Pressure from negative fluctuations in the world stock market after the Fed meeting decision made domestic investors pessimistic. The whole market recorded 441 stocks decreasing, while only 243 stocks increased.

Pressure from negative fluctuations in the world stock market after the Fed meeting decision made domestic investors pessimistic. The whole market recorded 441 stocks decreasing, while only 243 stocks increased.

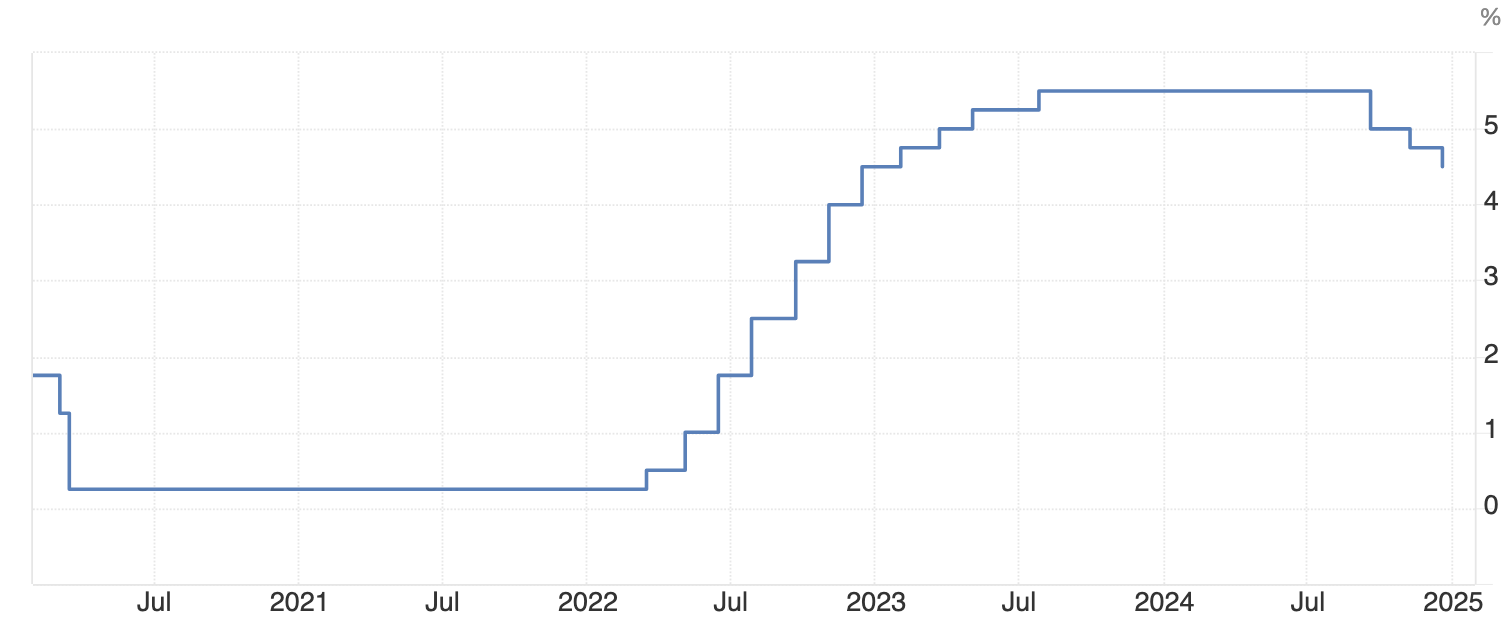

In the trading session on December 19, strong selling pressure pushed a series of stock groups below the reference level in the early morning. The indices therefore fell simultaneously. Investor sentiment was pessimistic in the face of negative fluctuations in the world stock market after important information from the meeting of the Federal Open Market Committee (FOMC) - the monetary policy-making body of the US Federal Reserve (Fed) cut the federal funds rate by 25 basis points to around 4.25 - 4.5%. This is the third interest rate cut this year by this central bank, bringing the interest rate level to the same level as in December 2022.

In addition to the 0.25% rate cut, the Fed has signaled that it will likely only cut rates two more times in 2025, a “deceleration” from the FOMC’s previous projections when the dot plot was last updated in September of this year, according to the Dot Plot.

|

| The Fed cut interest rates for the third time this year. |

In addition, the increase in exchange rate, the State Bank selling a large amount of USD, the expiration of VN30 index futures contracts, etc. also negatively impacted investor sentiment. Selling pressure remained throughout the morning session and the index had almost no significant recovery.

In the afternoon session, trading was still somewhat negative as the recoveries were insignificant. Selling pressure remained high while demand was very thin. However, with the recovery at the end of the session, VN-Index did not close at the lowest level of the session. Meanwhile, the good recovery helped HNX-Index close in the green.

At the end of the trading session, VN-Index decreased by 11.33 points (-0.89%) to 1,254.67 points. HNX-Index increased by 0.11 points (0.05%) to 227.54 points. UPCoM-Index decreased by 0.34 points (-0.37%) to 92.73 points.

