| Commodity market today, February 29: Strong USD puts pressure on world raw material prices Commodity market today, February 28: MXV-Index hits highest level since early February |

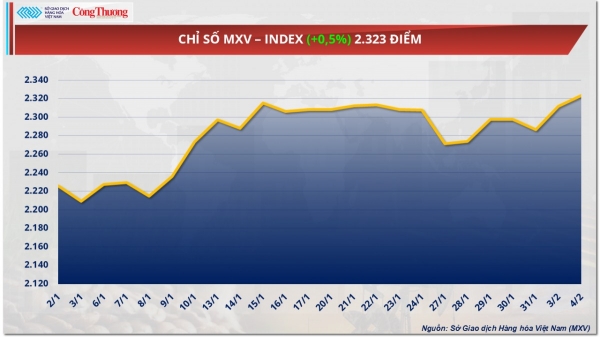

At the end of the day, the price index of 3 out of 4 commodity groups increased, pushing the MXV-Index up 0.23% to 2,130 points. The total transaction value of the entire Exchange increased by more than 41%, reaching nearly 5,200 billion VND. Notably, the agricultural product group strongly attracted investment cash flow in the market yesterday when the transaction value unexpectedly increased by 154% and accounted for 37% of the total transaction value.

Overwhelming purchasing power in the world agricultural market

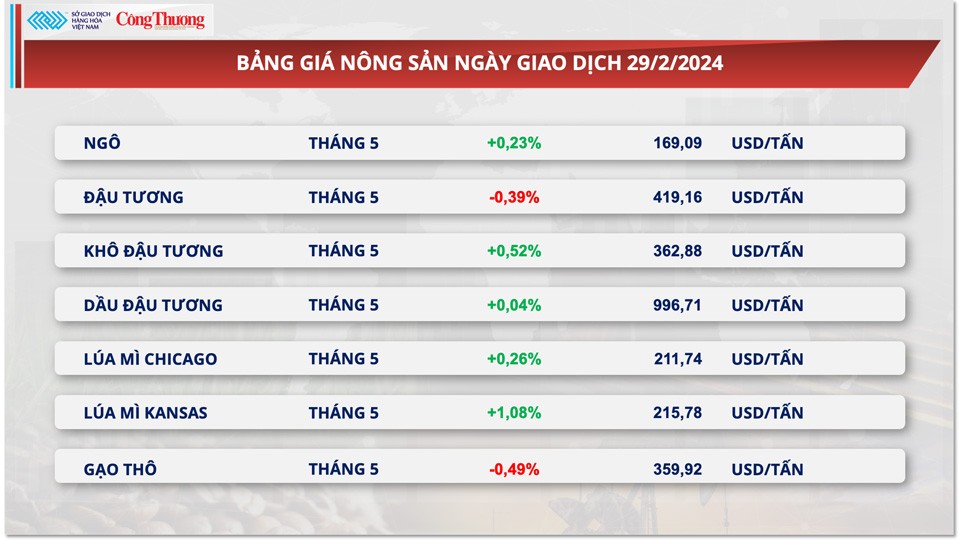

According to MXV, at the end of the last trading day of February, buying power dominated the world agricultural market. Of which, 5/7 items closed in green. In the corn market, prices increased for the fourth consecutive session. Last night, the Export Sales Report was released with relatively positive figures, supporting prices in the last session. In addition, the market received some information about production prospects in the South American region, which also contributed to price movements. At the end of the session, the May futures contract increased by 0.23% compared to yesterday.

|

| Agricultural product price list |

The USDA said that the US sold 1.08 million tonnes of corn for the 23/24 crop year in the week of February 16-22, up nearly 32% from the previous report and above the market average forecast of 900,000 tonnes. Year-to-date, cumulative US corn sales have exceeded 30% compared to the same period in 2023, reflecting that global demand for US corn remains high. This is the driving force that pushed up corn prices in the evening session.

The Rural Economy Department of Deral (Brazil) recently slightly revised up the second corn crop production in Paraná state to 14.63 million tons, 3% higher than in 2022/23, with the planted area expanding by 1% compared to 2023. Favorable weather has returned to support crop development. As the second largest corn crop growing state in Brazil, the increase in Paraná's output has helped strengthen the South American country's production outlook this year. This has put slight pressure on CBOT prices and curbed the corn rally in the last session.

