The New Year of the Snake 2025 brings with it expectations, beliefs, and hopes for a new year of good results and many achievements for each individual, organization, and enterprise. To contribute to the success of production and business plans, credit capital from banks and credit institutions (CIs) is indispensable. Previously, in 2024, the State Bank - Thanh Hoa Provincial Branch (SBV Thanh Hoa) synchronously and optimally deployed operating tools and solutions, contributing to controlling inflation, stabilizing the macro-economy, supporting economic growth recovery and ensuring the safe development of the CI system, affirming its role as the "blood vessel" leading the economy.

Flexible monetary policy management

With the role of the "bloodline" of the economy, the Thanh Hoa banking sector has been and continues to follow the right direction and development strategy of the province. The State Bank of Thanh Hoa has promptly grasped, forecasted the situation and proactively and flexibly operated monetary policy, closely coordinated, effectively and promptly implemented the Government's fiscal policies to facilitate access to capital, remove difficulties, accompany and support people and businesses to recover and develop production and business. Along with promoting administrative reform, credit institutions have launched preferential credit packages, diversified products and services, in order to create the most favorable conditions for businesses and people to access capital. From the beginning of the year, credit institutions have focused on mobilizing capital from organizations and individuals for lending investment.

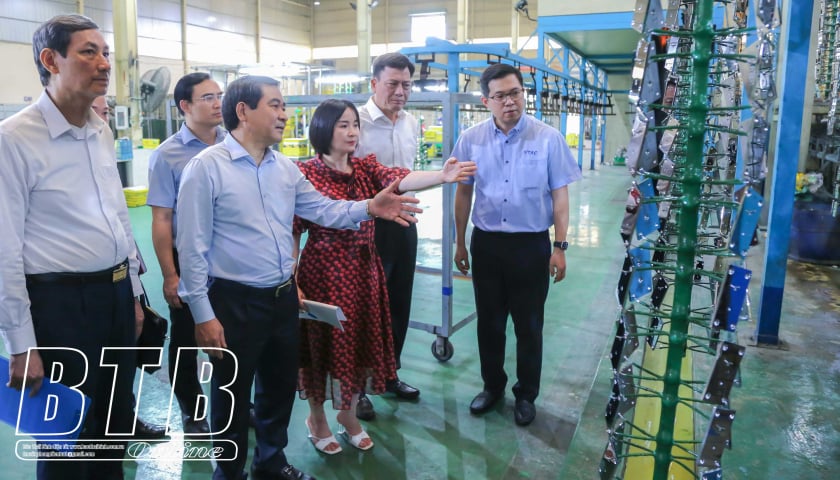

Along with that, under the direction of the State Bank of Thanh Hoa, many credit institutions in the province have done well in the program of connecting banks and enterprises. Credit institutions proactively approach reputable enterprises with feasible and effective production and business plans to meet the demand for capital and banking services, promoting business development. On the other hand, implementing solutions to remove difficulties for enterprises according to the direction of the State Bank and the superior bank, considering and resolving loans, and increasing credit growth effectively and safely. At the same time, credit institutions are interested in improving and innovating lending processes in the direction of simplifying procedures, improving appraisal capacity, shortening loan processing time, creating conditions for enterprises to access bank capital...

Director of Agribank Thanh Hoa Nguyen Thuan Phong said: The bank is always steadfast in its core mission of investing in the development of agricultural economy, farmers, and rural areas, contributing to stabilizing the macro economy, controlling inflation, and promoting local economic growth. Agribank's capital through preferential credit programs with appropriate interest rates has helped businesses, entrepreneurs, and production households... develop sustainable production and business.

Currently, Agribank branches in the province have proactively and actively implemented many policy credit programs, national target programs on new rural construction, sustainable poverty reduction, and socio-economic development in ethnic minority and mountainous areas. Agribank's mark has been and is being strongly imprinted in the development transformation of Thanh Hoa. By the end of 2024, the total outstanding debt of Agribank branches in the province reached VND 66,450 billion, an increase of VND 7,024 billion, accounting for 31% of the market share. In addition to implementing loan packages for each customer segment, Agribank branches also support customers in a number of related areas such as reducing or exempting money transfer fees, account management fees for individual and corporate customers in each period...

