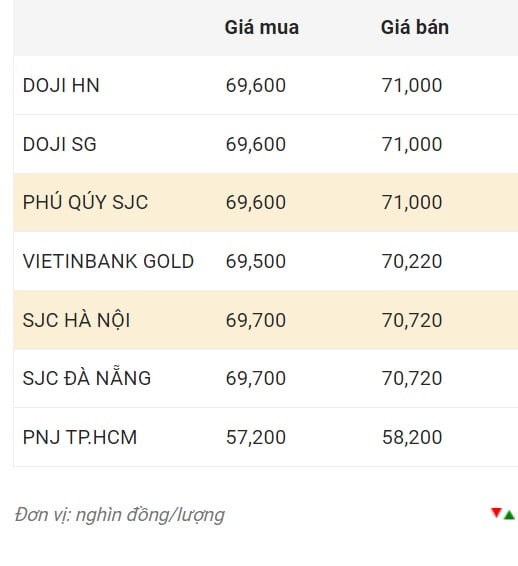

Domestic gold price

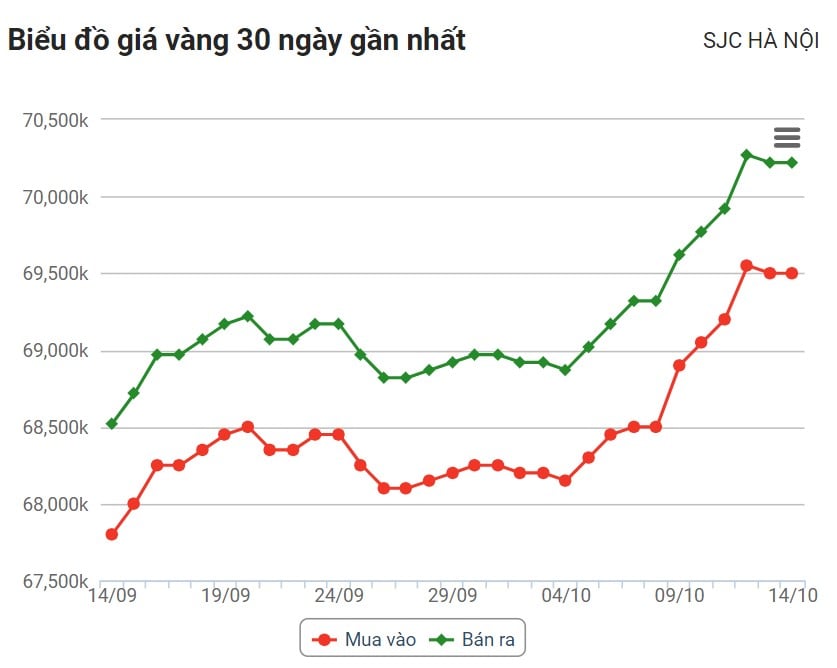

Domestic gold price developments

World gold price developments

World gold prices increased sharply despite the USD's continued strength. At 7 p.m., the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 106.450 points (up 0.08%).

The demand for gold as a safe haven amid geopolitical tensions around the world has increased. In addition, the US announced tightening sanctions on Russian crude oil exports. As a result, oil prices have returned to $90 an ounce and increased by nearly 4% on the day. The rise in oil prices has further strengthened gold’s role as a safe haven against inflation. Geopolitical tensions are supporting gold’s higher price.

While gold remains well supported by rising safe-haven demand, it faces challenging resistance at $1,950 an ounce, according to Ole Hansen, head of commodity strategy at Saxo Bank. If ETFs return to the market, gold could potentially hit $2,000 an ounce and then all-time highs.

Many experts and investors predict that gold prices will continue to rise next week. Specifically, in a Kitco News survey of 14 Wall Street analysts, 10 people, equivalent to 72%, said that gold prices will increase. The remaining 2 people, equivalent to 14%, said that the precious metal will decrease and 2 people predicted that gold will go sideways.

Similarly, an online survey of 595 individual investors found that the majority believed that gold would continue to rise. The results showed that 431 investors, or 72%, predicted that gold prices would rise. On the other hand, 106 people, or 18%, predicted that the precious metal would fall. The remaining 58 investors, or less than 1%, said that gold would remain flat.

Source

Comment (0)