Fertilizers not subject to VAT: When and who benefits?

According to Law No. 71/2014/QH13 amending and supplementing a number of articles of tax laws, fertilizers are not subject to value added tax (VAT). The National Assembly is currently considering a proposal to transfer fertilizers to the VAT category at a rate of 5%. There are many conflicting opinions on this proposal. So what is the nature of the problem?

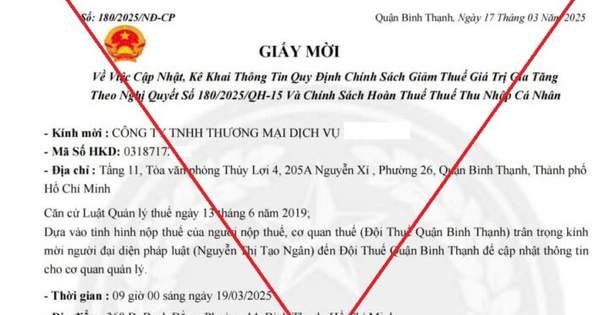

|

| Photo: Duc Thanh |

Impact of VAT on selling price

Moving from being subject to the 5% VAT rate to not being subject to VAT may seem beneficial for businesses and farmers, but in fact it is not.

Previously, fertilizer production was mainly subject to input tax of 10% and output tax of 5%. However, input tax was deductible and even refunded if the tax rate was higher than output tax. Now, when applying the new regulation, enterprises are not allowed to deduct input tax, but must account for it in expenses. This makes the production and business costs of fertilizer enterprises likely to increase significantly, leading to the final selling price for farmers.

In theory, shifting fertilizers from being subject to 5% VAT to being exempt from VAT could lead to two opposite possibilities: 1) reducing the selling price, and 2) increasing the selling price to the end buyer. This depends on the proportion of input costs subject to 10% VAT in the product selling price structure (excluding VAT).

If this proportion is low, for example 10%, and the remaining 90% of the selling price is made up of non-VAT items such as imported fertilizers (for example urea, potassium, phosphate used to produce NPK fertilizer), wages, machinery depreciation, business profits, etc., then not having to pay VAT at a rate of 5% on the selling price will reduce the selling price compared to having to pay 5% output VAT and being able to deduct input VAT (because input VAT is insignificant).

This happens to businesses that specialize in using imported single fertilizers (not subject to VAT) as raw materials to mix simply and produce NPK products, which people still call "hoe and shovel" technology.

On the contrary, if that proportion is high, from 50% of the selling price or more, which is a common situation in fertilizer manufacturing enterprises in Vietnam using raw materials, supplies, energy, equipment... subject to 10% input VAT, then the input VAT is larger than the 5% output VAT, therefore, exempting the 5% output but not allowing the 10% input deduction will cause the cost price to increase compared to when the fertilizer is subject to 5% VAT (because the enterprise is refunded a part of the VAT because the output tax is smaller than the input tax).

If the cost price increases but the selling price remains the same, the business will suffer. If the business wants to maintain the same profit, it must increase the selling price, and the one who suffers is the farmer. If they share, both sides will suffer, each side a little. Only imported goods benefit.

On the other hand, due to high costs, investors will hesitate to invest in domestic fertilizer production, especially high-tech projects because they will not be refunded VAT for factories, equipment, and raw materials. This leads to a situation where the domestic fertilizer industry loses its development momentum because its products become less competitive compared to imported goods, and there is a risk of being defeated by imported goods right at home.

What would happen if a 5% VAT was imposed on fertilizers?

If fertilizers are transferred from being non-VAT to being VAT taxable at a rate of 5%, the situation will be completely reversed.

Now, fertilizer importing businesses will have to pay 5% VAT upon import, causing costs to increase by 5% compared to before, and the selling price to farmers will also increase accordingly.

On the contrary, enterprises producing from domestic raw materials and supplies will be refunded a part of VAT because the output tax of 5% is lower than the input tax of 10%, causing the cost price to decrease compared to before, and the selling price to farmers will also have the conditions to decrease accordingly.

