(Dan Tri) - Different groups purchasing health insurance will have different contribution rates. From July 1, the revised Law on Health Insurance will take effect, so the regulations on health insurance contribution rates will also change accordingly.

Health insurance premium payment before July 1

In 2025, the regulations on health insurance will be applied in two different phases. The phase before July 1 will apply according to the current Health Insurance Law; that is, the Social Insurance Law of 2008, amended in 2014 and supplemented by a number of other laws. Accordingly, the health insurance contribution level will depend on the group of subjects participating in health insurance.

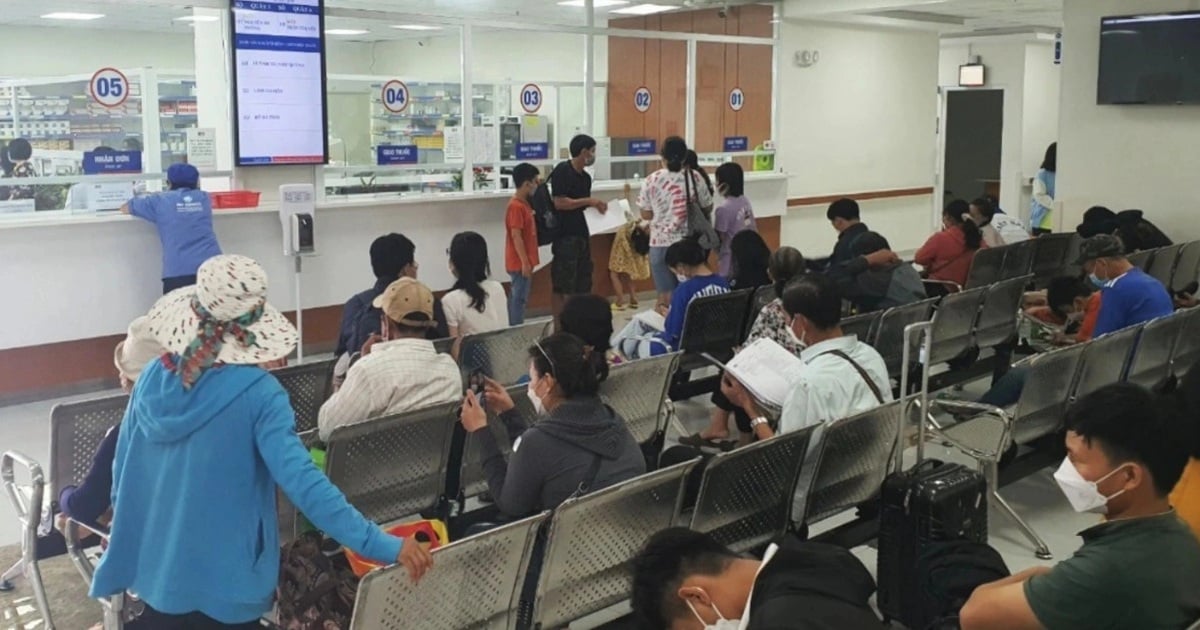

The State has many policies to support people participating in health insurance (Illustration: Hoang Le).

Firstly, the group paid by employers are employees working in the formal labor market, having signed labor contracts, participating in compulsory social insurance (SI) will pay health insurance based on the monthly salary used as the basis for SI payment.

The health insurance contribution rate for the official labor group is 4.5% of the monthly salary used as the basis for social insurance contribution; of which, the employer contributes 3% and the employee contributes 1.5%.

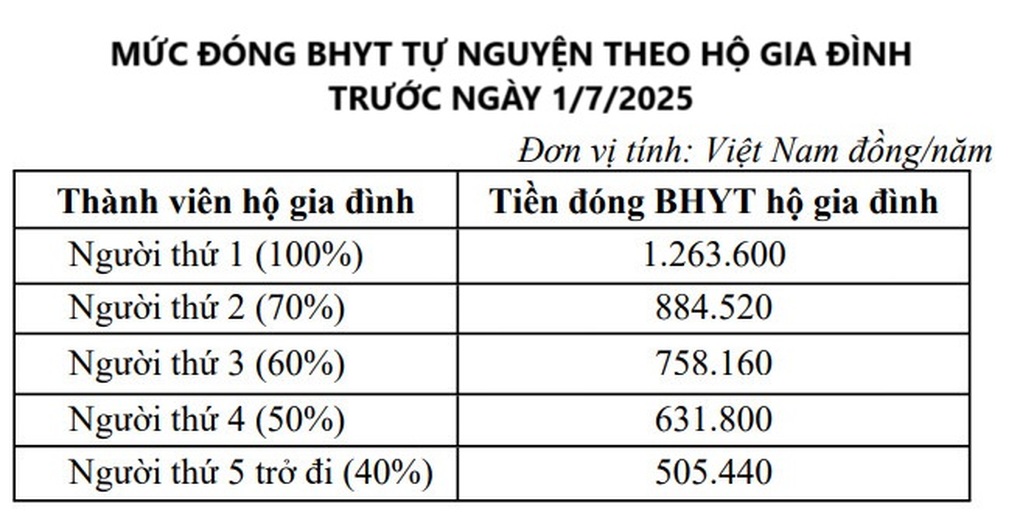

Second, the group participating in voluntary health insurance by household. The monthly health insurance contribution level of this group is regulated as follows: "The first person pays 4.5% of the basic salary; the second, third, and fourth people pay 70%, 60%, and 50% of the first person's contribution level, respectively; from the fifth person onwards, the contribution level is 40% of the first person's contribution level."