Similar to corn, wheat prices fluctuated strongly, ending the session with an insignificant increase of only 0.26%. The fact that US sales results recorded an improvement of more than 40% in the Export Sales report last night also helped prices recover.

Concerns about the outlook for supplies in Australia, one of the world's largest wheat exporters, also provided some support for prices in the last session. Specifically, the Australian Bureau of Meteorology (BOM) said that the country could have its third warmest summer on record this year. Many areas will experience warmer and drier-than-normal March to May. This could seriously affect the country's wheat yield, which will be planted starting in April.

|

| Wheat prices fluctuate strongly |

In the domestic market, it was recorded that on the morning of February 29, the price of imported South American corn at our ports was relatively stable. At Cai Lan port, South American corn futures for March delivery were at 6,200 VND/kg. For April delivery, the asking price fluctuated at 6,100 - 6,150 VND/kg. Meanwhile, the asking price of imported corn at Vung Tau port was recorded 50 VND/kg lower than the transaction price at Cai Lan port.

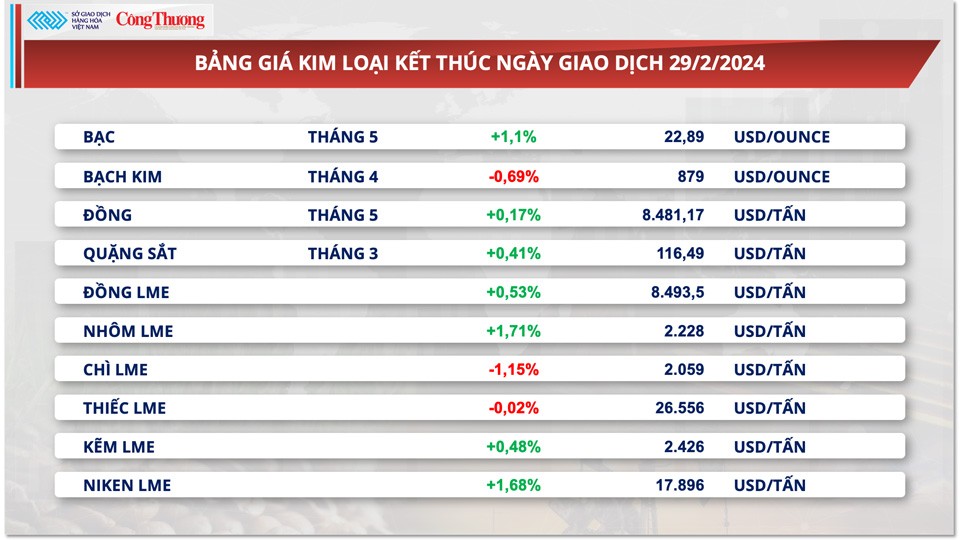

Silver prices surge after US inflation report

At the end of yesterday's trading session, green dominated the metal price chart. For precious metals, silver prices experienced a positive trading session when they increased by 1.1% to 22.88 USD/ounce. In contrast, platinum prices weakened by 0.69% to 879 USD/ounce. The main factor supporting silver prices in yesterday's session was the weakening greenback.

|

| Metal price list |

The USD was squeezed by the Japanese Yen from the morning session. The Yen received very positive buying pressure due to expectations that the Bank of Japan (BOJ) will soon end its loose monetary policy. Yesterday's data showed that inflation in Japan was higher than expected, with the personal consumption price index (CPI) in January 2024 increasing by 2.6% year-on-year, 0.3 percentage points higher than forecast.

In the evening session, the USD continued to weaken after the US released an inflation report in line with forecasts. Specifically, according to the US Bureau of Economic Analysis, the US core personal consumption expenditure (PCE) index in January 2024 increased by 2.8% compared to the same month last year. This figure is in line with forecasts and is the lowest annual increase since March 2021. On a monthly basis, the core PCE index in January increased by 0.4%, in line with analysts' forecasts.

However, platinum prices still ended the session slightly lower as market sentiment turned bearish after the leading mining company warned that platinum prices will not rebound this year. Impala Platinum forecasts a difficult year for platinum in 2024, due to weak investor and consumer sentiment for the precious metal amid prolonged economic and geopolitical uncertainty.

