Active internal shareholder transactions in recent months along with the potential to find strategic shareholders in a private issuance have had a positive impact on DBD shares of Binh Dinh Pharmaceutical and Medical Equipment Joint Stock Company (Bidiphar) in recent times.

Expectations of welcoming strategic investors to "heat up" pharmaceutical stocks

Active internal shareholder transactions in recent months along with the potential to find strategic shareholders in a private issuance have had a positive impact on DBD shares of Binh Dinh Pharmaceutical and Medical Equipment Joint Stock Company (Bidiphar) in recent times.

|

Insider trading is booming

At the end of October 2024, Ms. Nguyen Thi Thuy, sister of Mr. Nguyen Tien Hai - a member of the Board of Directors of Bidiphar, said that she had bought 1 million DBD shares, with an estimated transaction value of nearly 50 billion VND. The transaction helped this investor increase her ownership in Bidiphar from 1.88 million shares (1.79%) to more than 2.88 million shares (3.08%).

Recently, DBD stock trading has been active among both individual and institutional investors. Just before that, Bao Minh Securities Company (BMSC) successfully purchased 2.81 million DBD shares, equivalent to 94% of the registered shares. Mr. Phan Tan Thu, CEO of this securities company, is also a member of Bidiphar's Board of Directors.

Not only BMSC, two other organizations related to Mr. Thu, Lighthouse Bond Investment Fund and Lighthouse Dynamic Investment Fund, also bought 80,000 new shares and 170,000 DBD shares, respectively, equivalent to 0.09% and 0.23% of charter capital in the period from June to August 2024.

KWE Beteilgungen AG - a financial investment organization from Switzerland has purchased 205,000 DBD shares to increase its ownership ratio from nearly 8.23 million shares (8.79%) to more than 8.43 million shares (9.01%). This foreign organization is the second largest shareholder of Bidiphar, after the state shareholder, Binh Dinh Provincial Development Investment Fund (currently owning 13.3% of charter capital). KWE has become a major shareholder owning more than 5% of Bidiphar's charter capital since the beginning of 2023.

Buying orders from insiders have been continuously announced in recent months, partly contributing to the heat in DBD stock price movements. DBD shares at one point increased to over VND50,200/share, the highest level ever recorded since trading in mid-2018.

M&A Expectations

Bidiphar, formerly known as Binh Dinh Pharmaceutical and Medical Equipment Company, was transformed from a state-owned enterprise into a one-member LLC owned by the People's Committee of Binh Dinh Province. Since March 2014, the company has transformed its form of operation from a one-member LLC to a joint stock company model.

In the third quarter of 2024, Bidiphar's net revenue reached more than VND 452.8 billion, pre-tax profit reached more than VND 88.4 billion, up 10% and 15.6% respectively over the same period in 2023. Explaining to shareholders, General Director Pham Thi Thanh Huong said that the Company has promoted the production of pharmaceutical products, so the gross profit margin has improved significantly over the same period. According to the update of analysts from Phu Hung Securities Company, antibiotics, cancer treatment drugs and hemodialysis drugs are the main product lines of the Company, with the proportion in the revenue structure of manufactured goods in the first 9 months reaching 28%, 20% and 12% respectively. Along with that, dividends received in the quarter from subsidiaries increased by 23% over the same period last year. Some expense items such as provisions for bad debts decreased sharply.

Accumulated after 9 months of 2024, Bidiphar's net revenue reached more than 1,269 billion VND, up 5.1% over the same period. However, pre-tax profit decreased by 3%, to more than 246 billion VND.