For households eligible for State support for health insurance premiums, the remaining amount to be paid is calculated based on the contribution level of the first person in the table above.

For example, near-poor households are supported by the State with 70% of the health insurance premium. Therefore, people in near-poor households pay 30% of the normal rate, the annual premium is 379,080 VND.

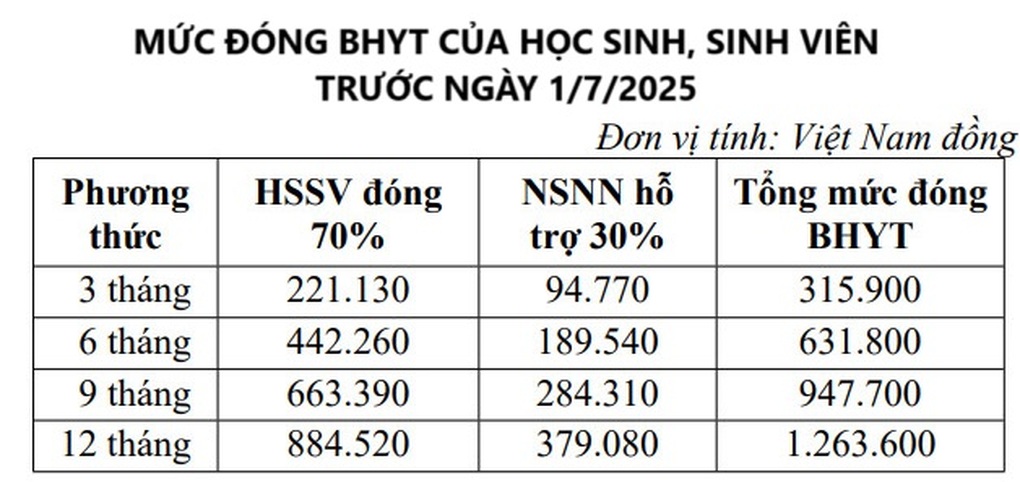

Third, the monthly health insurance premium for students is equal to 4.5% of the basic salary. Of which, the state budget supports 30%, and the participant pays 70%.

Health insurance premiums from July 1 onwards

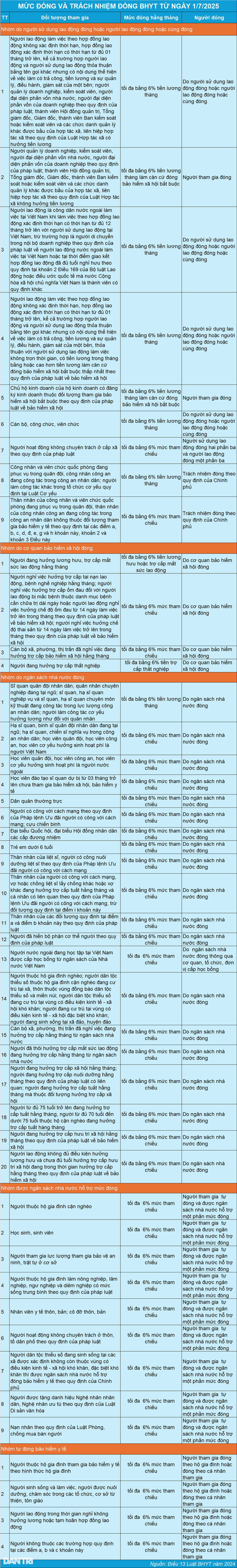

The period from July 1 onwards will apply according to Law No. 51/2024/QH15 amending and supplementing a number of articles of the Law on Health Insurance (referred to as the 2024 Law on Health Insurance).

Compared with the 2014 Law on Health Insurance, the regulations on health insurance contribution levels under the 2024 Law on Health Insurance have 2 new points.

Firstly, the 2024 Law on Health Insurance adds a basis for determining the health insurance contribution level as a reference level, replacing the basic salary. The 2024 Law on Health Insurance stipulates that the reference level is the amount of money decided by the Government to calculate the contribution level and benefits of some cases participating in health insurance.

Second, the 2024 Health Insurance Law adds many groups to participate in health insurance. Therefore, the regulations on health insurance contribution rates under the 2024 Health Insurance Law are also much different from the current contribution rates.

Specifically, according to Article 13 of the 2024 Law on Health Insurance, the contribution level and responsibility for health insurance contribution are prescribed as follows:

Source: https://dantri.com.vn/an-sinh/muc-dong-bhyt-nam-2025-20250123191740922.htm

Comment (0)