In his opening speech, National Assembly Chairman Vuong Dinh Hue said that in order to meet urgent practical requirements, based on the provisions of the Constitution and laws, the National Assembly Standing Committee decided to convene the 5th extraordinary session of the 15th National Assembly to consider and decide on important contents.

Regarding the draft Law on Land (amended), after being accepted and revised, the draft Law consists of 16 chapters and 260 articles (removing 5 articles and revising 250 articles compared to the draft Law submitted to the National Assembly at the 6th Session). Up to now, the draft Law has fully grasped and institutionalized the viewpoints and contents of Resolution No. 18-NQ/TW dated June 16, 2022 of the 5th Conference of the 13th Party Central Committee, in accordance with the Constitution, in sync with the legal system, and qualified to be submitted to the National Assembly for consideration and approval at this Session.

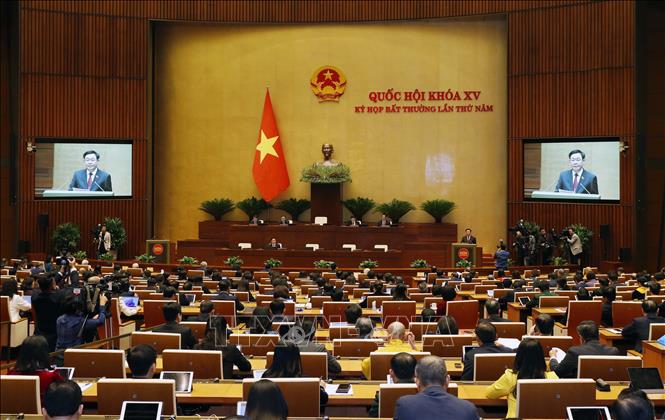

National Assembly Chairman Vuong Dinh Hue delivers the opening speech at the 5th Extraordinary Session of the 15th National Assembly. Photo: Nhan Sang/VNA

The draft Law on Credit Institutions (amended) contains many specialized contents, which have a direct impact on financial and monetary policies and macroeconomic stability. Therefore, the National Assembly Chairman requested that National Assembly deputies carefully and comprehensively study, contribute comments, complete and consider voting to pass the draft Law to meet practical requirements, ensuring the safety, soundness, transparency, stability and sustainability of the banking system and credit institutions.

The National Assembly Chairman said that regarding a number of specific mechanisms and policies for the National Target Programs, implementing the Resolution on thematic supervision at the 6th Session, the Government has submitted to the National Assembly for consideration and decision to apply a number of specific policies to remove difficulties and obstacles, speed up the progress and effectiveness of the implementation of the 3 National Target Programs.

At this session, the National Assembly will consider, comment and decide on a number of important and urgent financial and budgetary issues.

The contents decided at this Session are of great importance not only for the implementation of the socio-economic development plan for 2024 but also for the entire term, and have fundamental, strategic, and long-term significance. The National Assembly Chairman requested that National Assembly deputies promote democracy, uphold the spirit of responsibility, focus on research, discuss enthusiastically, and contribute many dedicated and quality opinions so that the Session can complete the entire program content with high unity and consensus.

Discussing in the hall about some new contents or different opinions of the draft Land Law (amended) in the morning meeting on January 15, delegates were interested and focused on giving opinions on land valuation methods.

Proposing not to prescribe the surplus method in land valuation, delegate Nguyen Hoang Bao Tran (Binh Duong) explained that the land valuation results when applying the surplus method are carried out on the basis of assumptions and estimates, so the level of reliability is not high for areas with limited actual information and revenue costs to make estimated costs.

"The calculation of assumed factors is very complicated, the valuation results are uncertain, inaccurate, and have large errors. For the same plot of land, just changing one indicator in the assumed factors will change the valuation results. This is the cause of confusion and delay in determining and deciding specific land prices in the past and the understanding of each person is different in different circumstances and times," said delegate Nguyen Hoang Bao Tran.

According to the delegate, in the context of incomplete price databases, land databases, including data on land prices, markets, and land use rights, which have not been fully and transparently developed, "it is necessary to remove a method of land valuation". "In cases where it is necessary to retain this method, there must be a "lock valve" to control the accuracy and appropriateness of land valuation results", said delegate Nguyen Hoang Bao Tran.

During the afternoon session, giving opinions on the draft Law on Credit Institutions (amended), many delegates expressed concerns about the regulation on commercial banks acting as life insurance agents.

National Assembly delegate of Bac Giang province Pham Van Thinh speaks. Photo: Pham Kien/VNA

Delegate Pham Van Thinh (Bac Giang) stated: The maximum discount for life insurance agents with two popular life insurance products (term life insurance and mixed insurance) is 4% for the first year's insurance premium. At commercial banks that are affiliated with life insurance agents, there is a phenomenon of suggesting and forcing loan customers to buy life insurance with an annual payment of 2 - 4% of the loan value. At commercial banks, bank employees are assigned targets for the number of insurance contracts and life insurance premium revenue.

Citing data from some banks, according to delegate Pham Van Thinh, in the period from 2018 to 2022, income from life insurance agents of commercial banks accounts for a very large proportion of the profits of these banks.

With such great reality and benefits, the delegate said that if the draft Law only accepts the direction of adding Clause 2, Article 113: "Commercial banks are allowed to conduct insurance agency activities according to the provisions of the law on insurance business, in accordance with the scope of insurance agency activities according to the regulations of the Governor of the State Bank", there will be no guarantee for the situation of forcing customers to borrow money to buy insurance or taking advantage of the lack of knowledge of customers with savings deposits to buy life insurance products as in the recent past.

Delegates suggested that if the ban on cross-selling life insurance through commercial banks is not implemented, the draft Law should add an article assigning the Government to issue regulations on the trading of insurance products for which commercial banks and credit institutions act as agents to ensure publicity, transparency, and protect the rights of customers borrowing capital as well as depositing savings at banks.

According to VNA/Tin Tuc Newspaper

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)