State Bank issues treasury bills, VN-Index drops nearly 12 points

The information that the State Bank of Vietnam (SBV) will issue treasury bills again after 4 months is considered to have an impact on the psychology of domestic stock investors.

|

| VN-Index down 12 points in first session of the week |

After closing the last trading session of the week with a sharp decrease and a sudden increase in trading volume compared to previous sessions, entering the first trading session of the week on March 11, investor sentiment was still quite cautious and this caused the indices to fluctuate narrowly around the reference level and there was strong differentiation in many stock groups. However, the positive thing here is that the indices mostly traded in mixed colors in the morning session.

In the afternoon session, despite some pressure, VN-Index still maintained its green color until investors received information that the State Bank of Vietnam resumed offering treasury bills after a 4-month suspension. Specifically, the State Bank of Vietnam (SBV) resumed offering treasury bills after a 4-month suspension. The treasury bills have a term of 28 days and are offered by the SBV through the interest rate bidding method and unit price bidding.

Immediately after the above information appeared, strong selling pressure was activated and this pushed a series of stock groups to plummet. However, the positive point can be seen that panic has not occurred and demand for low prices is still there. The market did not record a massive sell-off when HoSE only had 2 stocks hitting the floor.

The banking group still exerted the greatest pressure on the market, in which MBB decreased by 2.8%, LPB decreased by 3.2%, SHB decreased by 2.6%, VPB decreased by 2.4%, VCB decreased by 1.1%... VCB was the stock that had the worst impact on the VN-Index when it took away 1.37 points from the index. VPB also contributed significantly when it took away 0.87 points.

|

| VCB is the stock that has the most negative impact on the general index. |

Besides, large stocks such as GAS, VRE, BCM, BVH, MSN... were also in red and put great pressure on the general market. GAS decreased by 2.1%, VRE decreased by 3.5%, BCM decreased by 3.2%... GAS also took away 0.96 points from VN-Index.

In the group of small and medium-cap stocks, the situation was not quite as great when a series of stocks in the steel, real estate, securities industries... were also sold heavily. In the securities group, names such as VDS decreased by 3.1%, VND decreased by 2.6%, SSI decreased by 1.2%... However, the bright spots were recorded in the two names FTS and CTS when they increased by 2.7% and 1.4% respectively. In particular, FTS has supporting information that MVIS Vietnam Local Index - the underlying index of Vaneck Vectors Vietnam ETF (VNM ETF) was added to the portfolio in this first quarter restructuring period.

In the real estate group, NVL recorded a decrease of 2.7%, DXG decreased by 1.7%, AGG decreased by 4.8%. In the steel group, HPG also suffered strong selling pressure despite being quite excited at times during the session, this stock closed down 1.3%. In addition, POM decreased by 6.2%, SMC decreased by 2.7%, HSG decreased by 2%...

The rare bright spot in today's session came from the rubber and seafood groups, although the differentiation was still relatively strong. In the rubber group, PHR went against the general market when it increased by 4.6%, GVR also increased by nearly 2%. The seafood group also recorded a breakthrough from IDI with an increase of 4.8%, ANV increased by 1.3%...

At the end of the trading session, VN-Index decreased by 11.86 points (-0.95%) to 1,235.49 points. The entire floor had 106 stocks increasing, 392 stocks decreasing and 57 stocks remaining unchanged. HNX-Index decreased by 2.48 points (-1.05%) to 233.84 points. The entire floor had 56 stocks increasing, 124 stocks decreasing and 54 stocks remaining unchanged. UPCoM-Index decreased by 0.57 points (-0.63%) to 90.66 points.

Total trading volume on HoSE reached nearly 976 million shares, worth VND23,858 billion, down from the session at the end of last week. Negotiated transactions contributed VND1,311 billion. Meanwhile, the trading value on HNX and UPCoM was VND2,024 billion and VND724 billion, respectively.

MBB topped the market's order matching list with nearly 35 million shares traded. Following that, VIX, VND, HPG and SHB all matched orders of over 30 million units.

|

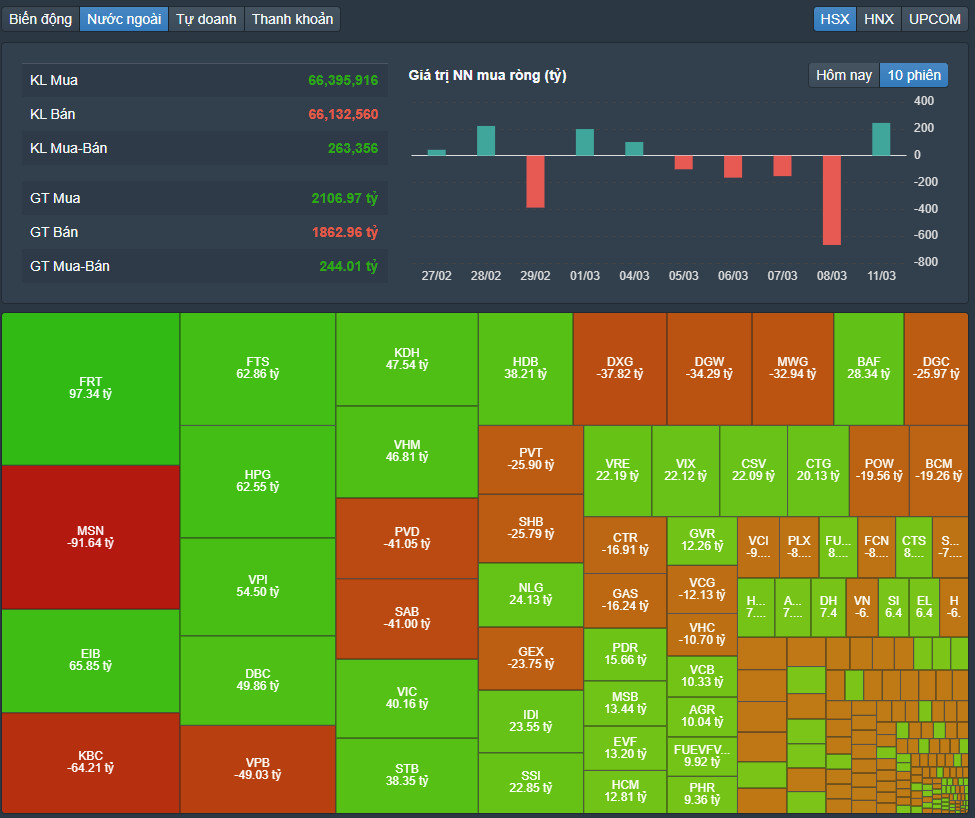

| Foreign investors return to net buying, focusing mostly on FRT code |

Foreign investors returned to net buying VND244 billion on HoSE alone, of which, this capital flow net bought the most FRT code with VND97 billion. EIB and FTS net bought VND66 billion and VND64 billion respectively. On the other hand, MSN was net sold the most with VND92 billion, KBC was also net sold with VND64 billion. Foreign investors on HNX had opposite movements when net selling VND152 billion, of which, this capital flow net sold mainly PVS code with VND98 billion.

Source

Comment (0)