Foreign exchange rate, USD/VND exchange rate today, December 25, increased slightly in the last trading session due to the expectation of a slower interest rate cut roadmap from the Fed.

Foreign exchange rate update table - USD exchange rate Agribank today

| 1. Agribank - Updated: December 25, 2024 07:00 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,280 | 25,283 | 25,523 |

| EUR | EUR | 25,941 | 26,045 | 27,143 |

| GBP | GBP | 31,274 | 31,400 | 32,361 |

| HKD | HKD | 3,210 | 3,223 | 3,327 |

| CHF | CHF | 27,780 | 27,892 | 28,734 |

| JPY | JPY | 158.10 | 158.73 | 165.51 |

| AUD | AUD | 15,562 | 15,624 | 16,129 |

| SGD | SGD | 18,421 | 18,495 | 19,007 |

| THB | THB | 724 | 727 | 758 |

| CAD | CAD | 17,376 | 17,446 | 17,939 |

| NZD | NZD | 14,114 | 14,600 | |

| KRW | KRW | 16.80 | 18.44 | |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:00 a.m. on December 25, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,315 VND, down 9 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,400 VND - 25,450 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 25,200 - 25,530 VND.

Vietinbank: 25,225 - 25,530 VND.

|

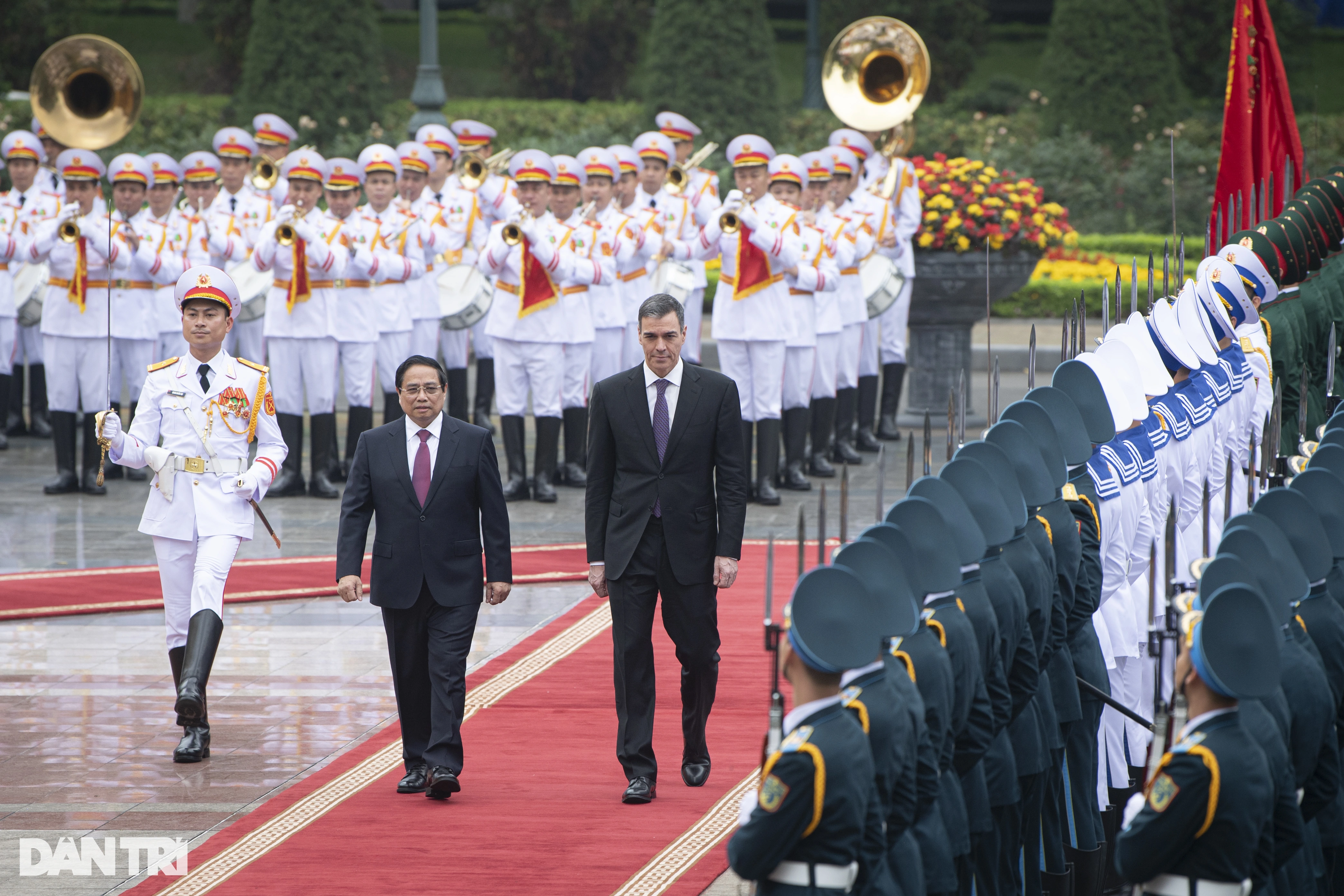

| Foreign exchange rates, USD/VND exchange rate today, December 25: USD continues to increase slightly. (Source: Xinhua) |

Exchange rate developments in the world market

The US Dollar Index (DXY) measuring the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.14%, currently at 108.24.

The US dollar edged up slightly in the last trading session, as the slower-than-expected rate cut path from the US Federal Reserve (Fed) compared to other global central banks continued to dominate market direction.

The greenback has gained more than 7% since late September, partly due to growing expectations that the US economy will see faster growth under the policies of President-elect Donald Trump.

Those expectations for the US contrast with the growth forecasts and interest rate views of other global economies and central banks, leading to widening interest rate differentials.

Last week, the Fed forecast a more measured path of rate cuts than the market had expected, adding further upside to U.S. Treasury yields, pushing the benchmark 10-year yield to a seven-month high of 4.629%.

“The markets are taking a breather from the Christmas holidays and the US presidential election and they are looking for positives,” said Joseph Trevisani, senior analyst at FX Street in New York.

The interest rate differential between central banks has contributed to the greenback's rally, amid expectations that the Fed will slow the pace of rate cuts next year.

The DXY index rose 0.14% to 108.24, while the euro fell 0.15% to $1.0389. The index is on track for its fifth gain in the past six trading sessions.

Trading volumes are likely to be light next week ahead of the 2025 New Year holiday, with little economic data due for release and analysts expecting interest rates to be the main driver of the forex market until the US jobs report on January 10.

The British pound fell 0.06% to $1.2527.

Against the yen, the dollar rose 0.1% to 157.34. The Japanese currency remained near lows that recently prompted Japanese authorities to intervene to support the currency.

Minutes of the Bank of Japan's policy meeting last week showed policymakers agreed to continue raising interest rates if the economy develops in line with their forecasts, but some stressed the need for more caution.

Donald Trump's return to the White House, along with his expected policies on tariffs, tax cuts and immigration restrictions, has had a significant impact on the currency market in recent times.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-2512-dong-usd-tiep-tuc-tang-nhe-298547.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)