SGGPO

Investors had a panic sell-off session that caused the VN-Index to lose nearly 40 points at one point. However, some major bank stocks turned green, contributing to significantly narrowing the decline, but the VN-Index ended the session losing the 1,200 point mark.

|

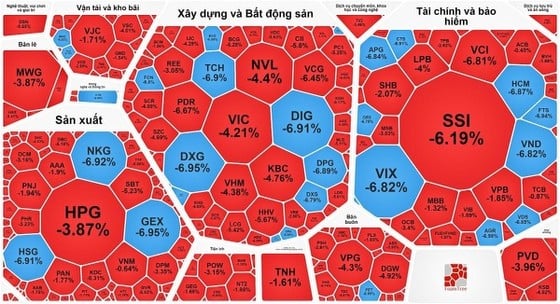

| A series of stocks hit the floor in the sell-off session on September 22. |

Following the previous session's decline, the Vietnamese stock market opened the trading session on September 22 with a sharp decline. This development is believed to be influenced by information that the State Bank withdrew about VND10 trillion through treasury bills, and some securities companies reduced margin lending.

Along with that, the rumor that the leader of the Ho Chi Minh City Stock Exchange (HOSE) had resigned also affected investors' trading sentiment. Therefore, panic selling occurred in the market, causing the VN-Index to drop nearly 40 points at one point, but then support from banking stocks significantly narrowed the decline.

The market's support came largely from large bank stocks such as: VCB up 2.64%, BID up 1.88%, STB up 1.7% and EIB up 0.51%. In addition, GAS up 2.43% also helped the VN-Index narrow its decline.

The two groups of stocks that fell the most were real estate and securities, as a series of stocks hit the floor.

Specifically, the securities group with VND, HCM, VIX, FTS, BSI, VDS, AGR, ORS, CTS, APG all hit the floor; SSI decreased by 6.19%, VCI decreased by 6.81%... The real estate group with DIG, TCH, DXG, DXS, DPG, FCN, EVG, SGR all hit the floor, VHM decreased by 4.38%, VIC decreased by 4.21%, NVL decreased by 4.4%, KBC decreased by 4.76%, KDH decreased by 5.17%, PDR decreased by 6.67%, NLG decreased by 5.11%, VCG decreased by 6.45%, ITA decreased by 5.34%... In addition, the energy, steel, retail, aviation stocks... also decreased sharply.

Particularly, the manufacturing stock group had many codes that went against the market trend, increasing quite strongly such as: CSV increased to the ceiling, DGC increased by 4.26%, ANV increased by 3.27%, PTB increased by 3.44%, TLG increased by 1.26%, CAV increased by 1.36%, DBD increased by 1.82%, STK increased by 1.74%, GIL increased by 1.98%...

At the end of the trading session, VN-Index decreased by 19.69 points (1.62%) to 1,193.05 points with 455 stocks decreasing, 70 stocks increasing and 47 stocks remaining unchanged.

At the end of the session on the Hanoi Stock Exchange, the HNX-Index also decreased by 8.72% (3.46%) with 176 stocks decreasing, 40 stocks increasing and 36 stocks remaining unchanged. Because it was a sell-off session, liquidity was at a record high, with the total trading value of the entire market reaching nearly VND37,300 billion, of which HOSE accounted for nearly VND32,334 billion. Although foreign investors continued their net selling streak, the selling volume decreased compared to previous sessions, with the total net selling value on the HOSE being nearly VND181 billion.

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)