Growing consumer sentiment is fueling hopes inside the White House that Americans will warm to President Joe Biden's economic leadership.

Newly released data show improvements in prices and consumer sentiment about the economy. Gas prices have fallen significantly this year, mortgage rates have dropped, and supply chain woes have largely eased.

“Potential Asset”

Biden’s economic advisers have argued for years that the 46th US president’s policies have produced strong growth and low unemployment, but those calls have failed to gain traction with voters as high inflation has hurt the pocketbooks of American consumers.

The cooling of prices in the final months of 2023 has given the White House confidence that the Bidenomics agenda could be a “potential asset” in convincing voters to give the 82-year-old president a second term in 2024.

“If you look back over the year, it’s really staggering how much progress the economy has made,” Lael Brainard, director of the White House National Economic Council (NEC), told Bloomberg Television.

The surge in consumer confidence “suggests that Americans can finally start to feel a little more confident, a little more secure. But the president is going to keep pushing us to get to work,” she said.

US President Joe Biden at an event in Milwaukee, Wisconsin, December 20, 2023. Photo: Getty Images

Economic data released over the past few months has been largely positive. Inflation has fallen but is still below the Federal Reserve's 2% target. Unemployment remains below 4% and the world's No. 1 economy is growing strongly.

Specifically, the latest data, released on December 22, showed that the core personal consumption expenditures (PCE) price index - the Fed's preferred inflation measure - barely rose in November and has remained below the US Central Bank's 2% target for the past 6 months.

Additionally, two measures of US consumer sentiment released last week, including the University of Michigan sentiment index and the Conference Board consumer confidence index, also recorded large monthly increases.

Ms Brainard cited the latest PCE data in particular in a series of US media appearances throughout the day. “That should give people a lot of confidence that inflation is coming down in a sustainable way and that we can continue to see good growth in real income and real wages,” she said.

Much work to do

But not all is well. A Quinnipiac University poll released on December 20 found that 39% of voters approve of President Biden's handling of the economy, while 56% disapprove.

While that's a significant improvement from a similar poll 18 months earlier, when just 28% of voters approved, it's clear many voters remain dissatisfied with the economy.

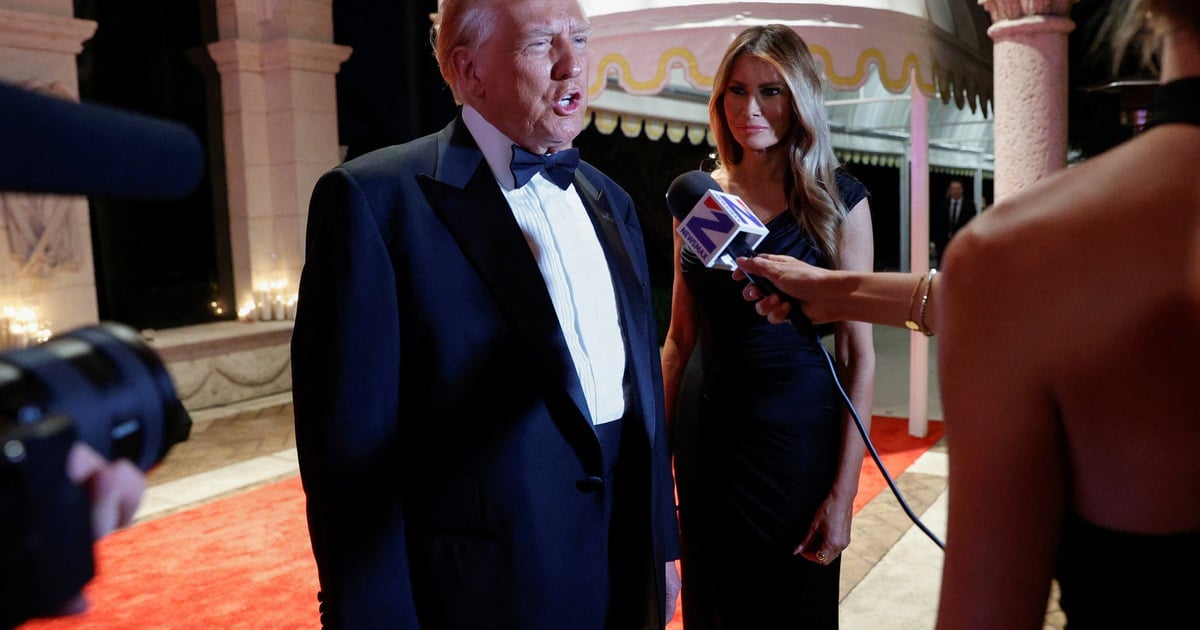

According to a Bloomberg News/Morning Consult survey released earlier this month, Republican presidential frontrunner Donald Trump led Biden 51% to 33% when voters were asked who they trusted more to handle the economy.

Surveys also regularly show a gap between how people feel about the economy and how it is performing, according to several measures tracked by Bloomberg.

“People don’t pay attention to macroeconomic data, they only care about grocery prices, while in fact grocery prices are still much more expensive than before,” said Michael Strain, director of economic policy studies at the American Enterprise Institute (AEI).

“We’re on the right track, but we have a lot of work to do — quite a bit of work to do … in the spirit of Bidenomics,” Jared Bernstein, a Biden confidant and chairman of the Council of Economic Advisers (CEA), said in response to a Washington Post question about voter dissatisfaction with the economy.

“If you’re going to judge the Biden administration based on polling data, you should also ask detailed questions about exactly what we’re doing. At the same time, people are the best arbiters of their economic conditions. If they tell me they’re feeling bad, I’ll believe them. We’re working hard in ways that we believe will close the gap between the indicators and sentiment,” Bernstein said.

The gap between perception and reality

The Biden administration has begun to subtly argue that conditions have actually improved for some people, even if it may not feel like it. The average American worker will still have $1,000 more left in their pocket after buying the same goods in 2023 than they did in 2019, according to a Treasury Department analysis released on Dec. 14, because inflation-adjusted incomes have increased.

“Americans are starting to feel better about the overall economy, just as they have felt about their finances in some time,” said Daniel Hornung, deputy director of the White House National Economic Council. “As inflation continues to moderate, that momentum will only grow.”

Gasoline prices, which are closely tied to consumer sentiment, have fallen sharply from highs after Russia launched its military campaign in Ukraine in February 2022.

Customers shop in Herald Square, New York, US, December 11, 2023. Photo: Journal Gazette

Neale Mahoney, a professor of economics at Stanford University who served on the NEC, said two factors are contributing to the gap between sentiment and data: reaction lag and partisanship.

Research from Mr Mahoney and former White House economist Ryan Cummings shows that the psychological weight of inflation wears off consumers' minds at a rate of about 50% per year, meaning people don't relax immediately when prices fall.

“It’s reasonable for consumers to still feel a bit of a shock today,” Mahoney said. “We think the downward drag on sentiment from inflation will be significantly less.”

Biden’s economic advisers also warn that events can always derail the recovery, even as hopes of avoiding a recession grow.

Brainard acknowledged on Dec. 22 that geopolitical risks could threaten the U.S. economy, including attacks in the Red Sea that disrupted global shipping, although she said they had not yet disrupted supply chains .

Minh Duc (According to Bloomberg, Washington Post)

Source

Comment (0)