In late August 2024, many people were surprised by the news that Starbucks closed its most high-end store in Ho Chi Minh City at 11-13 Han Thuyen, District 1 after 7 years of operation and always crowded with customers. What shocked many people more was that Starbucks returned this space after the contract expired and the landlord increased the rent from 700 million to 750 million VND/month, or about 9 billion VND/year.

Race to pay for prime land

For business people and those working in the real estate rental sector, the rental price of the above premises is not too high.

In fact, there are other premises on the same Han Thuyen street or neighboring streets with much higher rental prices. For example, the premises of %Arabica Coffee, a famous Japanese coffee chain that just opened a few months ago, cost no less than 700 million VND/month.

A prime location in the center of Ho Chi Minh City has been vacant for many years. Photo: PHAM DINH

However, these types of super high-end premises are only for businesses with their own strategies. For businesses that only want to make profits from selling products and services, it will be very difficult to survive.

A few months before Starbucks Han Thuyen closed, a series of famous brands such as Highlands Coffee returned the premises at the corner of Nguyen Du and Pasteur streets; YEN Sushi restaurant closed its branch at 8 Dong Khoi. The MIA luggage and handbag store also returned the premises at Phu Dong intersection a few months ago. This premises also had a rental price of up to 700 million VND/month and had been transferred to 4 big brands in just 5 years.

In fact, the fact that the premises are expensive and businesses cannot afford them in the context of economic difficulties and are forced to return them is not a new thing but has been happening since the COVID-19 pandemic broke out in 2020 until now. According to the reporter of Nguoi Lao Dong Newspaper, up to now, there are still many premises along busy streets in the center of Ho Chi Minh City such as Nguyen Hue, Le Loi (District 1), Vo Van Tan (District 3), Nguyen Trai (District 5), Nguyen Van Linh (District 7), Phan Xich Long (Phu Nhuan District) ... are in a state of "closed doors" with no tenants or have been rented but continue to be closed.

Le Loi Street (District 1) is about 550 m long and is one of the most beautiful streets in the center of Ho Chi Minh City, intersecting with "golden" streets such as Pasteur, Nam Ky Khoi Nghia, Nguyen Hue, but currently has about 15 vacant premises. Ms. Nguyen Hanh, manager of a souvenir shop on this street, said that the reason many surrounding shops closed was because they could not afford the rent, up to 25-30 million VND per day, or 800-900 million VND/month; not including personnel costs, taxes, capital... Some shop owners did not initially anticipate the business situation, so they rented at a price beyond their ability, leading to not being able to cover expenses, and had to close and rent elsewhere even though they had only moved in for a few months.

"Jewelry stores, famous PL milk tea chain, travel agencies... have been unable to bear the rental costs and have returned their premises one after another. Up to now, no one has dared to rent again because the price is too high. I am also asking the landlord to reduce the rent because there are many tourists but few buyers, I don't know if I can last until next year" - Ms. Hanh worried.

Mr. Hoang Thanh - broker of the house at 48 Le Loi, with a structure of 1 ground floor and 1 upper floor - said that the owner of this house is offering the price of 12,000 USD/month (nearly 300 million VND), with the condition of deposit of 4 months, payment of 2 months in advance and rent for at least 2 years. It is worth mentioning that this house has been vacant for more than 1 year since the TT watch store "ran away" but the owner refused to reduce the rental price.

"If customers want to rent a space on Le Loi Street for business or branding, they need to consider carefully because the price is very high, ranging from 10,000 - 12,000 USD/month. Many customers cannot afford this rental fee and have to accept losing their deposit of hundreds of millions of VND" - Mr. Thanh informed.

Nguyen Trai Street (District 5) was once known as the "fashion street" of Ho Chi Minh City, with hundreds of shops selling shoes, clothes, handbags, hats, glasses... However, due to sluggish business and sky-high rental fees, many people have hung up signs to liquidate goods and transfer premises.

Ms. Pham Ngoc, representative of the Mdl designer maternity dress store, said she wants to transfer a 14.5 m2 space, with a usable area of 35 m2 including 1 floor, 1 ground floor and 1 small warehouse, with a rental price of 60 million VND/month, a transfer price of 259 million VND (including air conditioner, lights, signboard, deposit...) to switch to another business line. "Fashion sales are decreasing while the rental price is high, not suitable for the market. After negotiating many times without success, I decided to transfer it" - Ms. Ngoc explained.

Ms. Ha Phuong, owner of the NN fashion store nearby, also said that she is in need of liquidating all goods and leasing the ground floor area of 80 m2 due to "retirement". The current rental price is 45 million VND/month and the tenant must rent for at least 1 year, deposit 2 months. The tenant will save on the cost of shelves, counters... However, according to research, Ms. Phuong stopped selling and returned the premises because the landlord refused to reduce the price to support the business but still increased it regularly every year.

Better to leave it empty than to lower the rent!

As a tenant, Ms. Le Thi Tu Uyen, who specializes in selling environmentally friendly consumer goods and clean food, said that she once rented a space for 20 million VND/month on Nguyen Hue Street, District 1, but closed it after only 3 months despite losing her deposit. Because although this street is crowded, it is mainly young people, consumers with moderate spending ability, so the revenue earned is not enough to cover expenses.

