The central exchange rate increased by 10 VND, the VN-Index decreased slightly by 1.77 points, or as of November 29, 2024, the total outstanding debt of the economy reached about 15,300,000 billion VND, an increase of 11.9% compared to the end of 2023... are some notable economic information on December 10.

| Review of economic information week 2-6/12 Review of economic information on December 9 |

|

| Economic news review |

Domestic news

Foreign exchange market, session 10/12, State Bank listed the central exchange rate at 24,258 VND/USD, up 10 VND compared to the first session of the week.

The buying and selling prices of USD were kept unchanged by the State Bank of Vietnam at 23,400 VND/USD and 25,450 VND/USD, respectively.

On the interbank market, the dollar-dong exchange rate closed at 25,375 VND/USD, a slight increase of 5 VND compared to the session on December 9.

The dollar-dong exchange rate on the free market decreased by 40 VND in both buying and selling directions, trading at 25,550 VND/USD and 25,660 VND/USD.

Interbank money market, on December 10, the average interbank VND interest rate increased by 0.02 - 0.17 percentage points in most terms of 1 month or less, except for the 2-week term unchanged compared to the first session of the week; specifically: overnight 4.22%; 1 week 4.34%; 2 weeks 4.48 and 1 month 4.80%. The average interbank USD interest rate decreased by 0.01 percentage point in the 2-week term while remaining unchanged in the remaining terms, trading at: overnight 4.61%; 1 week 4.66%; 2 weeks 4.70%, 1 month 4.76%.

Government bond yields in the secondary market remained unchanged for 5-year and 15-year terms while slightly increasing for the remaining terms; closing at: 3-year 1.87%; 5-year 2.02%; 7-year 2.33%; 10-year 2.80%; 15-year 2.99%.

In open market operations, on the mortgage channel, the State Bank bids VND5,000 billion, with a term of 07 days, and an interest rate of 4.0%. VND4,999.99 billion was won. VND10,000 billion matured on this channel. The State Bank bids for SBV bills with two terms of 14 days and 28 days, and bids for interest rates. VND850 billion was won for a term of 14 days, with an interest rate of 4.0%; VND800 billion was won for a term of 28 days, with an interest rate of 4.0%. VND300 billion was matured.

Thus, the State Bank of Vietnam net withdrew VND6,350.01 billion from the market through the open market channel yesterday. There were VND19,999.96 billion circulating on the mortgage channel, and VND43,955 billion in treasury bills circulating on the market.

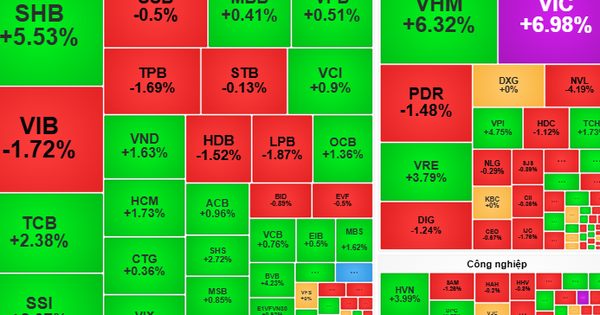

In the stock market yesterday, selling pressure increased, liquidity weakened, VN-Index closed below the reference level. At the end of the trading session, VN-Index decreased slightly by 1.77 points (-0.14%) to 1,272.07 points; HNX-Index added 0.03 points (+0.01%) to 229.24 points; UPCoM-Index lost 0.17 points (-0.18%) to 92.74 points. Market liquidity decreased compared to the previous session with a trading value of over VND 15,700 billion. Foreign investors net sold more than VND 300 billion on all 3 floors.

According to data from the State Bank of Vietnam, as of November 29, 2024, the total outstanding debt of the economy reached about VND 15,300,000 billion, an increase of 11.9% compared to the end of 2023; by December 7, 2024, the credit growth rate had reached 12.5%, higher than the 9% of the same period in 2023. Capital mobilization had also reached about VND 14,800,000 billion; the growth rate of outstanding debt is higher than capital mobilization; credit structure continues to focus on production and business sectors, especially priority sectors and growth drivers according to the Government's policy.

International News

The Reserve Bank of Australia (RBA) left its policy rate unchanged at its final meeting of the year. At its meeting yesterday, December 10, the RBA said that inflation had eased significantly from its peak in 2022, as higher interest rates brought aggregate supply and demand closer to balance. Core inflation is currently around 3.5%, still well below its 2.5% average target. The Monetary Policy Board is confident that inflation is moving towards its target on a sustained basis.

In addition, the RBA said that recent data showed that economic activity was generally weaker than forecast in November. The labor market remained tight, with the unemployment rate at 4.1% in October, up from 3.5% in 2022 but still relatively low. The employment rate was also at a record high. The RBA's top priority was to control inflation, and decided to keep the policy rate unchanged at 4.35% at this meeting to achieve that goal. The RBA will continue to rely on data in future meetings to make its next decision.

The German Federal Statistical Office Destatis announced that the country's headline CPI officially decreased by 0.2% month-on-month in November, unchanged from the preliminary results and in line with experts' forecasts. Compared to the same period in 2023, the German CPI still increased by about 2.2% last month, higher than the 2.0% recorded in October, mainly due to the digital effect.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-ngay-1012-158682-158682.html

![[Photo] Late season Bauhinia flowers hold Hanoians back](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/41b044c33c5c4f00859ad39a08d3ffa3)

![[Photo] Close-up of the construction of the first dam to retain water on the To Lich River](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/0b561f1808554026a87a8cb1f79c8113)

Comment (0)