Just one day after suing the world's largest cryptocurrency exchange Binance with 13 charges, the US Securities and Exchange Commission (SEC) announced on June 6 that it is suing Coinbase for violating securities rules.

The SEC lawsuit is notable because Coinbase is the largest and most reputable cryptocurrency exchange in the United States and a publicly traded company. Coinbase shares fell 12% to close at $51.61 in New York trading on June 6.

Lawsuits against Coinbase and Binance have rocked the cryptocurrency world, wiping more than $1.7 billion off the net worth of the industry's richest billionaires.

Binance CEO Changpeng Zhao (also known as CZ) saw his fortune drop by $1.4 billion to $26 billion over the past two days, while Coinbase CEO Brian Armstrong's net worth fell by $361 million to $2.2 billion, according to the Bloomberg Billionaire Index.

In 2022, the net worth of cryptocurrency billionaires plummeted after the collapse of a series of big names such as stablecoin TerraUSD, Three Arrows Capital - the world's leading cryptocurrency investment fund, or Sam Bankman-Fried's FTX exchange.

However, the recovery in Bitcoin and other digital assets has helped their fortunes increase by $15.4 billion since the start of the year.

Mr. Zhao’s fortune rose 117%, and Mr. Armstrong’s 61% before falling this week, while the fortunes of other crypto billionaires on the Bloomberg Billionaire Index rose a combined 9%.

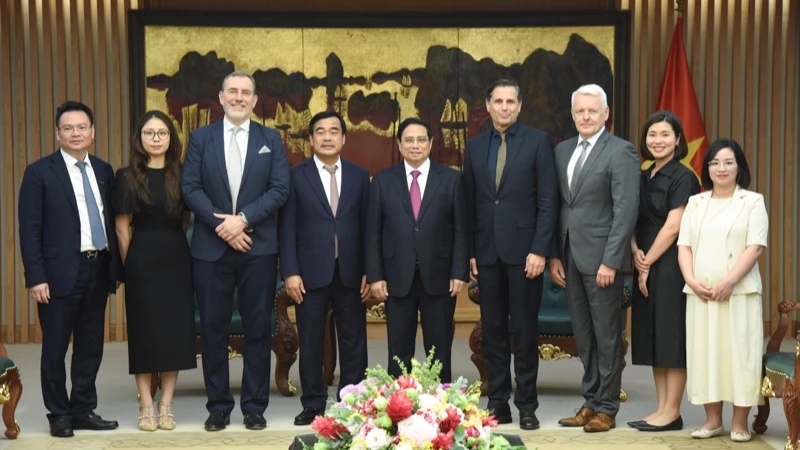

Billionaire Zhangpeng Zhao lost more than $1 billion immediately after the lawsuit of the US Securities and Exchange Commission (SEC). Photo: Reuters

Bitcoin has rallied strongly this year as investors expect that the US banking crisis that erupted in March will force the US Federal Reserve to pause interest rate hikes, and Bitcoin will benefit from this trend as it becomes a refuge from the chaos in the traditional financial environment.

However, the situation could change if US regulators make it harder for the industry and cryptocurrency players in the US to operate.

In a lawsuit filed on June 5, the SEC accused Binance and CEO Zhao of engaging in fraud and market manipulation, misleading investors and regulators, mishandling customer funds, and violating securities rules.

Mr. Zhao has grown Binance into a global “giant” after founding it in 2017. His personal net worth reached $96.9 billion in January 2022.

Meanwhile, the SEC did not accuse Armstrong of any wrongdoing, but accused the company of evading SEC rules by allowing users to trade tokens that were actually unregistered securities.

Armstrong owns 16% of Coinbase, both directly and indirectly through several trusts. He has sold about $27 million worth of Coinbase stock since the beginning of the year.

Coinbase co-founder Fred Ehrsam also saw his net worth drop to $1.1 billion .

