Profits plummet

According to the consolidated financial report for the second quarter of 2023, An Binh Commercial Joint Stock Bank (ABBank - code ABB) recorded a 20.4% decrease in net interest income compared to the same period last year, down to VND 776.5 billion. Profit from foreign exchange trading activities also decreased by 51.3% to VND 236.6 billion and profit from other activities decreased by 71.3% compared to the same period, down to VND 62.2 billion.

As of June 30, ABBank's total bad debt on the balance sheet was at VND3,820 billion, an increase of nearly VND1,455 billion, equivalent to an increase of 61.5% compared to the beginning of the year.

In contrast, profit from service activities increased by 78.6% over the same period, reaching VND154.6 billion. Profit from trading securities reached VND4.7 billion while in the same period, there was a loss of more than VND7.4 billion. Profit from trading investment securities reached nearly VND81 billion, much higher than the loss of VND11 billion in the same period last year.

In the second quarter of 2023, ABBank's operating expenses for the period were VND550.6 billion, up 12% over the same period last year. As a result, the bank's net profit from business activities decreased by more than 39% over the same period, down to nearly VND765 billion.

Notably, ABBank's credit risk provisioning in the period was 4 times higher than last year, equivalent to nearly VND 700 billion. According to the bank's explanation, the increased provisioning is in accordance with Circular 11/2021/TT-NHNN and will help the bank be more proactive in handling risks in the coming time.

As a result, ABBank's pre-tax profit was VND67 billion in the second quarter, down 94% year-on-year. In the first 6 months of the year, the bank recorded nearly VND679 billion in pre-tax profit, down 59% compared to the first half of last year. Compared to the pre-tax profit plan (VND2,826 billion) set for 2023, ABBank has only completed nearly 1/4 of the journey after the first half of the year.

ABBank's bad debt skyrocketed

As of June 30, 2023, ABBank's total assets were VND 154,447 billion, up 18.6% compared to the beginning of the year. Of which, deposits at the State Bank increased by 13.2% to VND 3,064 billion; Deposits at other credit institutions doubled compared to the beginning of the year, to VND 43,102 billion.

As of the end of the second quarter, ABBank's outstanding customer loans stood at over VND84,020 billion, a slight increase of 2.4% compared to the beginning of the year. However, it is worth noting that the credit quality of this bank has clearly declined.

As of June 30, ABBank's total bad debt on the balance sheet was VND3,820 billion, an increase of nearly VND1,455 billion, equivalent to an increase of 61.5% compared to the beginning of the year. The ratio of bad debt to outstanding loans also increased from 2.88% at the beginning of the year to 4.55%.

In ABBank's debt structure, group 3 debt (substandard debt) increased 2.5 times compared to the beginning of the year to VND1,385 billion. Group 4 debt (doubtful debt) also increased 3.1 times to VND1,311 billion. In contrast, group 5 debt (debt with the possibility of losing capital) was at VND1,124 billion, down 20% compared to the beginning of the year.

Source

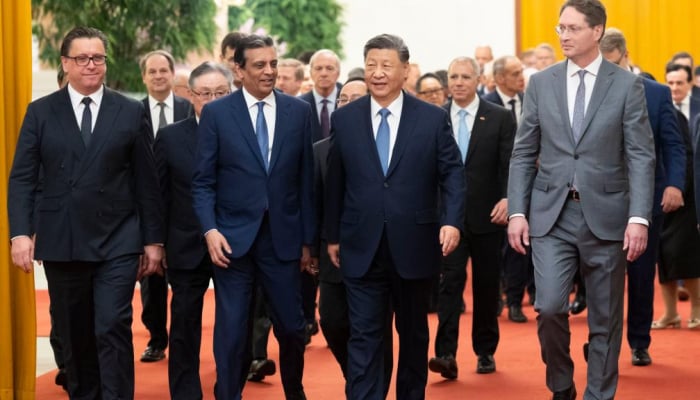

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

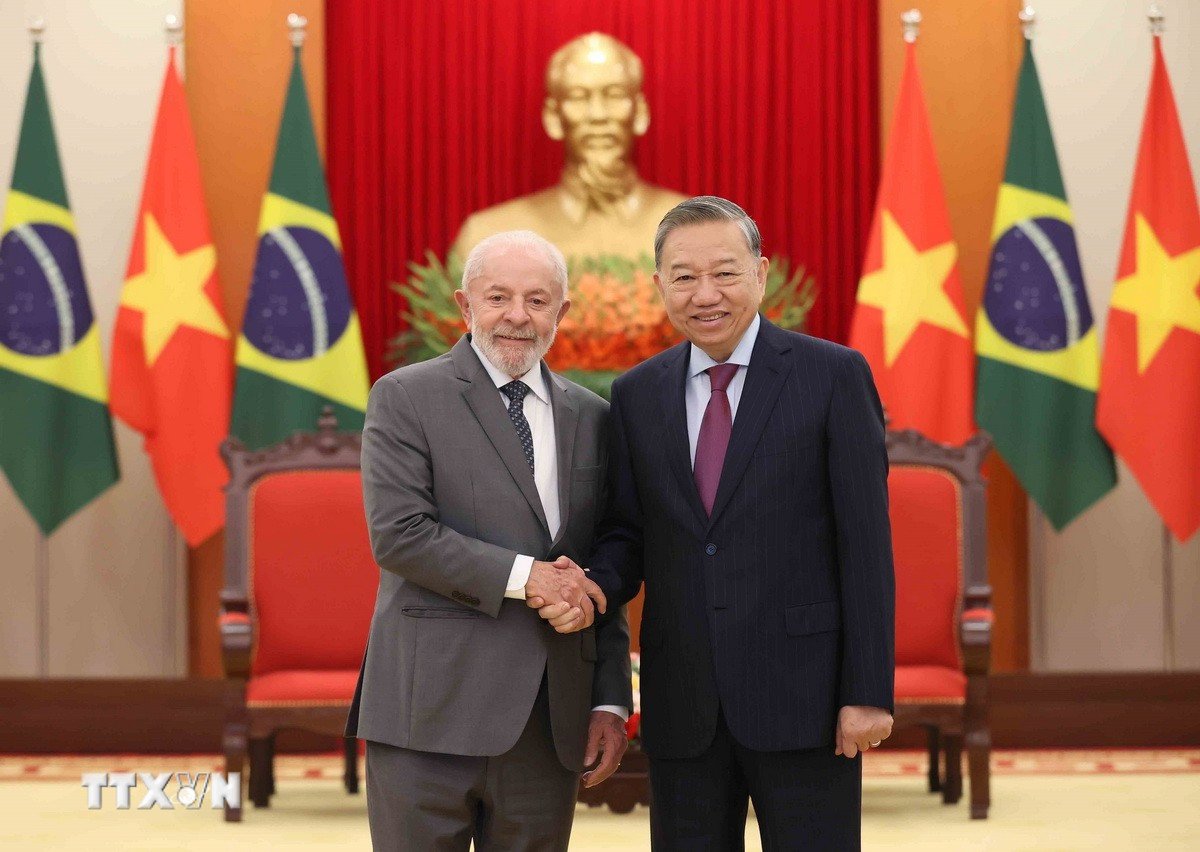

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

![[Photo] President Luong Cuong hosts state reception for Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/56938fe1b6024f44ae5e4eb35a9ebbdb)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

![[Photo] Working overtime to build a house at night](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/9c0474ac4d0d44ceb13ecf7922ab7ab1)

Comment (0)