(NLDO) – Techcombank, VPBank, MSB are the next names to "join" the trend of increasing deposit interest rates.

On December 6, the savings interest rate market at some banks had new adjustments, bringing attractive opportunities for depositors.

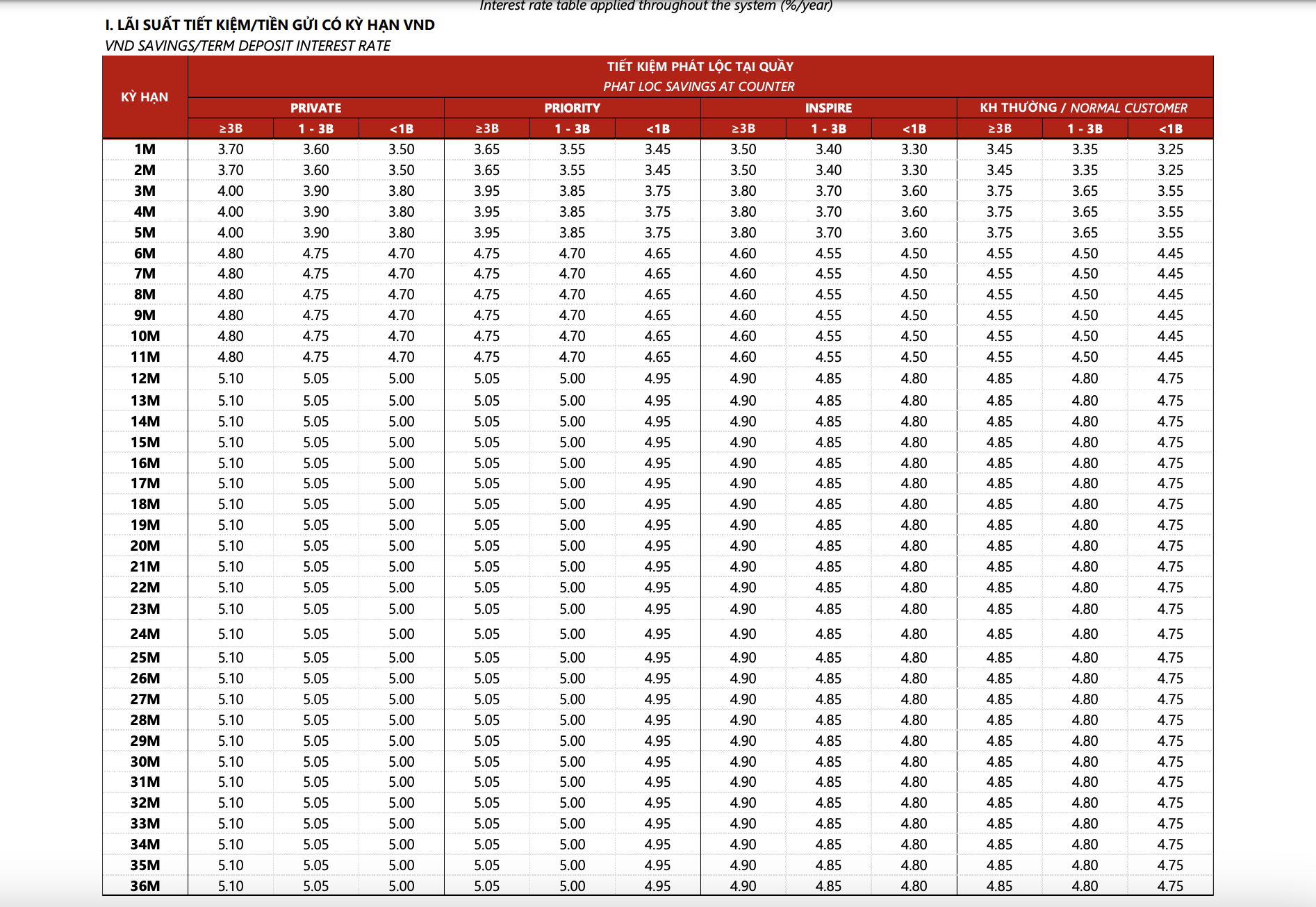

At Techcombank, the interest rate for regular customers has changed significantly. Specifically, the 1-2 month term is applied at 3.45%/year, the 3-5 month term is 3.75%/year, and the 12 month term increased to 4.85%/year, recording the highest increase of 0.15%. For the high-end customer group, Techcombank offers the most attractive interest rate for long terms, reaching 5.1%/year.