In base metals, COMEX copper rebounded 0.17% to $3.84 a pound. Iron ore closed at $116.499 a tonne, up 0.41%. Both copper and iron ore were supported by bullish sentiment ahead of a key meeting in China next week. Investors are betting that policymakers will continue to roll out stimulus measures to revive the economy this year.

In addition, the pressure on the US dollar also helps support base metal prices, due to reduced transaction and investment costs.

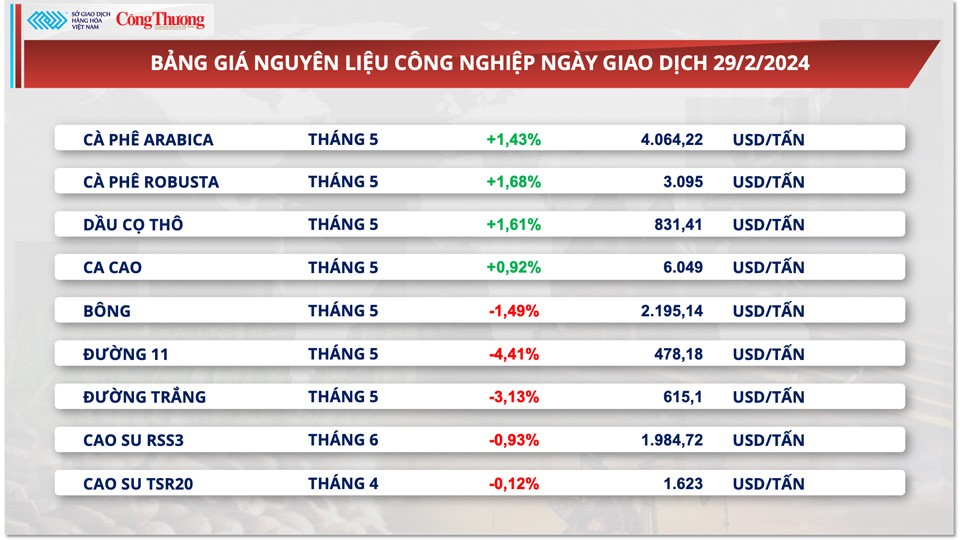

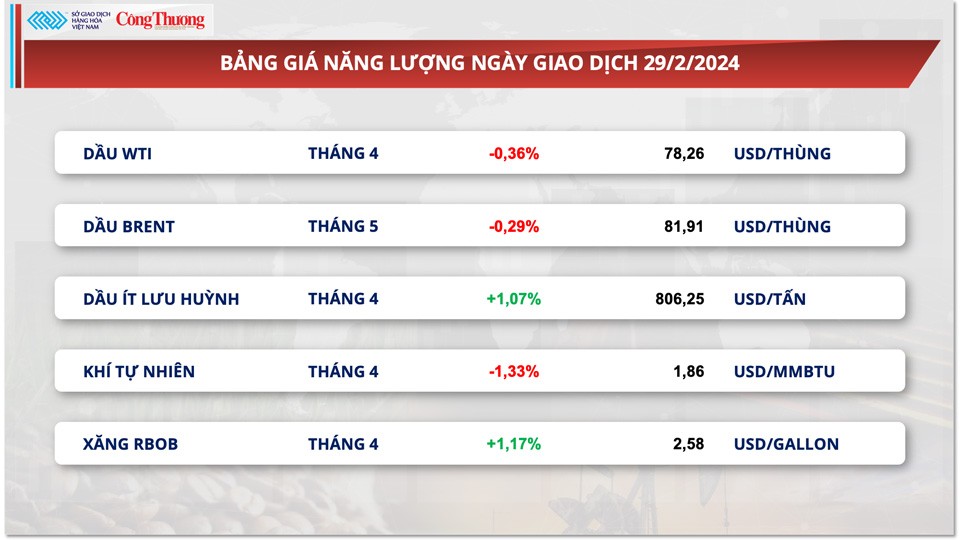

Prices of some other goods

|

| Industrial raw material price list |

|

| Energy price list |

Source

Comment (0)