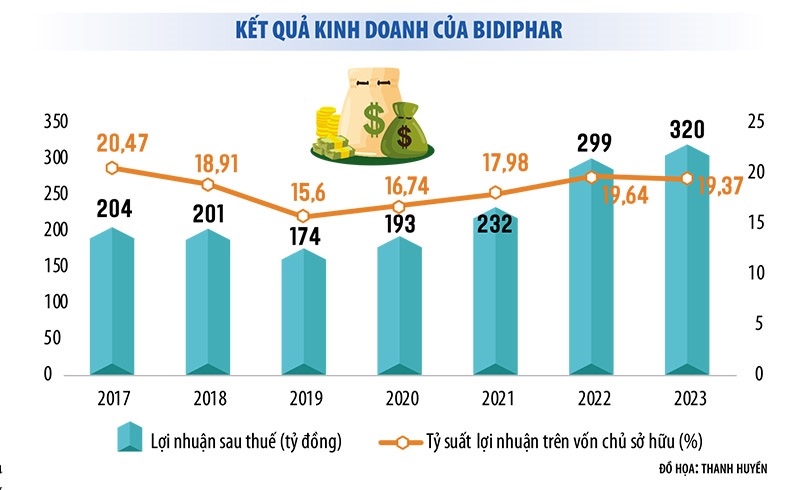

Compared to the target of VND2,000 billion in revenue and VND320 billion in pre-tax profit this year, this pharmaceutical company has completed more than 65% of the revenue plan and nearly 79.5% of the pre-tax profit plan. Despite modest growth, Bidiphar's return on equity (ROE) has been over 19% in recent years. The dividend payout ratio for the past 4 years has been over 20%.

At the annual general meeting of shareholders held in mid-2024, Bidiphar approved a plan to offer individual shares to a maximum of 5 professional securities investors. The total number of shares expected to be offered is 23.3 million shares, with a minimum offering price of VND50,000/share. The number of new shares offered is equivalent to 25% of outstanding shares.

All proceeds from the issuance will be used to supplement capital for investment activities for the new OSD Non-Betalactam factory project in Nhon Hoi Economic Zone. The factory meets EU-GMP/WHO-GMP standards to produce solid drugs such as tablets, coated tablets, hard capsules, etc. and is divided into two phases. In phase I, the Company will invest in a factory with a capacity of 500 million products/year and carry out administrative procedures from 2024 to 2029. After 2029, the total capacity of the factory will be expanded to 1.3 billion products/year.

The private placement is expected to take place in 2024-2025. According to Phu Hung Securities, Bidiphar is still negotiating with 4 foreign and domestic investors, with the priority being to find strategic partners who bring new value, can transfer technology and accompany the Company for a long time.

While the appearance of a strategic shareholder is still a story of the future, the potential from mergers and acquisitions (M&A) is more or less affecting DBD's stock price. Previously, M&A deals in the pharmaceutical sector such as Aska Phamaceutical Co., Ltd (Japan) holding nearly 35% of Ha Tay Pharmaceutical's capital caused DHT's stock to "heat up".

It should also be added that, in the Government's plan to restructure state-owned enterprises and enterprises with state capital, Bidiphar is one of the enterprises that the State will divest capital from in the period of 2022-2025. However, in a report in early October 2024, Mr. Pham Anh Tuan, Chairman of the People's Committee of Binh Dinh province, said that the locality is seeking opinions to leave state capital in Bidiphar, because this is an enterprise that has a great impact on the social security issues of the province. The story of divesting 13.3% of state capital in this pharmaceutical company may change direction even though the deadline is near.

The prestigious annual event on mergers and acquisitions and investment connections organized by Dau Tu Newspaper under the direction and sponsorship of the Ministry of Planning and Investment, will be held at JW Marriott Saigon Hotel (HCMC) on Wednesday, November 27, 2024. With the theme “Bustling Deals/A Blossoming Market”, the 2024 Vietnam M&A Forum will discuss in-depth emerging M&A opportunities in potential sectors such as real estate, retail, technology, renewable energy, financial services and logistics.

The M&A Forum 2024 will have the following main activities:

Main workshop with leading Vietnamese & international speakers.

Honoring outstanding M&A Deals & Consultants in the period 2023 - 2024.

Release of Special Edition M&A Market Panorama 2024 (bilingual Vietnamese - English).

Source: https://baodautu.vn/ky-vong-don-nha-dau-tu-chien-luoc-lam-nong-co-phieu-duoc-d229273.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)