Gold prices have just experienced a week of great fluctuations. At the beginning of the week, the precious metal prices stabilized as the market awaited important economic reports in October.

Gold prices then surged after a report showed a significant reduction in inflationary pressures, raising expectations that the US Federal Reserve (FED) had completed its monetary policy tightening roadmap. Gold was pushed higher, breaking a series of consecutive weeks of decline.

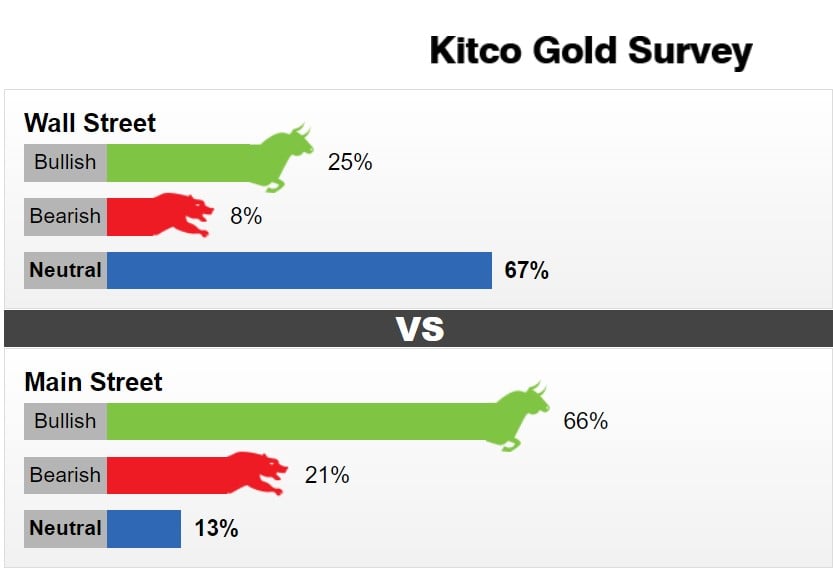

The latest Kitco News weekly gold survey shows that retail investors remain strongly bullish for next week, but most analysts have turned neutral on the short-term outlook for gold.

This week, 12 Wall Street analysts participated in the Kitco News Gold Survey. Like last week, three experts, or 25%, see gold prices rising next week. Only one expert, or 8%, sees gold prices falling. Meanwhile, 67% are neutral on gold next week.

Meanwhile, 595 votes were cast by investors in Kitco’s online polls. Market participants were even more optimistic than in last week’s survey.

394 retail investors, or 66 percent, expect gold to rise next week. Another 125, or 21 percent, expect prices to fall. Meanwhile, 76 respondents, or 13 percent, are neutral on the precious metal’s near-term outlook.

After the recent rally, gold is vulnerable to negative news, but the medium-term outlook for gold is strong, said Adrian Day, chairman of Adrian Day Asset Management.

This expert believes that at some point, the Fed and other central banks will ease the tightening before inflation is contained and that decision will trigger a strong recovery in the gold market. However, this is unlikely to happen.

Similarly, Daniel Pavilonis, senior commodities broker at RJO Futures, said that while gold prices continue to react to economic indicators, recent developments do not provide a clear direction for the precious metal. According to this expert, there will be no news that can provide momentum for gold next week and gold will trade around current levels.

Meanwhile, Gainesville Coins market analyst Everett Millman said the Fed may have finished raising interest rates and the gold market will be interested in when to cut interest rates. According to him, lower interest rates are basically the biggest bullish driver for gold, barring a recession. Accordingly, the gold market in the near term will be stable until we see a clearer picture of the economy.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is neutral on gold, saying he does not expect any major moves in the gold market over the next 10 days amid a lack of economic data and a shortened trading week as the US enters the Thanksgiving holiday.

Domestic investors lose money when buying gold in the short term

As of 11:00 a.m. on November 19, 2023, the domestic gold price listed by DOJI Group for buying was 69.95 million VND/tael; the selling price was 70.75 million VND/tael. The difference between buying and selling prices of gold at DOJI is 800,000 VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the buying price of gold at 69.95 million VND/tael; the selling price is 70.75 million VND/tael. The difference between the buying and selling price of SJC gold is currently 800,000 VND/tael.

Last week, domestic gold prices increased sharply, but the difference between buying and selling prices last week was so high that buyers still suffered losses.

Specifically, if you buy gold at DOJI Group on November 12 at VND70.3 million/tael and sell it today (November 19), you will lose VND350,000/tael. Similarly, if you buy gold at Saigon Jewelry Company SJC, you will lose VND350,000/tael.

Meanwhile, the world gold price closed the trading session of the week listed on Kitco at 1,981.1 USD/ounce, up 42.4 USD/ounce compared to the closing price of the previous trading session.

Source

Comment (0)