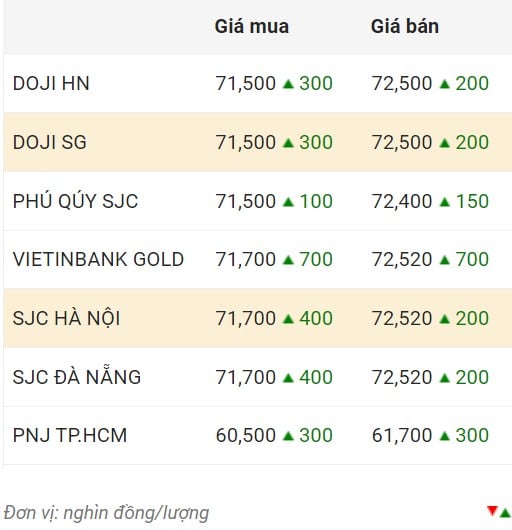

Domestic gold price

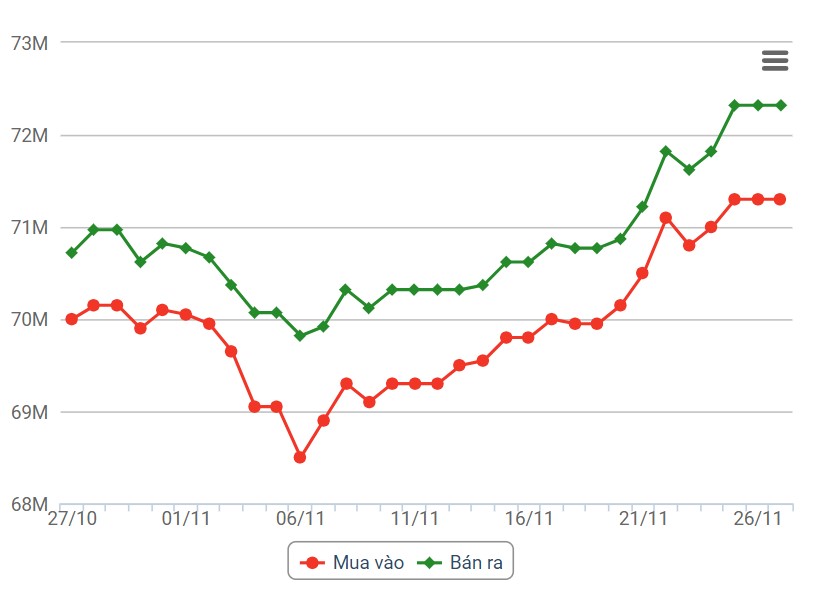

Domestic gold price fluctuations

World gold price developments

World gold prices increased amid a decline in the US dollar. Recorded at 5 p.m. on November 27, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 103.249 points (down 0.06%).

Gold prices rose to a six-month high, supported by a weaker US dollar and speculation that the US Federal Reserve has completed its interest rate hike roadmap.

Technical analyst Wang Tao said spot gold could rise in the range of $2,026-$2,032 an ounce, as it has broken through the resistance level of $1,999 an ounce.

On the other hand, Mark Leibovit, a financial expert, said that gold prices could be at risk due to a sell-off when the need to raise cash for the stock market increases. Mr. Leibovit warned that gold prices could face disadvantages because the USD is showing signs of increasing again.

Kyle Rodda, a market analyst at financial website Capital.com, said that economic data released this week in the US, including growth and inflation, will determine whether gold prices will remain above the $2,000/ounce threshold.

Investors' attention is focused on the US third quarter gross domestic product (GDP) data scheduled to be released on November 29 (local time), along with the personal consumption expenditures (PCE) price index a day later.

Recent data has shown signs of slowing inflation in the US, a development that has raised expectations that the Fed could start easing monetary policy sooner than expected.

Source

Comment (0)