This is part of the interview with Mr. Phan Nhu Anh - CEO of Military Commercial Joint Stock Bank (MB) at the Banking Industry Conference - Promoting Credit Growth in 2024 held on June 19, 2024 in Hanoi.

|

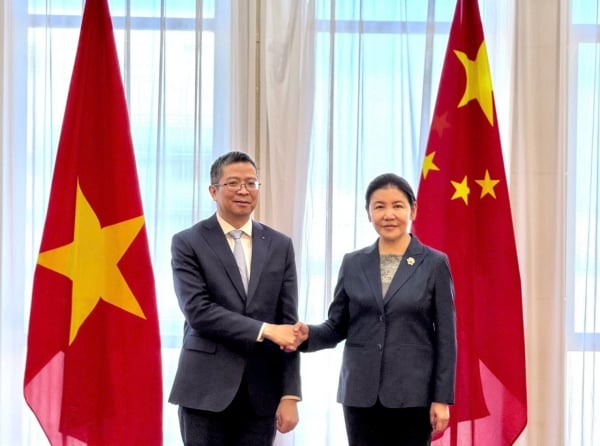

| Mr. Phan Nhu Anh - New General Director of Military Commercial Joint Stock Bank (MB) |

PV: Many banks believe that real estate credit will decrease in the first 6 months of 2024. So will MB have a decrease in real estate lending? What is the reason?

MB CEO: Real estate has 4 areas. Including: Banks lending to people to buy houses; Industrial park real estate; Real estate of housing projects; Resort real estate. In the first 6 months of the year, all 4 areas faced difficulties. For real estate loans to buy houses to live in, due to economic difficulties and slow income of people, the demand for buying and converting houses in the first 6 months of the year was quite slow. Therefore, retail credit of banks was affected, including MB. And this is the area that joint stock banks identified as the main lending focus.

The real estate lending market is also very slow. Transactions are quite few. Prices are also high, with no signs of decreasing. Therefore, people's demand for buying houses is quite low.

The second difficult sector is resort real estate. After COVID-19, the resort real estate sector has not recovered. The number of tourists has partially recovered compared to before COVID-19, but the supply of resort real estate was too large during the Covid period and before Covid. Therefore, this sector is now facing many difficulties.

Industrial real estate can be said to be a bright spot in the first 6 months of the year. Basically, banks operating in the industrial real estate sector have grown. Industrial real estate projects have also basically had their legal problems resolved. Recently, the State Bank of Vietnam also lowered the credit risk coefficient for industrial real estate from 200% to 160%, encouraging banks to lend. MB is also a bank that lends a lot in the industrial real estate sector. The shift of FDI into Vietnam also has a positive impact on this sector.

Real estate and housing projects have been talked about a lot in recent years about legal issues. Recently, the Government as well as Ministries, Departments and Branches have also focused on solving this problem. However, it is still in the process. Recently, a part of it has been solved. This process depends on new laws such as the land law, housing law... the laws that we are creating will take effect from August 1. I think that after the law takes effect from August 1, a series of problems will be solved. Hopefully, by the third and fourth quarters, the real estate sector and housing projects will be solved, at that time it will create a general effect for the real estate market. Hopefully, people will start buying and changing houses and the purpose of banks will grow better.

PV: MB's credit growth target this year is 15%. It's been half a year now but it's only been 4.5%. How can MB complete this year's target?

MB CEO: By the end of June, MB expects to grow 6-6.5%. With this year's target of about 15.5% growth, we need to achieve about 8% more in the last six months of the year. We expect to complete the target in early or mid-fourth quarter.

When setting the credit growth target, what MB and other banks expect most is the absorption capacity of the economy. In addition to the absorption capacity of the economy, banks now have comprehensive solutions, there is no single solution to ensure credit growth and market absorption. Up to now, banks have also reduced interest rates to the deepest level, perhaps in the past 10 years. Low prices will increase demand. Banks continue to cut costs to solve the price issue.

The second issue is about procedures, banks also continue to refine procedural processes. In particular, MB will rely on the MBBank App platform for individual customers and BIZ MBBank for corporate customers to continue lending and automatic approval. MB is now focusing on end-to-end processes, providing customers with automated experiences on MB's digital applications. This will help shorten the process and reduce human intervention in the decision-making process, thereby allowing customers to be more proactive. MB's ambition is that we provide credit products to customers as quickly as possible with the best experience.

Third is to develop products and processes according to new laws and policies. After the new laws come into effect after August 1, this will have a huge impact on customers, so we need to refine the processes and products according to the law and the circulars and decrees that will be issued to remove bottlenecks and difficulties. From there, we can serve and bring better experiences to customers.

Source: https://baoquocte.vn/mb-du-kien-hoan-thanh-muc-tieu-tang-truong-tin-dung-15-275796.html

Comment (0)