Large-cap stocks did not fully support the market this morning. The VN30-Index decreased by 0.24 points, or 0.02%. However, the VN-Index still maintained its increase of 2.02 points, or 0.16%, to 1,277.82 points. The HNX-Index edged up slightly by 0.01 points, and the UPCoM-Index increased by 0.04 points, or 0.04%.

Liquidity reached 320.12 million shares, equivalent to VND7,879.23 billion, on HoSE; 16.84 million shares, equivalent to VND303.46 billion, on HNX; and 11.89 million shares, equivalent to VND203.1 billion, on UPCoM.

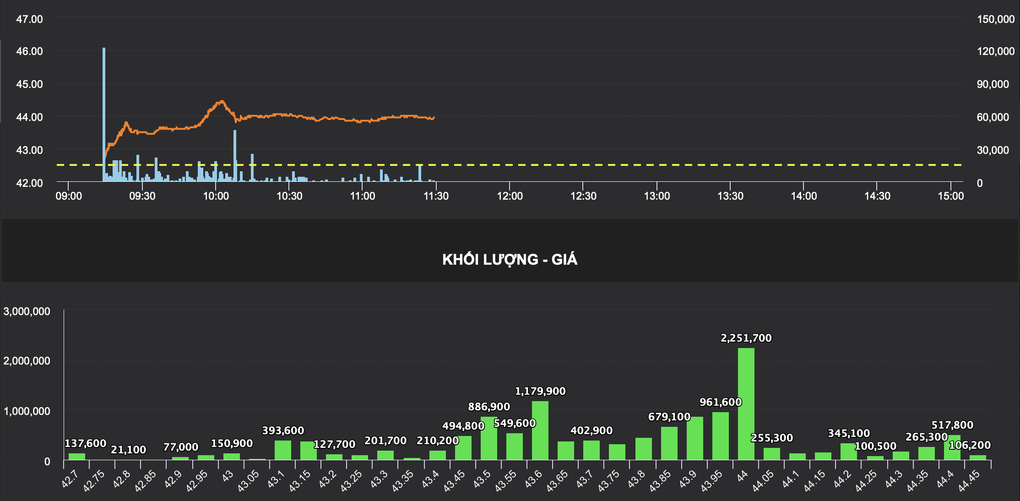

There were 12 stocks increasing in price, 12 stocks decreasing in price and 6 stocks remaining at reference price in the VN30 basket. The Vingroup group attracted attention when it achieved the best increase, in which, VHM increased by 3.4% to 43,950 VND, with 13.56 million units matched; VIC increased by 3.1% to 45,350 VND, with nearly 2.5 million units matched; VRE increased by 1.8% to 20,050 VND, with more than 7.3 million units matched.

VHM stock price movements this morning (Source: VDSC).

