Trading returned to a tug-of-war state, causing the VN-Index to fluctuate only narrowly around the reference level. Market liquidity did not improve even though this was the session when ETF funds restructured their portfolios.

Stock trading session at the end of the year of the Dragon: Small and medium-sized stocks attract cash flow

Trading returned to a tug-of-war state, causing the VN-Index to fluctuate only narrowly around the reference level. Market liquidity did not improve even though this was the session when ETF funds restructured their portfolios.

The trading session on January 24 took place in a rather quiet atmosphere as cash flow waited for the Tet holiday. Although in the morning session, the VN-Index had a time challenging the 1,260 point mark, selling pressure quickly pushed the general index back below the reference. Strong differentiation occurred in pillar stocks such as banks, securities, and steel. Profit-taking pressure before the Tet holiday made investors quite hesitant.

In the afternoon session, trading was more active as demand increased. Partly because today was the session when ETF funds simulating the VN30-Index, VNFIN Lead and VNDiamond indices completed trading in the restructuring period of the first quarter of 2025, the market had strong fluctuations at the end of the session. This helped many stocks increase in price. VN-Index therefore also recovered and edged above the reference level. Although there were some times of strong fluctuations, in general, VN-Index still maintained its green color.

At the end of the trading session, VN-Index stood at 1,265.05 points, up 5.42 points (0.43%) compared to the previous session. HNX-Index increased 0.34 points (0.15%) to 223.01 points. UPCoM-Index increased 0.42 points (0.45%) to 94.3 points. The whole market had 432 stocks increasing, 301 stocks decreasing and 799 stocks remaining unchanged/not traded. The number of stocks increasing to the ceiling was recorded at 53 while there were 15 stocks decreasing to the floor.

Today's session focused on some mid-cap stocks, along with strong transactions of ETFs, which also impacted some large-cap stocks.

|

| Top 10 stocks affecting VN-Index |

Stocks such as MSN, LPB, OCB... all had very good increases in today's session. These are all stocks that domestic ETF funds simulating the above indices increased their weight. Of which, LPB, with being added to the portfolio of the VN30 "basket", received good momentum and increased by 1.56%. In addition, MSN increased sharply by 4%. In this restructuring period, MSN was increased in weight by the VN30 simulation fund. MSN was also the stock with the most positive impact on the VN-Index, contributing 0.94 points. LPB contributed 0.39 points. In addition, stocks such as GAS, GVR, BCM, MWG... also increased in price well and contributed to supporting the VN-Index.

On the contrary, FPT, HPG, BSR, HVN… were the stocks that had the most negative impact on the VN-Index. Of which, FPT decreased by 0.58% and took away 0.32 points from the index. FPT was the stock that the DCVFMVN Diamond ETF reduced its weight in this restructuring period. Similarly, HPG was also reduced its weight by VN30 simulation funds, so it faced strong pressure and decreased by 0.38% in today's session.

The group of small and medium-cap stocks recorded surprises when GEX was pulled up to the ceiling price of VND20,200/share. In addition, some stocks in the real estate group such as NLG, TCH, PDR, NVL, DPG... also increased well in today's session. In the retail group, FRT continued to reach a new peak when it increased by nearly 4% to VND206,000/share. In addition, MWG increased by 1.5%, DGW increased by 1.2%...

|

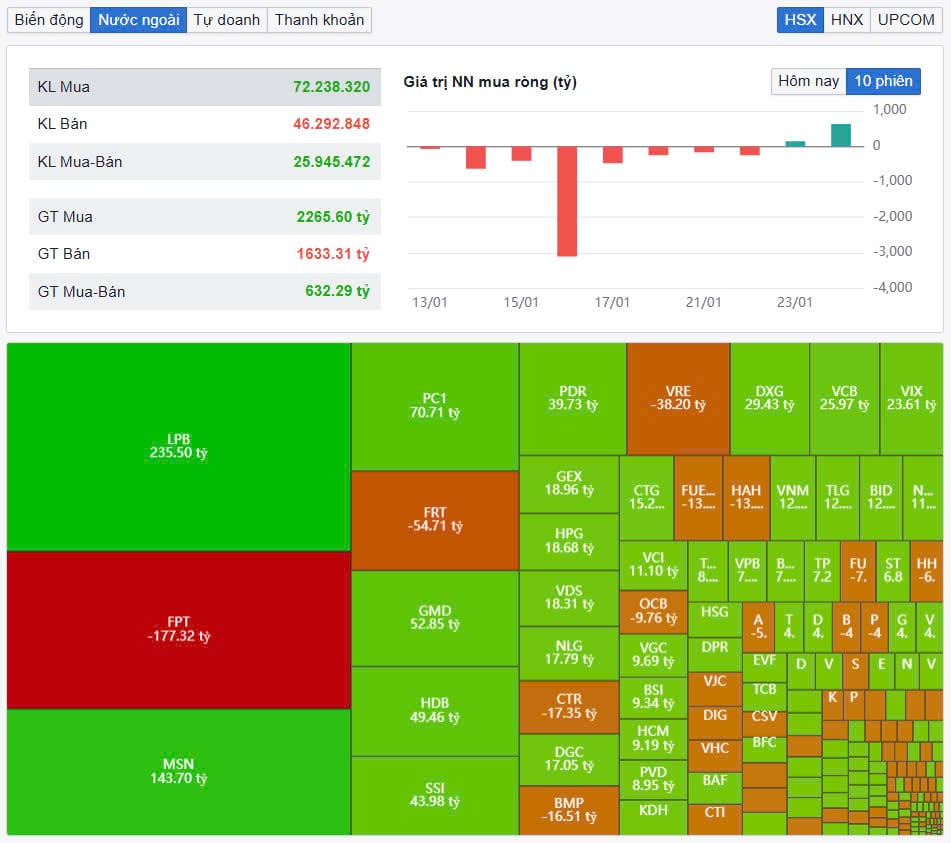

| Foreign investors continue to return to net buying |

Market liquidity decreased compared to the previous session. Total trading volume on HoSE reached 536 million shares, worth VND12,200 billion, down 8%, of which negotiated transactions accounted for VND1,100 billion. Trading value on HNX and UPCoM reached VND552 billion and VND678 billion, respectively.

FPT topped the transaction list with a value of VND561 billion. LPB and MSN traded VND525 billion and VND448 billion respectively.

Foreign investors increased their net buying by VND632 billion, of which, this capital flow bought the most LPB code with VND235 billion. MSN and PC1 were net bought by VND144 billion and VND71 billion respectively. On the other hand, FPT topped the net selling list with VND177 billion. FRT followed with a net selling value of VND55 billion.

Source: https://baodautu.vn/phien-giao-dich-chung-khoan-cuoi-nam-giap-thin-co-phieu-vua-va-nho-hut-dong-tien-d242723.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

Comment (0)