In the digital transformation race of the banking industry, expanding utilities and connections for users is going hand in hand with the problem of cleaning and protecting user data from the wave of cybercrime. Investment in technology needs to be long-term and large-scale. Biometric authentication is the first test, which bank will reach the finish line first?

High-tech crime "invades" the digital transformation era

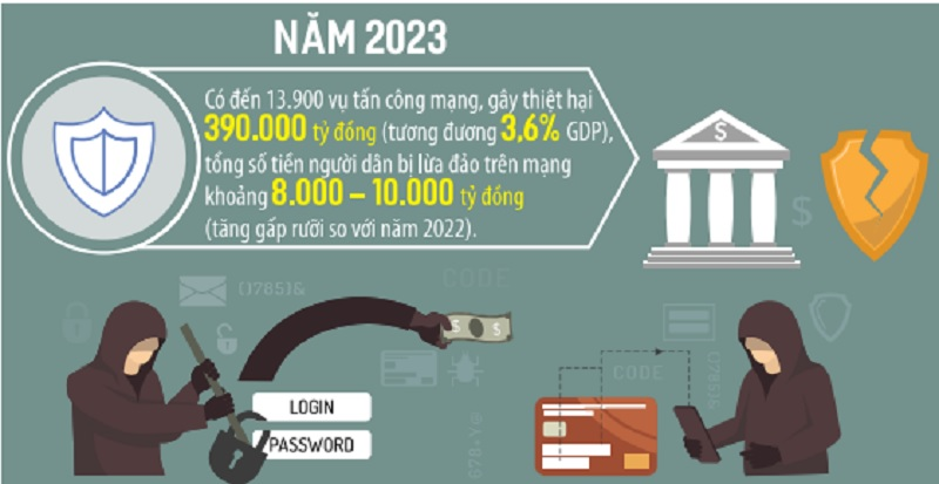

According to data from the Department of Cyber Security and High-Tech Crime Prevention, in 2023 there were 13,900 cyber attacks, causing damage of VND 390,000 billion (equivalent to 3.6% of GDP), the total amount of money people were scammed online was about VND 8,000 - 10,000 billion (an increase of one and a half times compared to 2022).

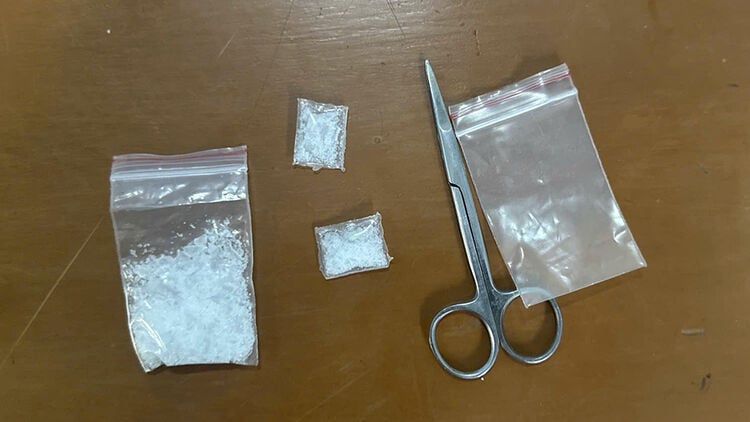

According to statistics from the Ministry of Public Security and the Ministry of Information and Communications, there are currently 3 main fraud groups (brand counterfeiting, account hijacking and other combined forms) with 24 fraud methods. Some typical methods and tricks of committing crimes in non-cash payment activities to appropriate assets.

Director of the Payment Department (SBV), Mr. Pham Anh Tuan said that in recent times, cashless payment activities have developed strongly, with more than 182 million payment accounts of individual customers, equivalent to more than 87% of adults having bank accounts. In particular, the number of payment transactions via mobile channels and QR Codes has grown rapidly. However, this means that the banking industry is facing risks and challenges in terms of security and confidentiality, especially criminals using high technology to defraud and appropriate people's money and accounts with many sophisticated tricks.

Accordingly, the most common scam is to take advantage of the State agency's policy on standardizing information on phone numbers, bank accounts, tax deduction declarations, VNIeD account identification... (containing malware) and requesting to follow instructions, then appropriating phone numbers, using the obtained numbers to appropriate assets in people's accounts (e-wallets, banks).

