Dragon Viet Securities Joint Stock Company (VDSC, stock code: VDS) has just announced its financial report for the second quarter of 2024, recording total revenue of nearly VND 326.7 billion, an increase of more than 65% over the same period.

Rong Viet said the growth was due to a 220% increase in revenue from investment activities, an 8.7% increase in revenue from securities brokerage activities, a 31% increase in revenue from lending activities, and a 41.2% increase in revenue from other activities compared to the same period in 2023.

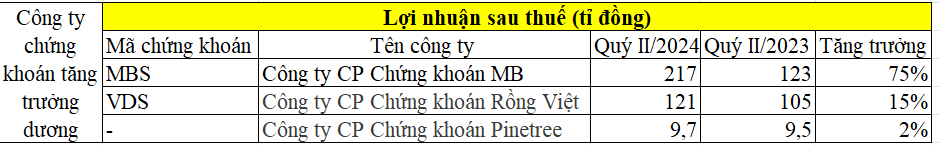

After deducting expenses, Rong Viet's after-tax profit was VND 121 billion, up 15% compared to the first quarter of 2023.

In the first 6 months of the year, this enterprise recorded a net profit of VND 231.6 billion, an increase of 43.4%. By the end of the second quarter of 2024, Rong Viet's outstanding loans increased by more than VND 350 billion, reaching nearly VND 3,138 billion, an increase of more than VND 350 billion compared to the beginning of the year.

Pinetree Securities Joint Stock Company also announced its business results for the second quarter of 2024, recording a 24% increase in operating revenue over the same period, to VND 73.6 billion and profit after tax reaching VND 9.7 billion, a slight increase of 2% over the same period last year.

However, in the first 6 months of the year, Pintree's net profit was 3 times higher than the same period last year, at 19.6 billion VND.

Photo: Le Tinh

Previously, MB Securities Joint Stock Company (stock code: MBS) - the first securities company to announce its financial report for the second quarter of 2024, recorded total revenue of VND 886 billion, double that of the same period and after-tax profit of VND 217 billion, up 75% compared to the second quarter of last year - a record high quarterly profit in MB's operating history.

At the same time, this is also the securities company that recorded the highest profit growth in the second quarter of 2024 in the securities industry to date.

On the other hand, Thanh Cong Securities Joint Stock Company (stock code: TCI) recorded total revenue in the second quarter of 2024 of only VND 50 billion, down 17% and profit after tax down 18.5%, down to VND 15.8 billion.

According to Thanh Cong's explanation document, the reason for the sharp decline in business results was due to a 97.4% decrease in revenue from financial activities, a 50.4% decrease in interest revenue from investments held to maturity, and a 15.7% decrease in revenue from financial assets available for sale.

Less optimistic, Wall Street Securities Corporation (stock code: WSS) reported a loss of more than VND4 billion in the second quarter while the same period last year it made a profit of nearly VND35 billion due to a 13-fold decrease in revenue while expenses were double the revenue. Notably, in the first half of the year, the company lost more than VND25.4 billion.

Similarly, in the second quarter of 2024, CV Securities JSC reported a loss of nearly VND 8 billion, increasing the loss in the first 6 months of the year to nearly VND 14 billion.

Source: https://nld.com.vn/cac-cong-ty-chung-khoan-dang-lam-an-ra-sao-196240717174910132.htm

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)