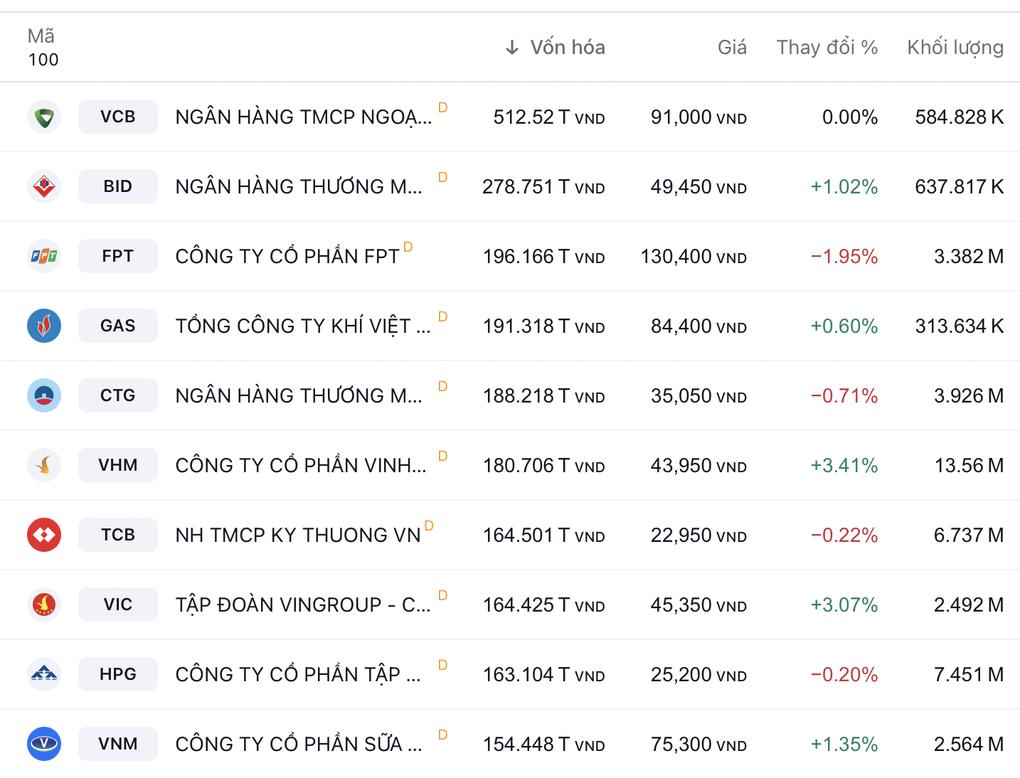

With positive price increases this morning and in recent trading sessions, VHM and VIC have further consolidated their positions in the top 10 stocks with the largest capitalization on the Vietnamese stock market.

VHM's current capitalization has reached VND180,706 billion, surpassing TCB (VND164,501 billion). At the same time, VIC has also surpassed HPG (VND163,104 billion) and is approaching TCB with a capitalization of VND164,425 billion.

Top 10 stocks with the largest capitalization value on Vietnam's stock market (Source: Tradingview).

Some other large stocks in the VN30 basket also achieved an increase this morning: VNM increased by 1.3%; BID increased by 1%; SSI, GAS, SHB, VIB, BVH, MBB, PLX also increased in price.

In fact, the HoSE floor this morning was "green on the outside, red on the inside" when the index increased but the number of stocks decreasing was slightly higher than the number of stocks increasing. There were 188 stocks decreasing and 174 stocks increasing on HoSE.

Banking stocks were slightly differentiated. While BID, SHB, VIB, LPB and MBB increased, NAB, HDB, STB, CTG, VPB, EIB, TCB and ACB decreased in price. The difference between the increase and decrease of the stocks was insignificant.

With the leadership of the "Vin family", most real estate stocks had positive developments. LDG increased by 1.6%; DXS increased by 1.3%; NVL increased by 1.2%; HAR increased by 1.1%. AGG, HPX, HQC, HTN, HDG, TCH increased slightly.

Construction and materials stocks, on the other hand, mostly fell. The decline in these stocks was not large, but the correction was widespread. Some stocks that increased were EVG, up 4.5%; HBC, up 2.2%; PHC, up 1.8%.

The positive point is that most stocks in the financial services sector increased. EVF increased by 1.7%; HCM increased by 1.4%; TCI increased by 1.2%; BSI increased by 1%; CTS, SSI, AGR, VDS all increased in price. The increase of these stocks is not large, investors have not bought aggressively, but it can be seen that investor sentiment has improved.

According to analysts, VN-Index is being supported at 1,270 points and is trying to hold the 1,275 point area. This signal could help the market recover in the near future and re-test the supply at 1,280-1,285 points before there is a more specific signal.

Investors are advised to slow down and observe supply and demand developments to assess the market situation, temporarily consider a recovery to take short-term profits or restructure the portfolio to minimize risks.

Source: https://dantri.com.vn/kinh-doanh/co-phieu-ho-vin-dong-loat-tang-gia-von-hoa-vinhomes-vuot-180000-ty-dong-20240905131045950.htm

Comment (0)