For example, according to a representative of the Department of Cyber Security and High-Tech Crime Prevention (A05) of the Ministry of Public Security, the scammer sent a strange link and asked the victim to access and install software called "General Department of Taxation" to pay taxes and reduce VAT from 10% to 8%. After installing the software, the victim discovered that hundreds of millions of dong had been lost from his bank account.

Some other forms of fraud by cybercriminals in the financial and banking sector are impersonating branded messages (SMS Brandname) of banks; impersonating employees or emails of some banks and financial institutions to lure people in need of loans to fill in account information, provide OTP codes to register for online loans or transfer money to make loan applications, then appropriate money from borrowers/people providing OTP codes to bank accounts.

To prevent cybercrime, banks are determined to clean and protect data

In Vietnam , banking is one of the industries with the strongest and most successful digital transformation. According to statistics from the State Bank of Vietnam (SBV), the average growth in the number of mobile payment transactions and QR codes in the period 2017 - 2023 reached over 100%/year.

In the digital transformation race, banks identify data cleaning and data protection as key issues. Connecting and integrating national population data helps banks not only develop digital products, but also prevent fraud. According to Mr. Pham Duc Long, Deputy Minister of Information and Communications: "The banking industry needs to improve risk management capacity, protect customer data, and cooperate closely with authorities to build a safe and healthy digital ecosystem" .

For people, connecting to authenticate their identity from VNeID on digital banking applications helps provide and share their information with the bank quickly and conveniently, ensuring security, safety, and data confidentiality, avoiding cases of information forgery and most importantly, preventing risks, because authentication is performed on the correct customer device.

Along with data cleaning, banks have also introduced many new solutions and applications to authenticate chip-embedded citizen identification cards. Accordingly, the use of authentication readers at transaction counters, authenticating information through NFC reading to decode information stored in the chip of citizen identification cards has replaced the old traditional technology that poses many risks when people open accounts.

With Vietcombank , along with allowing customers to register/update biometric information, this bank also simultaneously reviews and cleans customer information with many methods, including: applying chip-embedded CCCD cards, applying electronic identification accounts (VneID). In addition, Vietcombank is also applying citizen credit scoring in credit granting activities for customers.

Customers can register/update information, register for services via tablet at Vietcombank transaction counter.

The first bank to connect and authenticate with the VNeID App, building a "digital fence" to protect customers

At the 2024 Banking Digital Transformation event, Vietcombank introduced a solution to identify and authenticate personal customer information and customer facial biometric images through a direct connection between the banking app and the VNeID app. Vietcombank is the first bank to apply this solution, providing a seamless and completely online experience that ensures that the information matches the most up-to-date National Population Database. Vietcombank also demonstrated the biometric authentication application using facial data (Facepay) according to the new regulations of the State Bank of Vietnam, helping to strengthen fraud prevention in electronic transactions.

When payment transactions require facial authentication, criminals will not be able to compare the face on the original profile and will have difficulty taking the account owner's money. Mr. Pham Tien Dung, Deputy Governor of the State Bank of Vietnam, assessed: " Biometric authentication is very important, because when the information is stolen, criminals often install it on another device to carry out the theft. But banks require biometric authentication. Therefore, criminals cannot install it on another device to steal money."

Speaking at a press conference held by the State Bank of Vietnam on July 23, Mr. Le Hoang Tung, Deputy General Director of Vietcombank, said that after more than 3 weeks of implementation, Vietcombank has successfully updated biometric information for more than 3.4 million customers, of which more than 600,000 customers have done so through direct app-to-app connection between the VCB Digibank application and the VneID application (a method that only Vietcombank has implemented up to now). "The bank is and will continue to increase investment in technology so that customers can have a better experience with biometric authentication and digital banking. Biometric authentication will help people's bank accounts be better secured, contributing to limiting increasingly sophisticated fraud , " emphasized the leader of Vietcombank.

It is known that Vietcombank has deployed many synchronous solutions to collect biometric information for customers at transaction counters, on VCB Digibank digital channel, manage centralized transaction limits, authenticate transactions on VCB Digibank or e-wallet top-up transactions...

PV

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to urge highway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/6a3e175f69ea45f8bfc3c272cde3e27a)

![[Photo] Dong Ho Paintings - Old Styles Tell Modern Stories](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/317613ad8519462488572377727dda93)

![[Photo] Prime Minister Pham Minh Chinh and Brazilian President Luiz Inácio Lula da Silva attend the Vietnam-Brazil Economic Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/f3fd11b0421949878011a8f5da318635)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)