VSF holds the top position in the entire market with an increase of 800%, many securities stocks also accumulated strong market value last year.

Stocks closed 2023 with the VN-Index up 12.2%. Last year's market was led by mid-cap (VNIMC) and small-cap (VNISC) stocks. According to statistics from the global stock data tracking platform Investing, the VNIMC and VNISC groups increased by more than 33% and 30% respectively, much higher than the increase of more than 12% of the VN30 basket and the HoSE representative index.

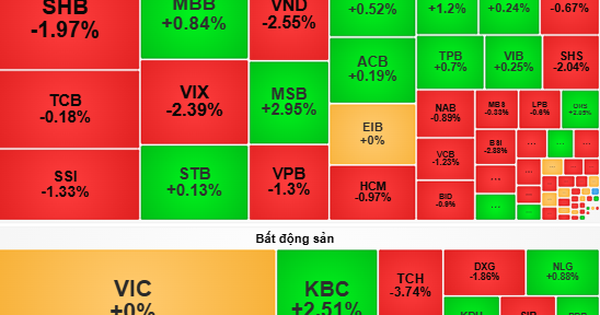

By sector, data from Fiintrade shows that securities, steel, construction, chemicals and information technology groups have outstanding performance with an increase of 35-78%. In contrast, real estate, utilities, industrial goods and services, tourism and entertainment, food and beverage, and insurance are sectors with poor performance compared to the VN-Index.

Correspondingly, the stocks with the strongest growth in 2023 are all small and medium-sized stocks, belonging to the above industries.

On the HoSE floor , the champion is VIX stock when closing the session at 17,100 VND, nearly three times higher than the end of 2022. Limited by the lowest trading amplitude compared to the other two floors (only 7% per session), this code is still in the leading group of stocks with the strongest growth in the whole market. In many sessions, VIX Securities shares played the role of "carrying" the VN-Index when the market price increased sharply and liquidity also reached a high level.

This code made waves when it announced that it had exceeded its profit target after only the first 6 months of the year with VND715 billion in pre-tax profit. Instead of competing for market share and brokerage activities with leading companies, VIX chose to operate actively in the proprietary trading and margin lending segments. This orientation helped the company achieve good business growth results this year.

In the top 10 codes with the best performance in the Ho Chi Minh City market, half are securities stocks. In addition to VIX, the codes BSI, FTS, VDS and CTS are in this group. Securities stocks increased sharply following the general market recovery in terms of scores and liquidity.

The biggest psychological support factor for this group is the expectation that the KRX system (a new information technology system for the HoSE, allowing same-day trading) will be operational by the end of the year, although in reality it has been delayed. In addition, the self-trading, margin and brokerage activities of securities companies themselves also recovered well last year.

On the HNX , the stock with the strongest increase of the year is VE4 of VNECO4 Electrical Construction Joint Stock Company. From the price range of 87,000 VND at the end of 2022, this code had many consecutive waves to pull up to over 288,000 VND after a year, an increase of more than 231%. The market price increased sharply even though this stock was put on warning status from the end of March 2023 because undistributed profit after tax was negative from 2022. After that, the stock was also cut margin due to tax violations. VNECO4's business results were not too positive when the first half of the year was still losing money, in the third quarter, the profit improved but was only a few tens of millions of VND.

In the group with the strongest increase in the Hanoi market, CMS is also a notable code. In September 2023, this stock had increased sharply to 31,000 VND per unit, 4.7 times higher than at the beginning of the year. At that time, the company's board of directors warned that there were many incorrect assessments about CMS, which may have contributed to the unusual fluctuations in stock prices and trading volume in recent times, potentially causing damage to investors. After that, the market price of this code went through many adjustments and closed in 2023 at 19,100 VND, an increase of nearly 190%.

With the highest trading amplitude per session, the UPCoM floor recorded many stocks increasing by hundreds of percentage points in 2023. In which, the codes CEG, TBH, QNT, STW and VSF all accumulated market prices of 4 times or more, much higher than the increase of the top stocks on the other two floors.

VSF of the Southern Food Corporation (Vinafood II) alone is the champion of the entire market. This code was traded around 4,300 VND per unit at the end of 2022. After being put on the warning list at the end of March, VSF's market price did not decrease sharply, only going sideways. By August, this code began to climb to the 40,000 VND area, accumulating 300% in just two weeks in the context of the rice industry receiving many positive news about selling prices. However, investors holding this code were afraid when many sessions recorded the price hitting the ceiling in the morning, then hitting the floor in the afternoon of the same day. The management explained that the stock price depends on supply and demand in the market, and the company has no influence.

VSF increased rapidly and remained around VND40,000 until the end of the year, although Vinafood II's health was still weak. Since 2013, this enterprise has been continuously losing money. The company returned to profit in the third quarter of 2023 but still had an accumulated loss of nearly VND2,800 billion. By the end of 2023, VSF shares increased by 800%. Although the market price skyrocketed, liquidity was still small, only a few million to hundreds of millions per session.

Siddhartha

Source link

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)