Thus, applying a 5% VAT will increase the price of imported goods and reduce the price of domestic goods, bringing both to a common level due to the same 5% tax rate, creating conditions for equal competition between domestic and foreign goods, overcoming the irrationality that has been going on for the past 10 years: imported goods have an advantage over domestic goods thanks to our own policy. In addition, the budget deficit from domestic goods will be partly offset by VAT revenue from imported goods.

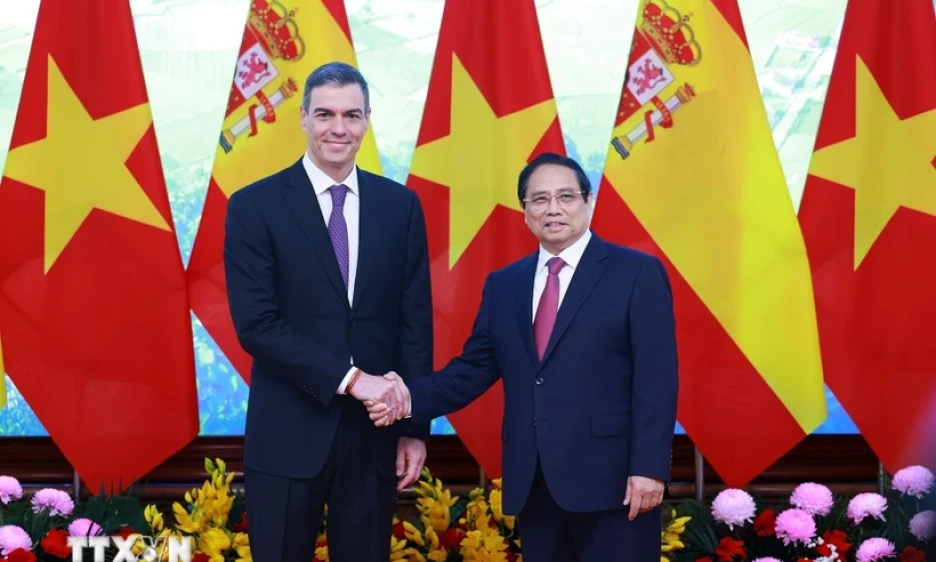

|

| Photo: Duc Thanh |

Is it guaranteed that domestic enterprises will reduce selling prices to farmers?

There are some concerns that applying a 5% VAT on fertilizers will help businesses reduce costs, but it is not certain that businesses will reduce selling prices, and farmers will still not benefit.

In fact, this concern is no different from the concern that when the National Assembly agrees to reduce VAT from 10% to 8%, what guarantees will businesses also reduce prices to consumers? Reality has shown that this concern is unfounded.

VAT is an indirect tax, businesses only collect it on behalf of the State from consumers, so there is no reason for them to be foolish enough to increase the price without VAT (which is their share) to pocket that 2% VAT from buyers. If they are greedy, there is a high possibility that they will not be able to sell their products because their selling prices are higher than other businesses. The competitive mechanism forces businesses to bring prices to a common level, made up of the price without VAT (which is the business's share), plus the prescribed VAT (which is the State's share).

Therefore, the Government has the basis to continue to propose that the National Assembly consider extending the reduction of VAT to 8% until the end of 2024.

When persistently proposing to change fertilizers into VAT-taxable subjects with a tax rate of 5% or better yet, 0%, domestic fertilizer producers and their representative, the Vietnam Fertilizer Association, must have a solid foundation. When the Government submitted to the National Assembly the draft amendment to the Law on Value Added Tax, it must have considered and weighed the issue comprehensively, thoroughly, and carefully. The ball is now in the feet of the National Assembly deputies, who will press the button to vote to pass the bill.

Source: https://baodautu.vn/phan-bon-khong-chiu-thue-gia-tri-gia-tang-khi-nao-va-ai-duoc-loi-d218458.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)