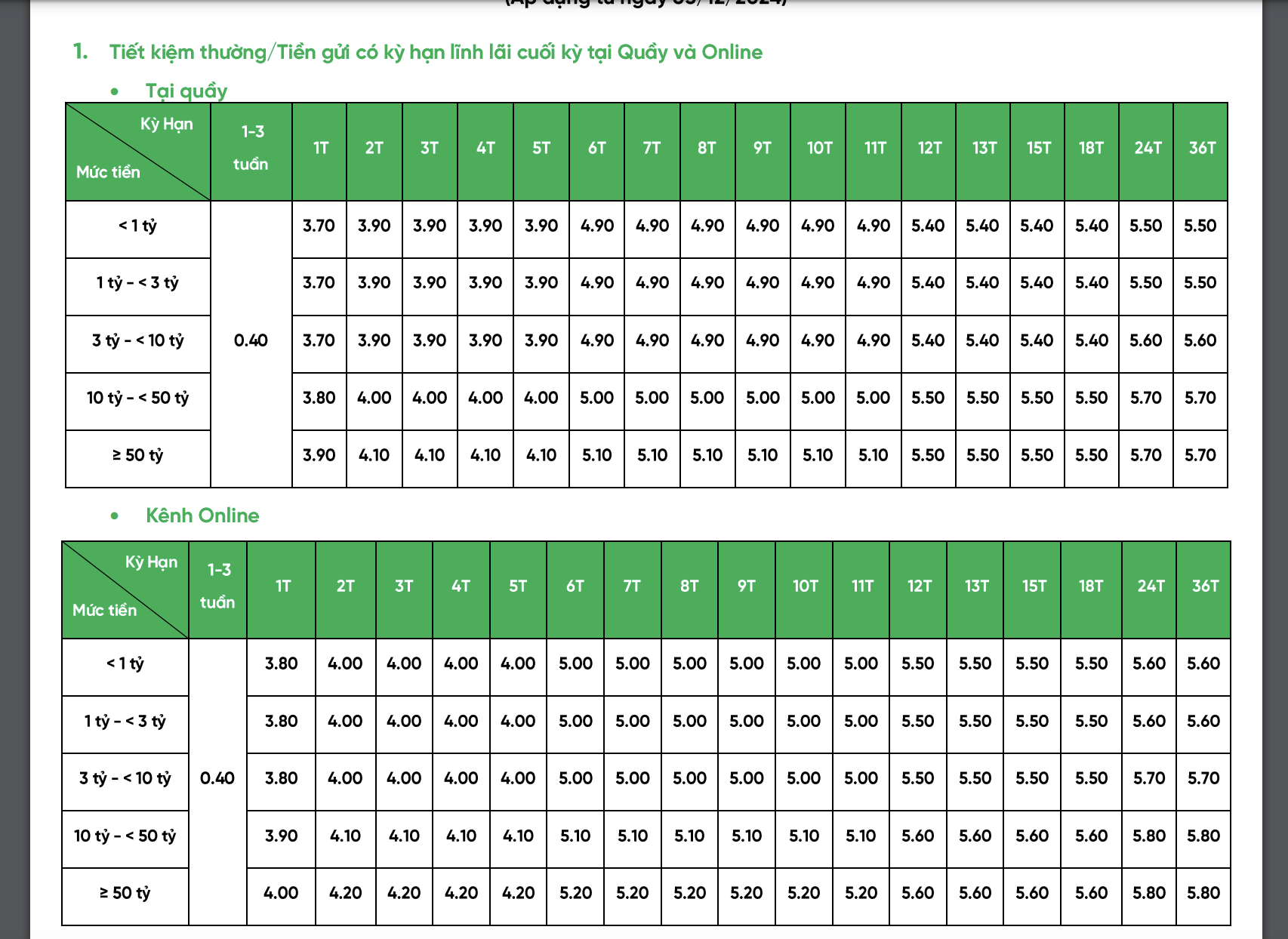

Meanwhile, VPBank also updated the new interest rate table from the beginning of December 2024, adjusting the increase for many terms. For deposits under 1 billion VND, the bank applies an interest rate of 3.7%/year for a 1-month term, 4.9%/year for a 6-month term, and 5.4%/year for a 12-month term. In particular, the 36-month term reaches the highest rate of 5.5%/year.

Interest rates continue to rise at some banks today.

Meanwhile, VPBank has implemented preferential policies for large deposits and online transactions. Specifically, customers who deposit from 10 billion VND or more will receive the highest interest rate, reaching 5.7%/year with a term of 24 months or more. Notably, the form of online deposits at VPBank also helps customers enjoy an additional 0.1% compared to depositing at the counter. These adjustments have increased by about 0.2% compared to before.

