Currently, a number of Vietnamese enterprises have plans to list on the Japanese stock exchange and receive support from investment funds and securities companies in this country.

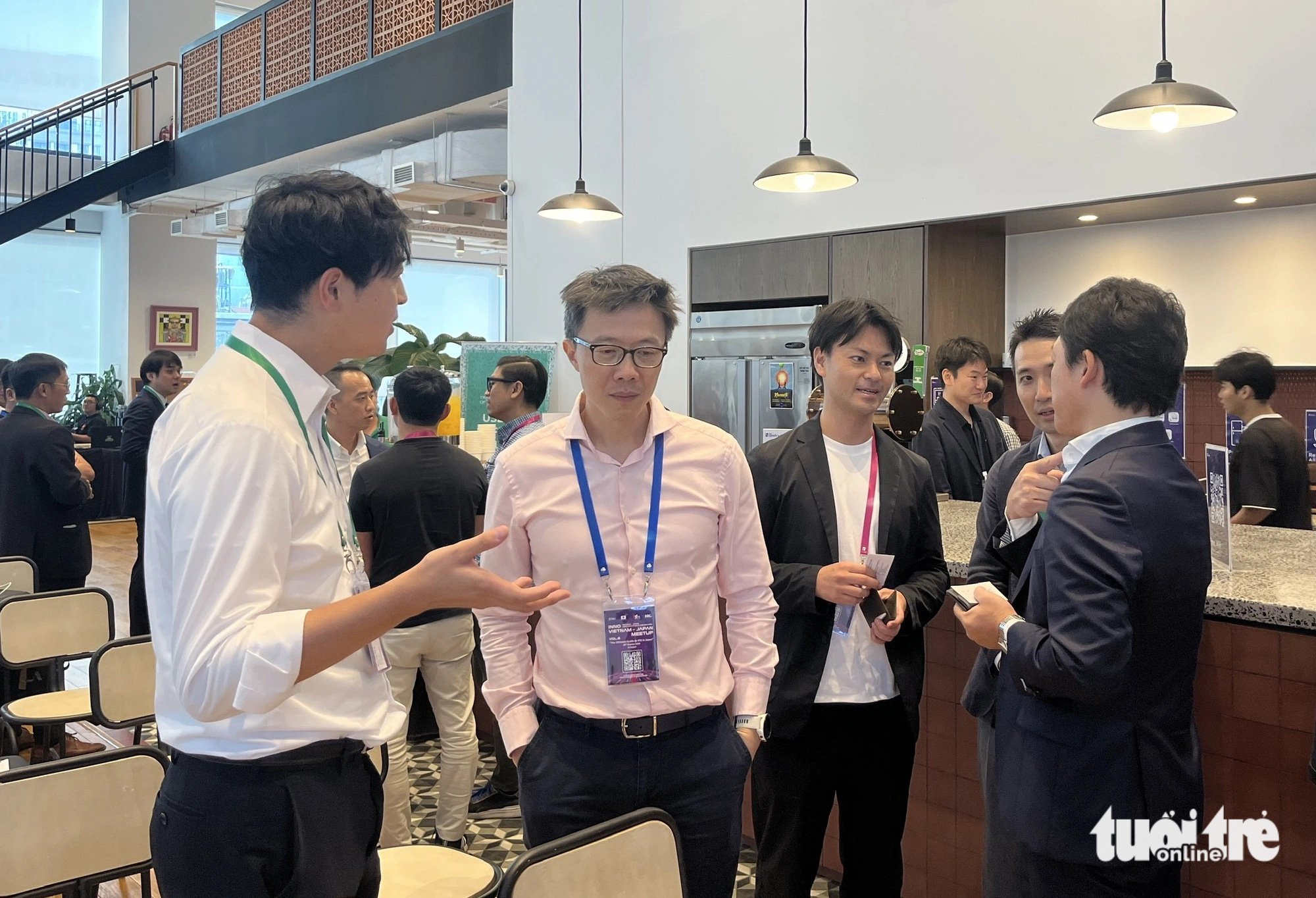

Vietnamese and Japanese investors and startups connect and seek cooperation opportunities - Photo: N.BINH

A delegation of Japanese businesses and venture capital (VC) funds met with Vietnamese start-ups in Ho Chi Minh City last weekend to discuss opportunities for initial public offerings (IPOs) in the Japanese market.

Speaking to Tuoi Tre Online, Mr. Yuma Yasu - Vice President of the IPO Department of Nomura Securities Company, Japan - said that to prepare for an initial public offering (IPO) in Japan, issuing companies need to carry out a strict process with many stages lasting two years or more.

Under Japanese exchange standards, companies must prepare at least two years of audited financial statements before they can apply for a listing. This stage includes working with legal, tax and trust banks to develop a detailed “IPO plan.”

However, unlike Vietnam's regulations, companies in some sectors do not necessarily have to be "profitable" to be considered eligible for an IPO.

Japan's stock exchanges allow loss-making companies to go public as long as they can demonstrate future growth, often technology companies.

"In the final stages before listing, issuers will conduct roadshows to meet with institutional investors. To attract market interest, companies need to develop a unique 'equity story' that highlights the reasons for choosing the Japanese stock market, their competitive advantages, and their long-term growth strategy," added Yuma Yasu.

Esther Nguyen, founder of Pops Worldwide, a digital entertainment start-up based in Vietnam, said the company is taking steps to list on the Tokyo Stock Exchange.

Sharing her experience, Ms. Esther Nguyen said that in addition to potential, businesses need to cooperate with Japanese companies to understand the market and laws of the host country.

In 2022, Pops Worldwide raised an undisclosed amount of capital in a Series D round led by Japan's TV Tokyo Corporation, officially entering this market.

According to Mr. Son Beomsu, deputy head of IPO in charge of APAC market of Tokyo Stock Exchange (TSE), Singapore branch, TSE sees growth opportunities from the market not only for Japanese companies, but also expanding to startups from the ASEAN region, including Vietnam.

Vietnamese startups planning to expand their business in Japan need to understand the IPO listing process in this market to maximize their potential and open the door to cooperation with international investors and partners.

The meeting is part of the "Vietnam - Japan Joint Initiative in the New Era" - co-organized by JETRO with the Embassy of Japan in Vietnam, the Japan Chamber of Commerce and Industry in Vietnam (JCCI, JCCH, JCCID) and the National Innovation Center (NIC) of Vietnam.

VinFast changes the way of IPO in the US

VinFast changes the way of IPO in the USSource: https://tuoitre.vn/gioi-khoi-nghiep-viet-nam-co-nhieu-co-hoi-niem-yet-tren-san-chung-khoan-nhat-ban-20241026113631047.htm

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] President Luong Cuong hosts state reception for Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/56938fe1b6024f44ae5e4eb35a9ebbdb)

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

Comment (0)