At the end of the session on March 31, the VN-Index closed at 1,306.8 points, down 10.6 points, equivalent to 0.8%.

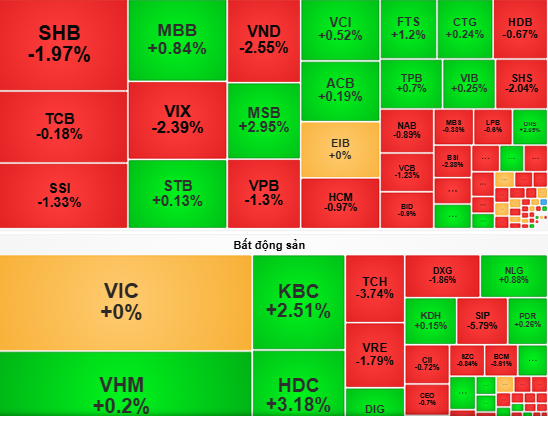

Due to the negative impact of the international market, Vietnamese stocks opened the morning session of March 31 with a decrease in points due to selling pressure from large-cap stocks such as BID, TCB, MWG... The general index at one point dropped to a low of 1,308 points and could not regain the green color.

Entering the afternoon session, the market continued to be immersed in red with strong net selling pressure from foreign investors, making domestic investors uneasy, leading to a stock sell-off.

Notably, in the second half of the afternoon session, rubber stocks such as GVR and PHR hit the floor price, negatively affecting investor sentiment. Foreign investors net sold nearly VND1,282 billion, focusing on selling VNM and HPG.

At the end of the session, the VN-Index closed at 1,306.8 points, down 10.6 points, equivalent to 0.8%.

Dragon Viet Securities Company (VDSC) said that liquidity on March 31 increased compared to the previous session. This shows that the supply of stocks, especially the selling pressure of foreign investors, continues to put pressure on the market.

Therefore, VDSC recommends that investors observe cash flow developments to re-evaluate the market status, structure and balance the portfolio to minimize risks with stocks that have fallen sharply in price.

VCBS Securities Company recommends that investors should not sell stocks immediately, maintain the proportion of stocks that tend to attract cash flow, and wait for the market's equilibrium point to disburse to buy new stocks.

Source: https://nld.com.vn/chung-khoan-ngay-mai-1-4-khoi-ngoai-con-ban-manh-co-phieu-196250331172602104.htm

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

Comment (0)