At the end of the session on August 19, the VN-Index increased by 9 points (+0.75%), closing at 1,261 points.

Following the upward momentum of the last session of the week, Vietnamese stocks continued to be green as soon as they opened on August 19. Demand for many large-cap stocks such as VCB, VNM, and GAS created a positive premise, pushing the general indices up in the morning session.

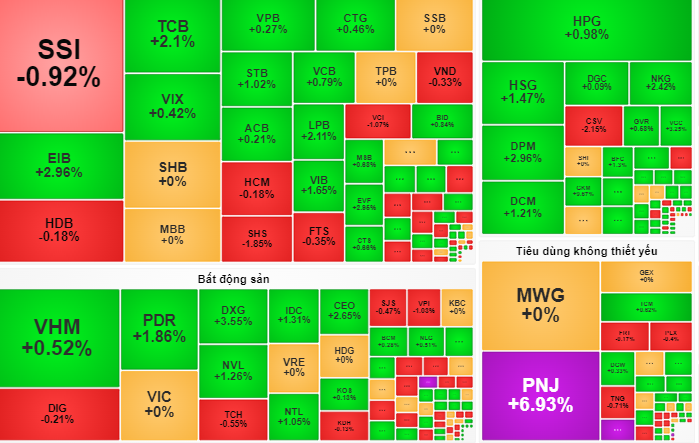

Entering the afternoon session, although the trading speed was slow, the market still maintained an upward trend, when more than 267 stocks on the HoSE maintained green.

At the end of the session, the VN-Index increased by 9 points (+0.75%), closing at 1,261 points. The group of utility, consumer - retail stocks had the best increase of 2.6%, in which the most notable was the stock price increase to the ceiling (6.93%). On the contrary, the group of securities stocks decreased slightly by 0.5%.

In the group of 30 large stocks, 18 codes increased in price: VNM (+3%), SAB (+2.7%), GAS (+2.3%), TCB (+2.1%), VIB (+1.7%) ...; 4 codes closed in red: SSI (-0.9%), PLX (-0.4%), HDB (-0.2%), FPT (-0.1%).

According to Mr. Nguyen Huy Phuong, Deputy Head of Individual Customer Consulting Department - Rong Viet Securities Company (VDSC), with the slowing down at the end of the session on August 19, there is a possibility that the market will have an adjustment phase in the next trading session to re-examine the supporting cash flow. Therefore, investors need to slow down to observe supply and demand, limit chasing stocks at rising prices, and consider good price areas to close short-term profits.

Meanwhile, Vietcombank Securities Company (VCBS) and several other securities companies said that market indicators are rising. This shows that active buying liquidity is increasing, helping many stocks extend their upward trend. Therefore, the VN-Index may continue to advance to the 1,280 point area.

"Investors can consider increasing the proportion of stocks that are attracting cash flow. Notable sectors are securities, banking, consumer - retail" - Mr. Tran Minh Hoang, Director of Research and Analysis of VCBS, recommended.

Source: https://nld.com.vn/chung-khoan-ngay-mai-20-8-suc-mua-co-phieu-se-tot-hon-196240819180853477.htm

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

Comment (0)