The entire market recorded 441 stocks decreasing while only 243 stocks increased and 898 stocks remained unchanged/no trading. However, the market still had 19 stocks hitting the ceiling and 12 stocks hitting the floor.

|

| Red dominated the trading session on December 19. |

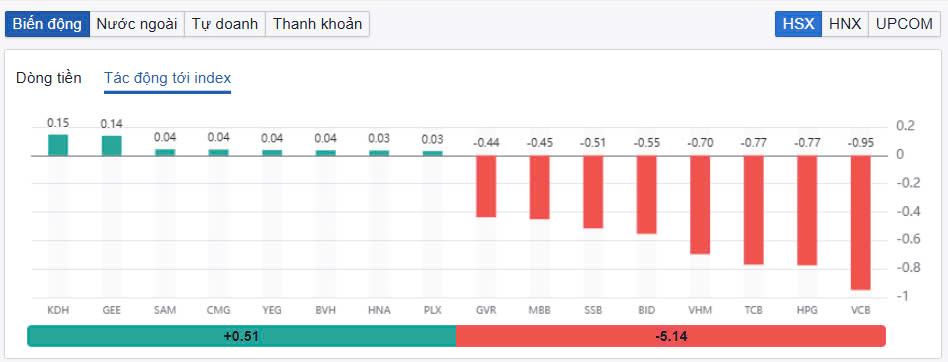

Red dominated most stock groups in the session on December 19. In the VN30 group, there were only 2 stocks that increased in price, BVH and PLX, while 26 stocks decreased in price. Stocks such as SSB, BCM, TCB, HPG, VHM... decreased quite strongly and negatively affected the VN-Index. VCB decreased by 0.75%, but with its very large capitalization, this stock had the most negative impact on the VN-Index, taking away 0.95 points. HPG decreased by 1.83% and took away 0.77 points, TCB also took away 0.77 points when it decreased by 1.86%.

BVH increased slightly by 0.38% today. In addition, insurance stocks were a rare bright spot when green dominated. BLI increased by 4%, ABI increased by 2.8%, MIG increased by 2%... In addition, oil and gas stocks also fluctuated quite positively when PGS was pulled up to the ceiling price, PVB continued to increase by 3%, OIL increased by 2.5%, PVS increased by 1.8%.

Meanwhile, a series of industry groups such as real estate, securities, retail... were all in red. In the real estate group, TCH fell sharply by 2.6%, PDR fell by 2.55%, NLG fell by 2.4%, CEO fell by 2.1%, NTL fell by 1.8%. KDH is a rare "top" real estate code that kept green in today's session when it increased by 1.7%.

In the securities group, codes such as VND, SHS, CTS, FTS, HCM... were all in red. SSI had an unexpected performance when most of the trading session fluctuated in red. However, SSI received good support at the end of the session and rose to the reference level.

The total trading volume on HoSE reached over 779 million shares, equivalent to a trading value of VND17,811 billion. Of which, matched transactions reached VND15,400 billion, up 74%. The trading value on HNX and UPCoM reached VND1,173 billion and VND1,409 billion, respectively.

HPG ranked first in terms of total market transaction value with 817 billion VND. SSI followed with a value of 791 billion VND. FPT also traded more than 711 billion VND in today's session.

|

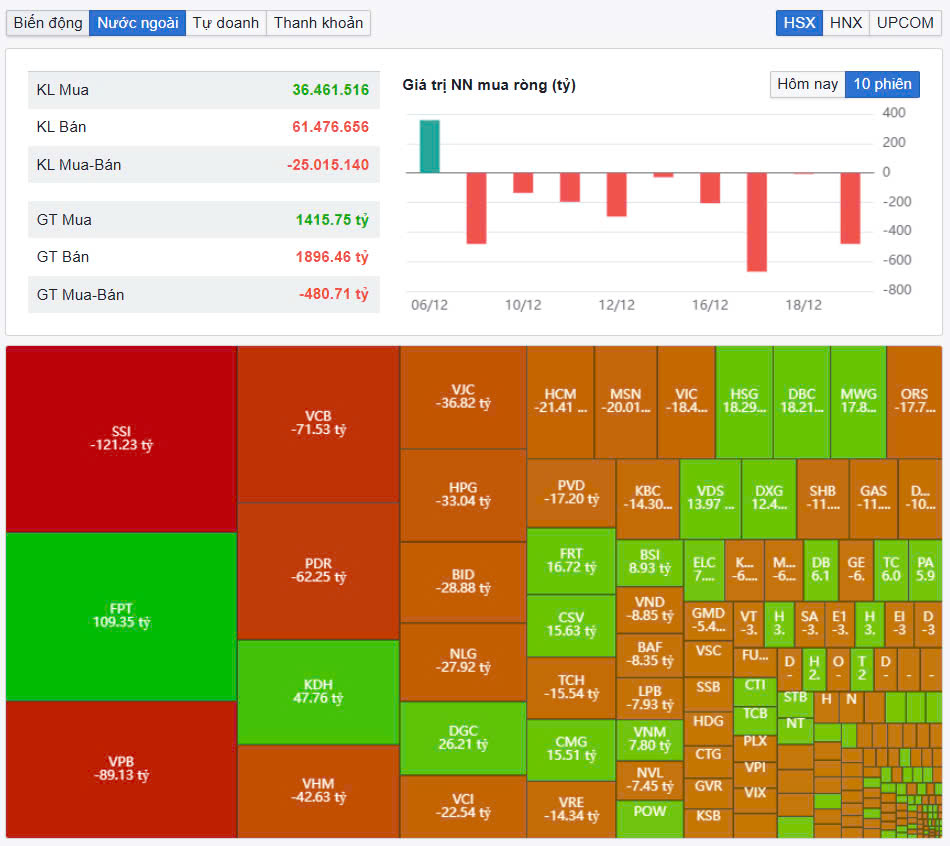

| SSI was the most net sold stock in the session on December 19. |

Foreign investors net sold about 480 billion VND in the whole market. Of which, foreign investors net sold the most SSI code with 121 billion VND. VPB and VCB were net sold 89 billion VND and 72 billion VND respectively. In the opposite direction, FPT was net bought the most with 110 billion VND. KDH was behind with a net buying value of 48 billion VND.

Source: https://baodautu.vn/tam-ly-bi-quan-bao-trum-vn-index-giam-hon-11-diem-phien-1912-d233031.html

Comment (0)