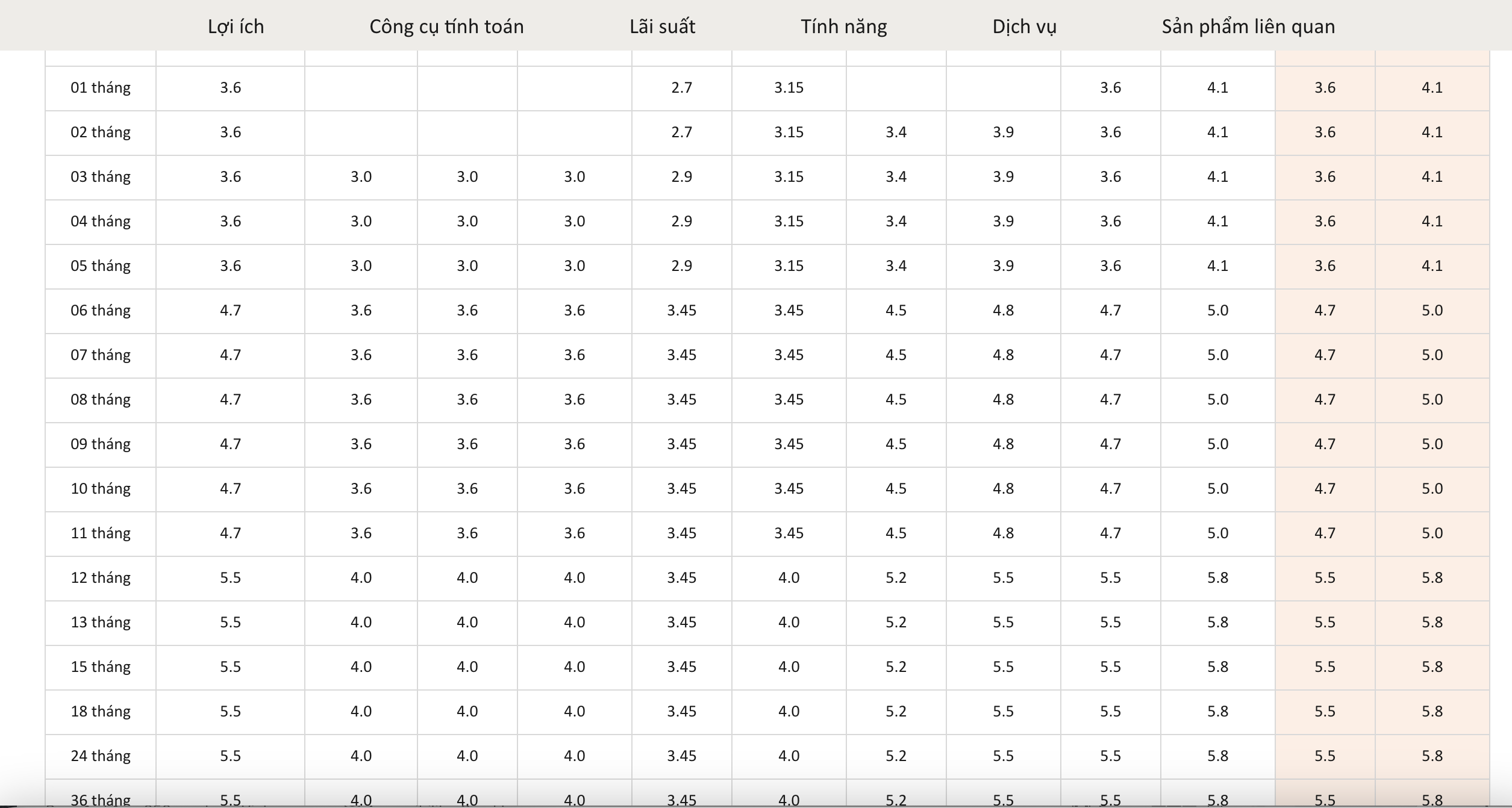

MSB is also not out of the trend of increasing interest rates to attract depositors. MSB's new interest rate table shows that the highest interest rate when depositing at the counter is 3.6%/year for short terms from 1-5 months, 4.7%/year for medium terms from 6-11 months, and 5.5%/year for long terms from 12 months or more. In particular, online savings at MSB are added 0.2% points, helping to optimize benefits for customers. Similar to VPBank, MSB's new interest rates also increased by about 0.2% points compared to before.

Associate Professor Dr. Nguyen Huu Huan, Ho Chi Minh City University of Economics, commented that the upward movement in deposit interest rates is a reasonable trend in the final period of the year, when the demand for capital mobilization to meet credit growth has increased more rapidly than recently. At the same time, the pressure on the USD/VND exchange rate has also remained high in recent times, forcing banks to increase interest rates to mobilize capital and ensure liquidity.

"If the input interest rate increases by about 0.5 percentage points, it is reasonable because the increase in deposit interest rates is more seasonal at the end of the year. Therefore, the lending interest rate will not be affected much and there is no need to worry too much about the loan interest rate going up" - Associate Professor, Dr. Huan said.

Latest deposit interest rates at Techcombank

Interest rates at VPBank applied from December 2024

MSB is also a bank that has just adjusted its input interest rate up.

Source: https://nld.com.vn/lai-suat-hom-nay-6-12-gui-tiet-kiem-techcombank-vpbank-ky-han-nao-lai-cao-nhat-196241206101005343.htm

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)