Nguyen Tuyet (According to Bloomberg, Mashable)

Source

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

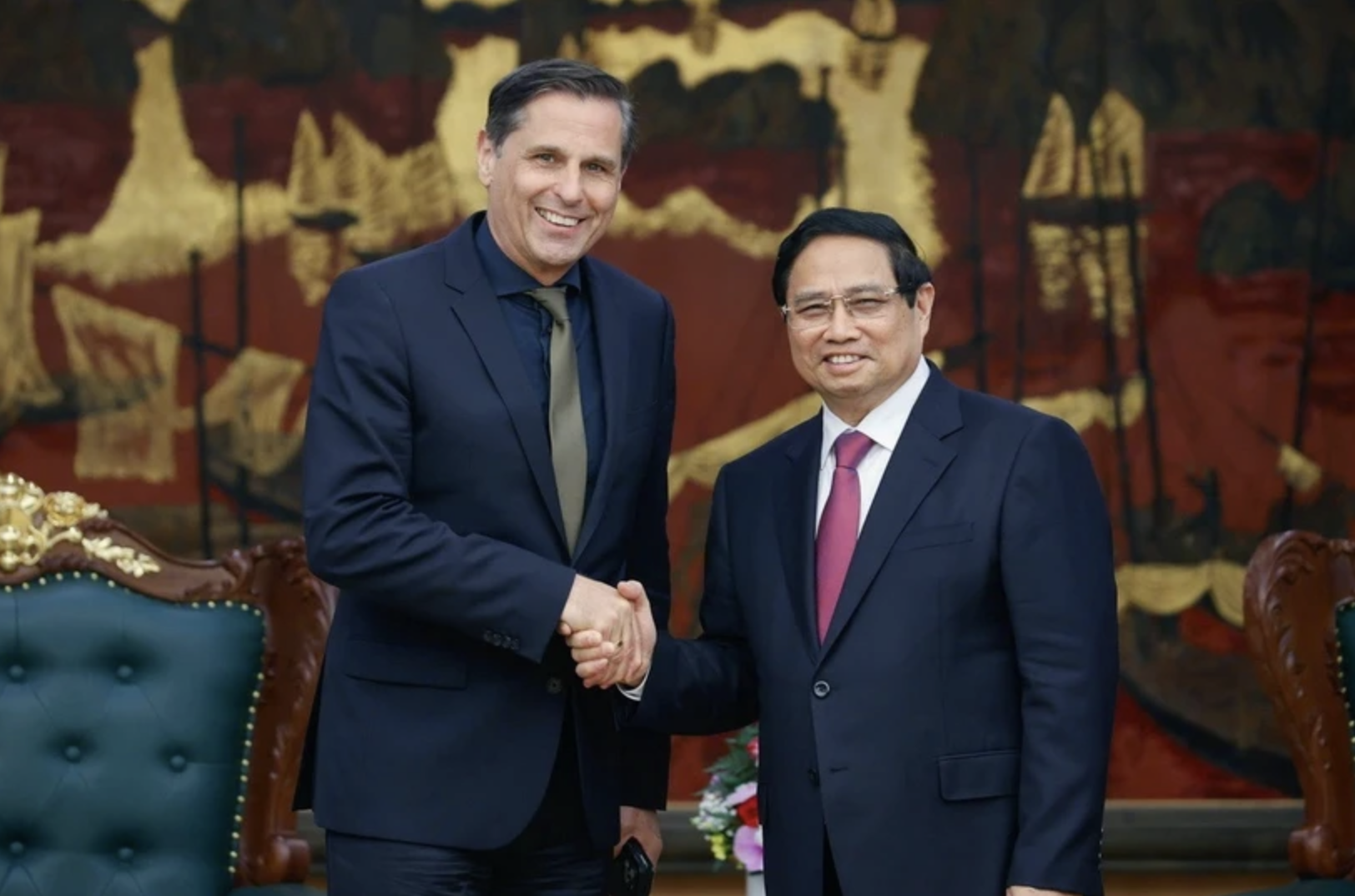

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)