Despite ambitious plans to become carbon neutral and energy self-sufficient by 2060, China remains reliant on fossil fuel imports. Unlike the European Union (EU) – which has “divorced” from Russia for energy – Beijing can still rely on Moscow’s natural gas and oil.

|

| Russia is looking to build the Power of Siberia 2 pipeline to deliver 50 billion cubic meters of natural gas per year to China in the future. Image of the Power of Siberia 1 gas pipeline. (Source: Forbes) |

Nikola Mikovic, a Serbia-based freelance journalist, researcher and analyst, commented so in an article in the South China Morning Post (SCMP), published on July 30.

Cut off from Western markets, Russia - a country whose oil and gas revenues account for nearly 30% of its national budget - aims to find new customers, the journalist said.

Russia has significantly increased its oil exports to India over the past two years. The country is also looking to build the Power of Siberia 2 pipeline to supply 50 billion cubic meters of natural gas per year to China in the future.

Big Project - Siberian Power 2 Uncertain

Russia will become China's top source of crude oil imports in 2023. Moscow's natural gas exports to Beijing will also increase by 61.7% in 2023 compared to 2022. However, journalist Nikola Mikovic said the world's second-largest economy seems to be in no hurry for the Power of Siberia 2 pipeline.

"One of the main reasons for this delay could be price concerns," journalist Nikola Mikovic commented.

As the EU finally “divorces” Moscow’s gas, China is taking advantage of preferential gas prices from Russia. However, energy cooperation with Beijing has not yet allowed Moscow to fully compensate for the loss of the European market.

In 2023, Russia will export only 28.3 billion cubic meters of natural gas to Europe - a small number compared to the 192 billion cubic meters that gas giant Gazprom sold to European countries in 2019, when the special military operation in Ukraine had not yet begun.

Mr. Nikola Mikovic cited that last year, China bought 22.7 billion cubic meters of natural gas from Russia, at a price of 286.9 USD/1,000 cubic meters. Meanwhile, the Kremlin charges more to European countries, selling natural gas at 461.3 USD/1,000 cubic meters.

Despite being able to buy gas at a lower price than Europe, journalist Nikola Mikovic notes that some reports suggest Beijing is expected to pay close to the price of Russian domestic gas - around $84 per 1,000 cubic meters.

“More importantly, Asia’s largest economy is expected to commit to buying only a small portion of the planned annual capacity of the Power of Siberia-2 pipeline. The Kremlin, at least for now, does not seem ready to make such major concessions to its strategic partner. Therefore, the implementation of the Power of Siberia-2 project remains uncertain,” Nikola Mikovic stressed.

The question is also: Does China need another pipeline to supply Russian natural gas? Currently, Beijing is still buying gas through Power of Siberia 1.

Like Europe, the world's second-largest economy also aims to diversify and expand its gas import sources. Geography plays a key role in Beijing's energy policy.

Therefore, not only buying Russian gas, gas from countries such as Turkmenistan, Myanmar, Kazakhstan and Uzbekistan is also "flowing" to China.

China's natural gas imports will reach 250 billion cubic meters by 2030, which could be almost entirely covered by existing contracts with its suppliers, experts say. Beijing also plans to buy large amounts of liquefied natural gas (LNG) from Australia, Qatar and Russia.

|

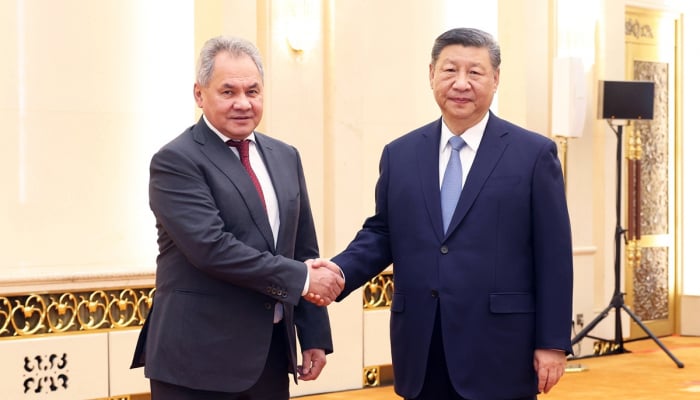

| China is taking advantage of preferential gas prices from Russia. (Source: Reuters) |

Who needs who more?

But looking further ahead, according to journalist Nikola Mikovic, China’s gas imports could reach 300 billion cubic meters per year by 2040. Half of this volume is expected to be covered by existing contracts. As a result, Beijing still has to reach an agreement with Moscow on the Power of Siberia 2 pipeline.

However, President Xi Jinping's country has ambitious plans to be carbon neutral and energy self-sufficient by 2060. Therefore, it is not out of the question that China will seek to significantly reduce its dependence on fossil fuels.

Beijing is poised to develop a green hydrogen industry as well as increase production of ammonia, methanol and green biomass to help meet the country’s energy needs. Following Beijing’s “historic surge” in installing solar, wind and other renewable energy sources last year, renewables are expected to be the dominant source of energy in China between 2035 and 2040.

Even if China fails to achieve all its ambitious plans regarding the transition from fossil fuels to renewable energy, it is unlikely that Power of Siberia 2 will soon become the country's top energy priority, journalist Nikola Mikovic predicts.

On the Russian side, recently, the Russian energy giant Gazprom reported its first loss in more than 20 years, as a result of its "energy divorce" with Europe. "Moscow seems to need the Beijing market more than China needs Russian gas," journalist Nikola Mikovic emphasized.

Aware of that, Beijing can set its own conditions for the Kremlin.

But the problem for Moscow is that the Power of Siberia 2 project may not be financially viable.

With the ongoing military campaign in Ukraine, a rain of Western sanctions and the country’s energy giant losing money, President Putin’s country is unlikely to be able to finance the construction of a multibillion-dollar 2,600-km pipeline through Russia, Mongolia and China (the Power of Siberia 2 pipeline). And so Russia is unlikely to benefit from the project.

Source: https://baoquocte.vn/nga-can-thi-truong-trung-quoc-hon-hay-bac-kinh-can-khi-dot-moscow-hon-280780.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)