The Ministry of Finance has just issued Document No. 8024/BTC-CST in response to the petition of voters of Vinh Long province requesting to amend the Law on Non-agricultural Land Use Tax, because the reality through the collection of non-agricultural land tax in the locality over the past many years has shown that the effectiveness of this policy is not high because the land area within the taxable limit of the people is still very small. Therefore, voters of Vinh Long province proposed that the Ministry of Finance should study and submit to the National Assembly for consideration of exemption from non-agricultural land use tax.

Responding to voters, the Ministry of Finance said that the 2013 Constitution stipulates that land is owned by the entire people, with the State representing the owner and uniformly managing it. The 2024 Land Law stipulates that land is owned by the entire people, with the State representing the owner and uniformly managing it, and the State grants land use rights to land users (Article 12); one of the principles of land use is to use land for the right purpose, economically, and effectively (Article 5).

In performing the function of State management of land, the State has issued financial policies on land, including land use tax policies. Currently, the non-agricultural land use tax policy is implemented according to the provisions of the Law on Non-agricultural Land Use Tax No. 48/2010/QH12, effective from January 1, 2012.

The Law on Non-agricultural Land Use Tax stipulates that taxable subjects include: residential land (rural residential land, urban residential land); non-agricultural production and business land; non-agricultural land used for business purposes.

The residential land limit used as the basis for tax calculation is the new residential land allocation limit as prescribed by the People's Committee of the province or centrally run city.

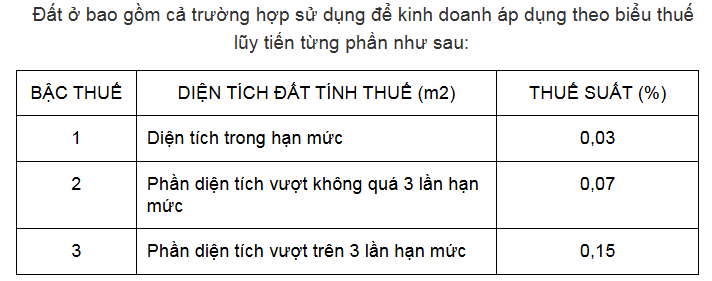

The tax rate for non-agricultural land use on residential land is applied according to the progressive tax schedule, with a tax rate of 0.03% for the area within the limit, 0.07% for the area exceeding no more than 3 times the limit, and 0.15% for the area exceeding more than 3 times the limit.

For non-agricultural production and business land, non-agricultural land used for business purposes, the tax rate is 0.03%.

According to the Ministry of Finance, through the assessment of the implementation of the non-agricultural land use tax policy, it shows that the ability to regulate the non-agricultural land use tax is still low. The average non-agricultural land use tax revenue is about 1,700 billion VND/year, accounting for about 0.14% of the total state budget revenue.

Regarding the shortcomings of this tax, many opinions say that the non-agricultural land use tax is calculated based on the land price issued by the provincial People's Committee, so it is far from the market price. In many localities, the land price is low, so the non-agricultural land use tax that many households and individuals have to pay is very low.

The low level of non-agricultural land use tax has resulted in the non-agricultural land use tax not achieving its objectives, especially the objectives of contributing to the regulation of users of multiple plots of land and not limiting real estate speculation. Because international experience shows that the tax revenue from land use in countries accounts for about 2-4% of GDP.

Pursuant to Plan No. 81/KH-UBTVQH15 dated November 5, 2021 of the National Assembly Standing Committee on implementing Conclusion No. 19-KL/TW of the Politburo and the Project on orientations for the Law-making Program for the 15th National Assembly term, the Government has issued Report No. 71/BC-CP dated March 16, 2023 to the National Assembly Standing Committee on the results of implementing Plan No. 81/KH-UBTVQH15, in which it reported the results of reviewing and researching the Law on non-agricultural land use tax.

In order to carry out the above tasks, the contents related to the completion of tax policies for land users are being studied and comprehensively evaluated by the Ministry of Finance to propose to competent authorities to amend and supplement at an appropriate time to ensure conformity with Vietnam's socio-economic conditions, in accordance with international practices, ensuring the consistency of the tax policy system and placed in the overall reform of the tax policy system in the period of 2021-2030.

University (according to VnEconomy)Source: https://baohaiduong.vn/bo-tai-chinh-phan-hoi-ve-kien-nghi-mien-thue-su-dung-dat-phi-nong-nghiep-390453.html

Comment (0)