buyers in social housing projects, worker housing...

Mr. Pham Van Duong, Director of Agribank Binh Trieu Branch, the unit that is conducting capital financing procedures for a social housing project in Ho Chi Minh City, said that customers who are eligible to borrow to buy houses in this project will have access to VND120,000 billion. The lending interest rate is implemented according to the agreement between the bank and the customer but is always 1.5-2 percentage points lower than the commercial lending interest rate.

Regarding the loan term, according to Mr. Duong, after investors complete all legal documents of the project, the bank will disburse the loan within 3 years to implement the project. As for home buyers, the bank will base on income to determine the loan term. For example, currently a social housing apartment has a selling price of 2-3 billion VND, requiring a family to accumulate 15 million VND/month to pay the capital and interest monthly. With this financial level, the bank will determine the loan term of about 15 years to suit the customer's ability to repay the debt.

Source: https://nld.com.vn/them-giai-phap-cho-goi-tin-dung-120000-ti-dong-19624062021540596.htm

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

Comment (0)