SSI Securities Corporation's analysis department (SSI Research) forecasts changes in the VNDiamond index portfolio and updates the calculation data for the weight of the VN30 portfolio for the second quarter of 2025.

The HoSE-Index, VNX-Index, and other investment indices including VNDiamond, VNFIN Lead, and VNFIN Select will undergo portfolio restructuring for the second quarter of 2025. Specifically, the VNDiamond index will review and make changes to its component portfolio. Meanwhile, the remaining indices, including VN30 and VNFIN Lead, will only update data and recalculate portfolio weightings.

According to the roadmap, the portfolio restructuring for the second quarter of 2025 will be based on data as of March 31. The new portfolio announcement date is April 16, 2025. Funds will have nearly 2 weeks to complete the portfolio restructuring by April 29, 2025.

CTD and MWG may fall into the VNDiamond "basket"

Regarding the VNDiamond index, based on estimated data as of March 14, 2025, SSI Research forecasts that MWG shares may be included in the "maintenance basket" because the stock was included for the first time in the index in the previous period and satisfies all conditions this period. Accordingly, the %wS coefficient (weight limit for maintenance, first-time inclusion, pending removal) applied to MWG will increase from 50% to 100%.

In addition, this unit also forecasts that CTD stock can enter the "basket" for the first time in the index because it satisfies all the conditions. According to the new rule, CTD is applied with a weight limit of 50% wS.

Meanwhile,VIB may be placed on the "waiting list" for removal. VIB's FOL (foreign ownership limit) fell below 65% after the bank adjusted the maximum foreign ownership ratio from 20.5% to 4.99% effective July 1, 2024. Under the new rules, VIB is placed on the "waiting list" and subject to a %wS (weighting by a factor of 50%), equivalent to a 50% reduction in its share weighting. In the next period, if it fails to improve its FOL above 65%, VIB may be completely removed from the index.

VRE shares may be removed from the index due to not meeting the FOL (Focus on Ownership) criteria. According to SSI Research's calculations, VRE has failed to be among the top 25 stocks with the highest FOL for the second consecutive period. Furthermore, because VRE was placed in the "Pending Removal" basket during the Q4/2024 review, it does not meet the criteria to remain in the index for this period.

It is known that the “basket” of stocks entering the index for the first time is determined according to two principles. Firstly, the stock is in the provisional stock basket this period but not in the official stock basket last period; or the stock is in the provisional stock “basket” this period and in the “basket” waiting to be eliminated last period.

The “basket” of stocks maintained for two consecutive periods is the stock in the “basket” of stocks provisionally calculated for this period but not in the basket of stocks awaiting removal and the basket of stocks entering the index for the first time. The “basket” of stocks officially for this period includes stocks awaiting removal, stocks entering the index for the first time and stocks maintained.

Assuming the above changes, the new index portfolio will include 19 stocks, of which 10 stocks in the banking sector will be subject to the maximum sector weighting of 40%. Currently, five ETFs on the market use the VNDiamond index as a benchmark: DCVFMVN Diamond, MAFM VNDiamond, BVFVN Diamond, KIM Growth Diamond, and ABF VNDiamond, with a total net asset value of approximately VND 12,400 billion as of March 14, 2025. The DCVFMVN Diamond fund alone currently has a total asset value of approximately VND 11,800 billion. Specifically, since the beginning of 2025, the fund's total asset value has decreased by 6.6%, Net Asset Value (NAV) has decreased by 3.4%, and net capital outflow is VND 418 billion.

SSI Research estimates that the DCVFMVN Diamond fund will buy 2.9 million MWG shares and 1.1 million CTD shares, while selling approximately 5 million VRE shares and 10.5 million VIB shares from its portfolio. In addition, some other stocks are estimated to see significant purchases, such as VPB (3.9 million shares), MBB (3.5 million shares), and MSB (3 million shares). Simultaneously, the fund may sell a large quantity ofACB (5.8 million shares) and HDB (3.5 million shares).

Changes in VN30: Many bank stocks were sold, buying a large amount of HPG

During this restructuring period, the HoSE-Index version 4.0 rules officially came into effect, therefore the weighting of the VN30 index portfolio will change significantly. Regarding the VN30 index, SSI Research stated that due to the addition of a 40% limit on the market capitalization weight of a group of stocks in the same industry to the HoSE-Index version 4.0 rules, they estimate that the weighting of the financial sector in the VN30 index basket will decrease from the current 60% to 40%. Consequently, the weighting of stocks in other sectors will increase proportionally.

The criterion of limiting the weight of market capitalization is not unfamiliar to the rules of the HoSE index. Previously, this rule applied to a single stock at 10% and to a group of related stocks at 15%. Adding a limit on the market capitalization weight of groups of stocks in the same industry within the VN30 index contributes to stabilizing the industry structure and preventing any single industry from having an excessively high weight in the index.

Among the ETFs on the market, there are currently 4 ETFs using the VN30 index as a benchmark, including DCVFMVN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF, and MAFM VN30 ETF, with a total net asset value of approximately VND 9,100 billion as of March 14, 2025. The DCVFMVN30 ETF alone currently has a total asset value of approximately VND 6,200 billion. Specifically, from the beginning of 2025 to date, the fund's total asset value has decreased by 7.4%, NAV has increased by 3%, and net capital outflows have been VND 683 billion.

According to SSI Research's estimates, some stocks that were heavily bought by the aforementioned funds include HPG (11.6 million shares), MWG (4.5 million shares), and VIC (4.5 million shares). At the same time, on the selling side, financial sector stocks were the most heavily sold, including TCB (9.5 million shares), VPB (9.1 million shares), and ACB (8.3 million shares).

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

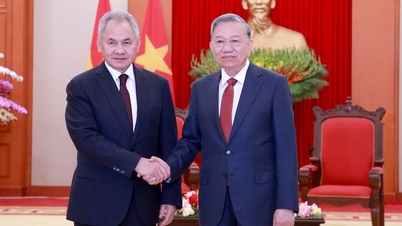

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)