Investors can disburse stocks that are showing a recovery trend such as banks, securities...

At the end of the session, the VN-Index decreased by 7.7 points (-0.6%), closing at 1,285 points. Liquidity decreased when only 751 million shares were successfully traded on the HOSE floor.

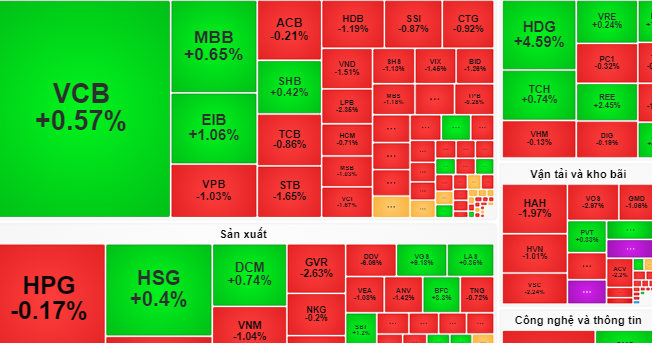

Among the 30 large stocks (VN 30), only 6 increased in price, including: PLX (+1.2%), VCB (+0.6%), MBB (+0.6%), SHB (+0.4%), MSN (+0.4%), VRE (+0.2%).

On the contrary, there were 23 stocks in the red: GVR (-2.6%), FPT (-2.5%), MWG (-2.4%), BCM (-2.1%), BVH (-1.9%) ... spreading the color to many other stocks. Accordingly, stock "players" are worried that this trend may continue to dominate the market in the next session.

However, Dragon Capital Securities Company (VDSC) commented that the liquidity of the session on July 10 decreased compared to the previous session, showing that the supply has not caused much pressure. It is expected that in the next session, the market will be supported in the 1,280 point area of the VN-Index.

"Investors need to slow down and observe supply and demand developments, and consider taking profits on stocks that have increased in price to resistance levels recently," VDSC advised.

VCBS Securities Company said that the market is increasing short-term profit-taking. Therefore, short-term investors can partially take profits on stocks that have reached their profit targets and are showing signs of price decline. Meanwhile, medium and long-term investors should be able to disburse more stocks in groups that are showing a recovery trend such as banks, securities, etc.

Source: https://nld.com.vn/chung-khoan-ngay-mai-11-7-co-phieu-lon-con-chi-phoi-thi-truong-196240710183157586.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on US imposition of reciprocal tariffs on Vietnamese goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/5/9b45183755bb47828aa474c1f0e4f741)

![[Photo] Dong Nai people warmly welcome the forces participating in the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/5/ebec3a1598954e308282dcee7d38bda2)

![[Photo] Hanoi flies flags at half-mast in memory of comrade Khamtay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/5/b73c55d9c0ac4892b251453906ec48eb)

Comment (0)