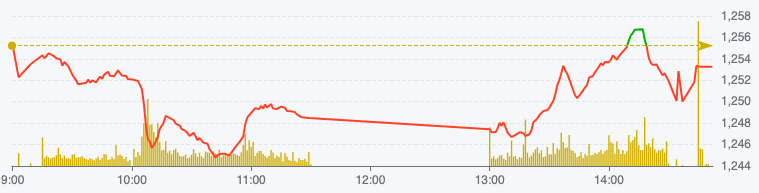

The pessimistic sentiment that pervaded the market caused the indices to be in red right from the opening. Low-price demand when VN-Index traded around the support level of 1,250 points appeared but was not significant.

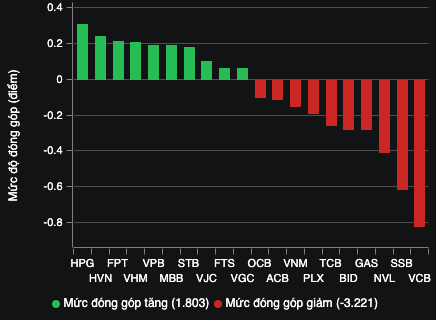

Three stocks VCB, VIC and VHM pushed VN-Index down more than 2 points. Meanwhile, the 10 stocks with the most positive impact only contributed less than 1 point to the general index.

At the end of the morning session on September 11, VN-Index decreased by 6.82 points, equivalent to 0.54% to 1,248.41 points. The entire floor had 80 stocks increasing and 298 stocks decreasing.

VN-Index performance on September 11 (Source: FireAnt).

Entering the afternoon session, buying power joined in, helping the index reverse above the reference at times, but at the end of the session it still decreased by nearly 2 points.

At the end of the trading session on September 11, VN-Index decreased by 1.96 points, equivalent to 0.16% to 1,253.27 points. The entire floor had 170 stocks increasing, 218 stocks decreasing, and 82 stocks remaining unchanged.

HNX-Index decreased 0.23 points to 231.46 points. The entire floor had 53 stocks increasing, 84 stocks decreasing and 61 stocks remaining unchanged. UPCoM-Index decreased 0.04 points to 92.32 points.

Leading the market decline was still VCB, losing more than 0.8 points; at the end of the session, this code decreased by 0.67% to VND88,400/share. Other codes in the banking group such as SSB, BID, TCB, ACB, OCB were also in the top 10 negatively affecting the market and lost a total of 1.2 points. The remaining codes mostly decreased in points, with only a few codes increasing in points such as VPB, MBB, STB, HDB, TPB, EIB.

Red also dominated the real estate group, NVL in particular dropped to the floor price of VND11,850/share after the information of margin cut. On the decline side, for example, codes DIG, VRE, TCH, HDG, CEO, HQC, KHG, KBC, LDG, ASM, VPI, IDC, SCR. On the contrary, codes DXG, VHM, PDR, NTL, TIG, OGC, CCL ended the session in green.

In contrast to the market, technology stocks surged as green dominated. Notable stocks were FPT, CMG, ELC, SRA, ST8, TTN, ITD, UNI. The steel group also had some notable gainers such as HPG, HSG, NKG, KVC, PAS, BCA.

Codes affecting VN-Index (Source: VNDIRECT).

The total order matching value in today's session was VND14,183 billion, down 18% compared to the previous day, of which the order matching value on the HoSE floor reached VND12,843 billion. In the VN30 group, liquidity reached VND5,889 billion.

Foreign investors net bought 7.07 billion VND in today's session, of which they disbursed 1,562 billion VND and sold 1,555 billion VND.

The codes that were sold strongly were MSN 71 billion VND, MWG 60 VND, HPG 55 billion VND, VCB 34 VND, VCI 29 billion VND,... On the contrary, the codes that were mainly bought were FPT 140 billion VND, VNM 66 billion VND, VHM 36 billion VND, PDR 27 billion VND, DXG 26 billion VND,...

Source: https://www.nguoiduatin.vn/nvl-nam-san-co-phieu-bds-va-ngan-hang-gay-suc-ep-len-vn-index-204240911154346098.htm

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)