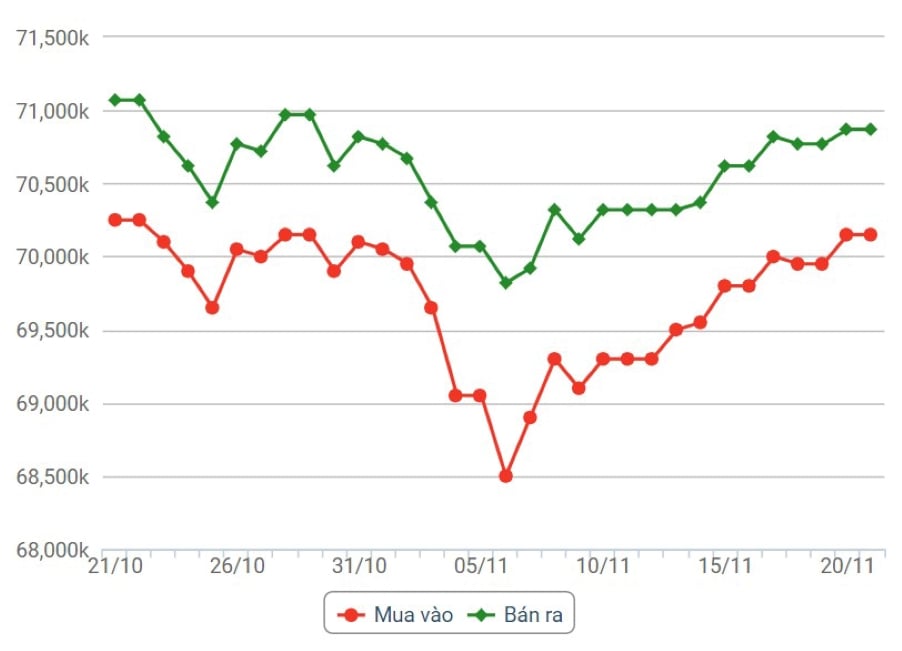

Domestic gold price

Domestic gold price fluctuations

World gold price fluctuations

World gold prices fell despite the USD's plunge. At 5 p.m., the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 103.269 points (down 0.05%).

Tom Barkin, president of the US Federal Reserve Bank (FED) in Richmond, said in a speech on November 20 that inflation is decreasing, but some businesses expect to continue to raise prices, which means the FED needs to maintain high interest rates for a long time.

Gold prices rose sharply after the dollar and Treasury yields weakened as markets bet the US Federal Reserve would not raise interest rates again, with minutes of the central bank’s recent meeting due later in the day.

Some forecasts suggest that the gold market remains positive. Many experts remain optimistic about this precious metal. Demand for gold from central banks around the world remains high. Meanwhile, geopolitical instability remains unpredictable.

However, in the short term, the gold market is expected to be volatile. The market is closed for the Thanksgiving holiday on Thursday.

In the long term, gold is still considered a safe haven for cash flow. The precious metal is forecast to rise back to $2,000/ounce. Some forecasts even believe that gold will break out to $3,000/ounce in 2024.

Source

Comment (0)