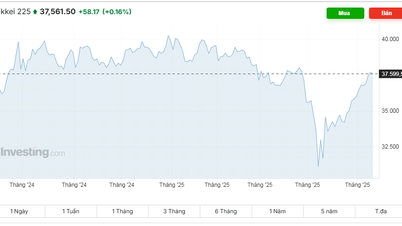

The trading session on April 4 ended in fiery red, marking an unprecedented sell-off since June 2020. The Dow Jones Industrial Average (DJIA) lost more than 2,200 points, equivalent to 5.5%. This was the deepest decline in nearly 5 years and the first time in history that the index fell more than 1,500 points in two consecutive sessions.

The S&P 500, which represents the entire market, also fell 5.9%, marking its lowest level since March 2020. Notably, since its peak in December 2024, the index has fallen 17%, officially entering a deep correction. According to statistics from Bloomberg, a total of $5,000 billion in market capitalization of companies in the S&P 500 was "blown away" in just two days.

|

| All three major US stock indexes plunged on April 4. |

Tech stocks continued to lead the decline, with three key names, Apple, Nvidia and Tesla, down 7%, 7% and 10% respectively. These are all companies with a large manufacturing presence and revenue in China - a country that is entering a tit-for-tat trade war with the US. In the past week alone, Apple has lost 13% of its value - a drop that has shaken investors.

Not only the technology group, all 11 sectors in the S&P 500 index were red. The Nasdaq Composite - a gauge of the health of the US technology sector - lost 5.8% in the session, putting the index in bear market territory (a market state in which prices continuously decline) with a decrease of more than 22% from its peak.

The main reason for the market turmoil is China's retaliatory tariffs, after US President Donald Trump announced a 10% tariff on all imports from more than 180 countries. On April 4, Beijing announced an additional 34% tariff on all goods from the US, effective from April 10.

Markets have reacted negatively to the threat of a return to inflation and the threat of an impending recession. JPMorgan has raised the probability of a US recession to 60%, while Goldman Sachs made a similar forecast in late March.

According to Fed Chairman Jerome Powell, the new tariffs “could have a lasting impact on inflation,” and the Federal Reserve will need time to assess before adjusting monetary policy. However, under pressure from the White House, the possibility of the Fed keeping interest rates unchanged in the near future is quite high, despite the increasing risk of recession.

The rare bright spot in the market came from the consumer sector, especially businesses with supply chains closely tied to Vietnam. Nike shares rose 3% after President Trump confirmed that he had a phone call with General Secretary To Lam, in which the two sides agreed to move towards a 0% tariff on imported goods. Brands such as Hoka, Ugg, Teva - part of the Deckers group - even increased by more than 5%, thanks to a large proportion of supply from Vietnam. Sketchers, Foot Locker and Crocs also recorded increases of 1.5% to 5%.

However, the overall market sentiment was still dominated by concerns as investors shifted money to safe-haven assets such as Treasury bonds. The credit risk index also rose to its highest level since the regional banking crisis in 2023. Gold, after hitting its peak, was also sold off to take profits, falling $78 to $3,036/oz.

Meanwhile, the Trump administration continues to demonstrate a tough stance. As of 0:00 on April 5, the 10% import tax order has officially taken effect on more than 180 countries, not excluding major partners such as China and Vietnam. Additional tax impositions are expected to be activated from April 9, with the highest rate up to 50%.

According to analysts, the market is in a strong correction phase and there is no sign of an end. Luca Paolini, Chief Strategist at Pictet Asset Management, warned: “If Mr. Trump does not back down, this tariff war will continue to destroy the supply chain and lead to a full-blown recession.”

Now, the question is no longer “will there be a recession” but “how bad will it be”, as both the global economy and financial markets are dragged into a spiral of uncertainty.

According to: Reuters, WSJ, Truth Social

Source: https://thoibaonganhang.vn/cuoc-chien-thue-quan-se-pha-huy-chuoi-cung-ung-dan-den-suy-thoai-toan-dien-162349.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

Comment (0)