After that, Ms. Uyen focused on developing the online channel and realized that she only needed to spend about 200,000 VND/day, or about 6 million VND/month on advertising, to reach about 40,000 people. With a "closing" rate of 0.5%, the store had 200 orders/month. The online store can reach customers everywhere and on target thanks to artificial intelligence (AI), so it converts to orders quite well. "The current price of retail space is unreasonably high. The development of the online channel will significantly reduce the rental price and gradually return to its real value," Ms. Uyen predicted.

Recently, a chain of high-end food stores in Ho Chi Minh City has closed its first store that has been operating for more than 10 years on Nguyen Dinh Chieu Street, District 3, due to the landlord's "unreasonable price increase request". The founder of this brand said that the above premises, with an area of less than 40 square meters, is very old, the air conditioner often breaks down and gets wet when it rains, and is difficult to renovate because the wall is shared with the store next door, but the rent is up to 60 million VND/month.

After more than 3 months of closure of the above food store, the premises are still for rent, and have not found any new customers. "With the above rental price and the condition of the premises, only "big guys" with a lot of money to rent for branding or "self-indulgent" business people can afford to rent, while normal businesses cannot afford the rental price" - the representative of this retail chain commented.

F&B industry expert Hoang Tung - Chairman of F&B Investment & FoodEdu Academy, said that although the online channel is growing rapidly, its contribution to revenue is still insignificant, with most of the revenue still coming from offline channels. Therefore, business premises still hold an important position in the F&B industry. "Not only are prime locations increasing in rent due to scarcity, with supply being less than demand, but normal business premises are also showing an upward trend in price," he said.

Mr. Tung said that according to the convention, the landlord always "holds the upper hand" when always requiring customers to deposit, pay in advance and increase the price annually or periodically with the reason of compensating for inflation. Most of the landlords have good financial conditions, so they can leave the house empty for 6 months to 1 year to maintain the price, determined not to lower the rental price. "Regarding the premises, keeping the rental price is good, but there is little hope of reducing it. F&B shop owners must consider this in their costs before starting a business" - Mr. Tung advised.

Meanwhile, Mr. Nguyen Hong Hai, Chairman of VNO Investment and Development Joint Stock Company - specializing in leasing and subleasing houses and premises - said that the reason why businesses close down and return premises is not necessarily because of the rental price, but maybe they no longer have a need or realize that the business situation is not feasible in the future.

Beautiful premises still in demand

According to an F&B industry expert, coffee and beverage chains that invest heavily in prime locations include Katinat Coffee & Tea, Phe La, Phuc Long, Highland... However, among these, Katinat Coffee & Tea and Phe La are owned by the same owner. Perhaps the purpose of the investor in developing the chain strongly at this stage is to sell shares or for some other purpose, so it cannot be compared with brands that are doing business to earn normal profits...

In fact, in areas where space is scarce, the rental price increases, but rarely decreases. Typically, beautiful spaces in the center of District 1 or the space on Han Thuyen Street that Starbucks just paid for, the space at the Ho Con Rua roundabout... are always "on the lookout" for large F&B brands and chains to rent.

Source: https://nld.com.vn/gia-thue-mat-bang-ngay-cang-cao-196240902193102544.htm

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

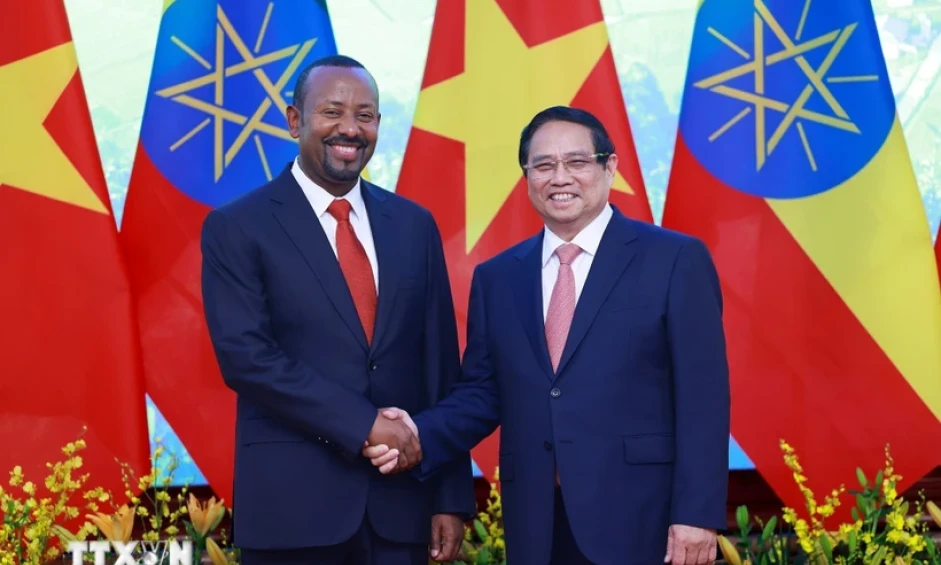

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)