The VNFINLEAD index - which concentrates the market's leading banking and financial stocks - had a sharp decline today (November 11), bringing the index back to the price range of the second half of September.

The VNFINLEAD index - which concentrates the market's leading banking and financial stocks - had a sharp decline today (November 11), bringing the index back to the price range of the second half of September.

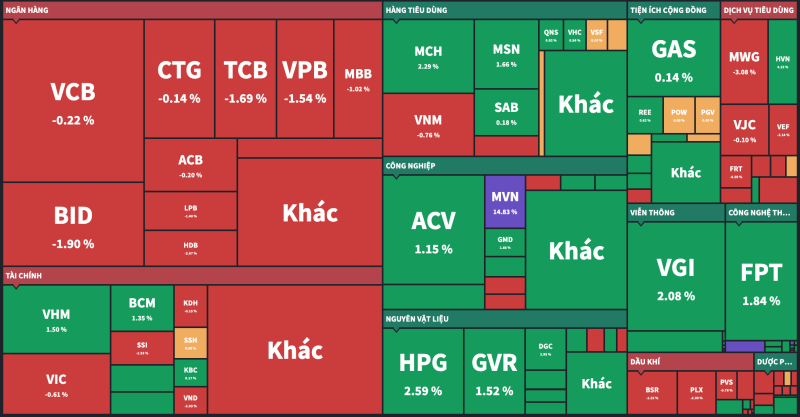

A series of leading financial bank stocks decreased in price.

In today's session, VNFINLEAD only had 2/23 stocks increase in price, VCI and NAB, the remaining stocks were all in red, at times, this index lost more than 2% of its value. At the end of the session on November 11, VNFINLEAD decreased by 1.67%, the VNFINLEAD Index was at 2,056.15 points, losing all efforts in the past 2 months.

Banking stocks fell across the board on November 11, especially CTG, BID, and STB, which were the three stocks that pulled the index down the most throughout the session. At the ATC session, CTG's trading was salvaged, escaping the group of stocks weighing down the index, closing the session down only 0.14%.

On the contrary, VCB tried to maintain green for most of the trading time, but at the end of the session, the ATC order caused VCB to turn around and decrease by 0.22%.

|

| Red dominates banking and financial stocks. |

In contrast to the banking and finance group, raw material and technology stocks increased significantly during the session, contributing to slowing down the index's decline.

Liquidity on HoSE was higher than the sessions in the past half month but mainly came from the selling side. VN-Index decreased by 0.18% today, the index retreated to 1,250.32 points.

Is there still room for bank stocks to increase in price?

A recent assessment by Dragon Capital Securities (VDSC) said that the stock market is at a fairly attractive discount. However, there are still short-term headwinds to pay attention to, such as geopolitical conflicts that have short-term signals that highlight investors' risk aversion and the USD may initially strengthen when the Trump administration is elected.

Therefore, VDSC recommends that investors should prepare for the scenario of “taking advantage of market declines to build long-term positions”, especially in the banking, real estate, technology, industrial and service sectors.

VDSC recommends increasing the weight of banking groups as revaluation opportunities still lie ahead.

Pre-tax profit in Q3/2024 of listed banks increased by 17.0% compared to the same period last year but decreased by 8.3% compared to the previous quarter. This result was weaker than previously expected, mainly due to narrowing NIM. The positive point from the Q3 business results picture is that bad debt has almost peaked at most major banks, while the cost of credit risk provisioning has not increased. VDSC expects NIM in Q4/2024 to stabilize at the current low level due to competitive lending pressure.

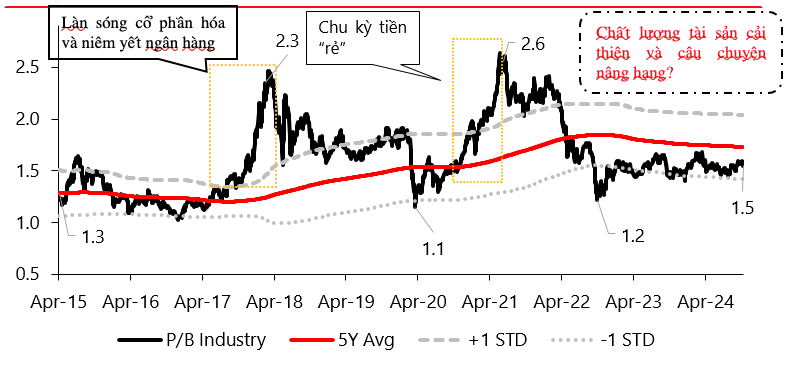

Statistics from this securities company also show that banking industry valuations have remained almost unchanged after a decade.

|

Banking sector valuations remain largely unchanged after a decade. Source: Bloomberg, Fiinpro, VDSC |

The sector-wide P/B valuation is currently 1.5x, unchanged since the start of 2023 and still below the 5-year average as of May 2022. This suggests that the market is still discounting asset quality risks for the banking sector as earnings recover more steadily.

Besides, the big story of upgrading to the secondary frontier market according to FTSE standards will still be a notable highlight in the next year for the group of banking stocks based on the largest market capitalization scale, VDSC said.

Source: https://baodautu.vn/co-hoi-nao-cho-co-phieu-ngan-hang-d229734.html

Comment (0)