Develop safe and efficient systems

To ensure capital sources and meet lending needs, from the beginning of the year, banks and credit institutions have focused on mobilizing capital from organizations and individuals for lending investment. By the end of December 2024, the total mobilized capital in the whole system reached VND 186,583 billion, an increase of 9.5% compared to the beginning of the year. Currently, outstanding loans to the province's economy reached VND 216,726 billion, an increase of 11.5% compared to the beginning of the year, the bad debt ratio accounted for 1.18% of the total outstanding loans in the whole area, under control. Unblocking credit sources not only helps businesses and people overcome difficulties, but also contributes to the sustainable development of the locality. The system of credit institutions in the area has played a good role as the "bloodline" of the economy; is the main capital channel, serving production and business, effectively supporting the economic restructuring, improving the quality of people's lives.

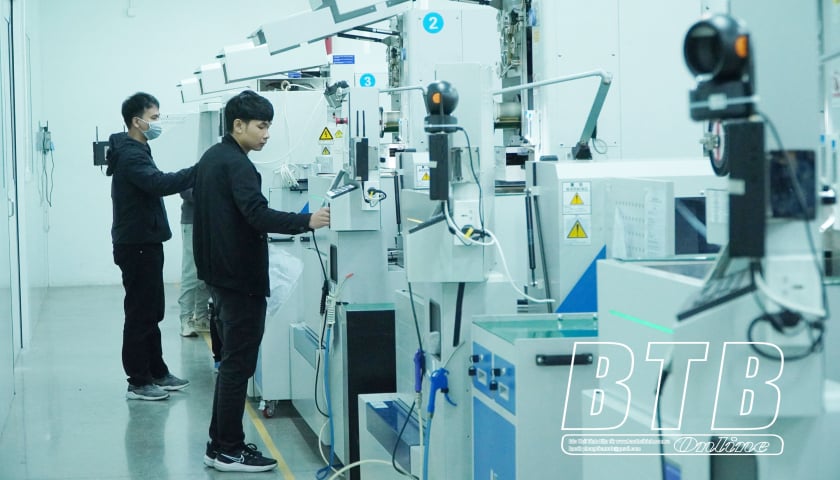

The year 2024 also marks the strong development of digital technology in the banking industry. Banks have applied advanced technologies and new solutions to payment activities to increase speed, ensure safety and security of services, and enhance customer experience and satisfaction. Typical examples are biometric authentication services, QR code payments, flexible payment acceptance solutions, and integration of mobile payments for other industries and fields such as payment for public services, electricity, water, telecommunications, healthcare, education, goods on e-commerce platforms, etc. Many credit institutions have a rate of over 90% of transactions conducted on digital channels along with the development of new, convenient and completely different products and services compared to before, such as: deposit/withdraw cash using chip-embedded citizen identification cards; online disbursement for small and medium enterprises; online international payments, etc.

In 2025, the State Bank of Thanh Hoa will continue to closely follow the goals and orientations of the industry, the socio-economic development goals of the province, fully and promptly deploy solutions to create favorable conditions for businesses and people to access credit capital. Further strengthen the bank-business connection program, promote the diversification of credit programs and products suitable to the needs of each target group and customer segment, and increase the ability to absorb capital for the economy.

Inheriting the achieved results, Thanh Hoa banking sector confidently enters the new year with a spirit and spirit of competition, together with the people and businesses, promising to make many important contributions to the socio-economic development of the province; continuing to affirm the role of "bloodline" leading the economy.

Article and photos: Khanh Phuong

Source: https://baothanhhoa.vn/khang-dinh-vai-tro-huyet-mach-dan-dat-nen-kinh-te-236673.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)