Vietnam Export Import Commercial Joint Stock Bank (Eximbank) has just officially increased its deposit interest rate on weekends (Saturday and Sunday) to the highest level of 6.4%/year.

This is the highest officially listed interest rate currently, and Eximbank is also the only bank applying a separate online interest rate schedule for weekends.

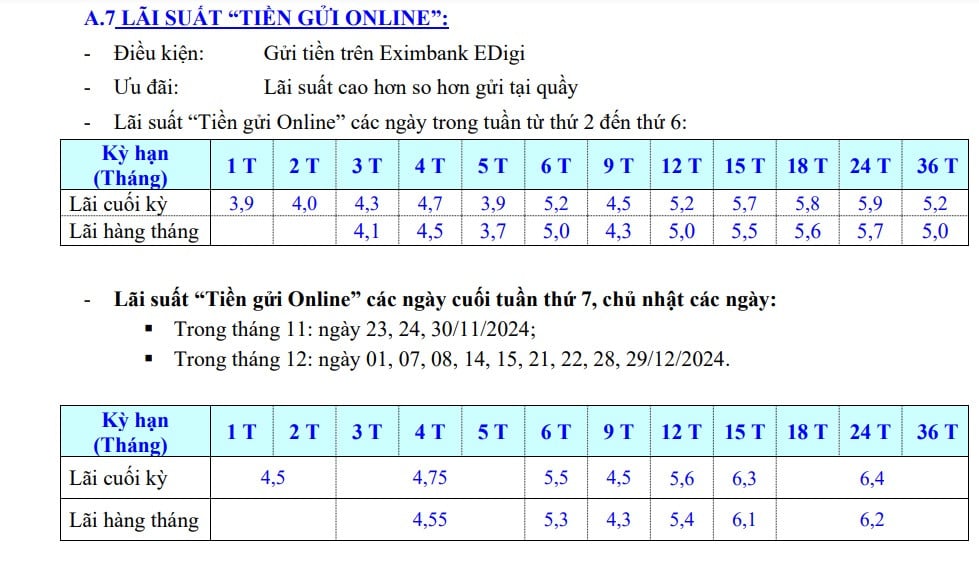

Starting from October 2024, Eximbank will launch an online deposit interest rate schedule specifically for weekends in the month. After more than a month of implementation, this bank has officially adjusted to increase the online deposit interest rate for weekends, starting from today, November 23, 2024.

Accordingly, the 12-month term deposit interest rate increased sharply by 0.4%/year to 5.6%/year from today. The 15-month term bank interest rate increased even more sharply by 0.6%/year to 6.3%/year.

Notably, the interest rate for deposits with terms from 18 to 36 months has been adjusted up by 0.1%/year to 6.4%/year. This is the "top ceiling" interest rate on the market today according to official listing.

Eximbank keeps the interest rates for the remaining terms for weekends unchanged. Accordingly, the interest rate for 1-month term is 4.5%/year, the interest rate for 3-5 months term is 4.75%/year (the ceiling interest rate for term deposits under 6 months according to the State Bank's regulations), and the interest rate for 6-month term is 5.5%/year.

The above interest rates are for customers who receive interest at the end of the term. In case customers choose to receive interest at the beginning of the term, the interest rate will be 0.2% lower per year for terms from 3 to 36 months, while the 1 to 2 month term remains unchanged.

Eximbank's online deposit interest rate schedule for this weekend applies to weekends in November including: November 23, 24, 30, 2024; and weekends in December including: December 1, 7, 8, 14, 15, 21, 22, 28, 29, 2024.

Compared to the online deposit interest rate schedule applied on weekdays, the highest interest rate difference is up to 1.2%/year. Eximbank only adjusts bank interest rates for deposits on weekends.

Bank interest rates for online deposits (interest paid at the end of the term) on weekdays remain the same as follows: 1-month term 3.9%/year, 2-month term 4%/year, 3-month term 4.3%/year, 4-month term 4.7%/year, 5-month term 3.9%/year, 6-month term 5.2%/year, 9-month term 4.5%/year, 12-month term 5.2%/year, 15-month term 5.7%/year, 18-month term 5.8%/year, 24-month term 5.9%/year, and 36-month term 5.2%/year.

Eximbank is the 14th bank to increase deposit interest rates since the beginning of November, including: Eximbank, BaoViet Bank, HDBank, GPBank, LPBank, Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, and VietBank. Of which, ABBank, Agribank and VIB are the banks that have increased interest rates twice since the beginning of the month.

On the contrary, ABBank is also the only bank that reduces deposit interest rates by 0.1%/year for a 12-month term.

| INTEREST RATES FOR ONLINE DEPOSITS AT BANKS ON NOVEMBER 23, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| ABBANK | 3.2 | 4.1 | 5.5 | 5.6 | 5.8 | 6.2 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| AGRIBANK | 2.4 | 2.9 | 3.6 | 3.6 | 4.8 | 4.8 |

| BAC A BANK | 3.95 | 4.25 | 5.4 | 5.5 | 5.8 | 6.15 |

| BAOVIETBANK | 3.3 | 4.35 | 5.2 | 5.4 | 5.8 | 6 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.5 | 5.45 | 5.65 | 5.8 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 4.5 | 4.75 | 5.5 | 4.5 | 5.6 | 6.4 |

| GPBANK | 3.4 | 3.92 | 5.25 | 5.6 | 5.95 | 6.05 |

| HDBANK | 3.85 | 3.95 | 5.3 | 4.7 | 5.6 | 6.1 |

| IVB | 3.8 | 4.1 | 5.1 | 5.1 | 5.8 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| MB | 3.5 | 3.9 | 4.5 | 4.5 | 5.1 | 5.1 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 4.5 | 4.7 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.9 | 4.2 | 5.55 | 5.65 | 5.8 | 5.8 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.35 | 3.65 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | |

| VIET A BANK | 3.7 | 4 | 5.2 | 5.4 | 5.7 | 5.9 |

| VIETBANK | 3.9 | 4.1 | 5.2 | 5 | 5.6 | 5.9 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7x |

| VPBANK | 3.6 | 3.8 | 4.8 | 4.8 | 5.3 | 5.3 |

Source: https://vietnamnet.vn/lai-suat-huy-dong-cao-nhat-tang-len-6-4-nam-tu-hom-nay-2344807.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)