(NLDO) - On October 28, the stock market session saw the prices of some stocks fall to rock bottom, which could encourage investors to disburse.

At the end of the session on October 28, the VN-Index closed at 1,254 points, up 2 points.

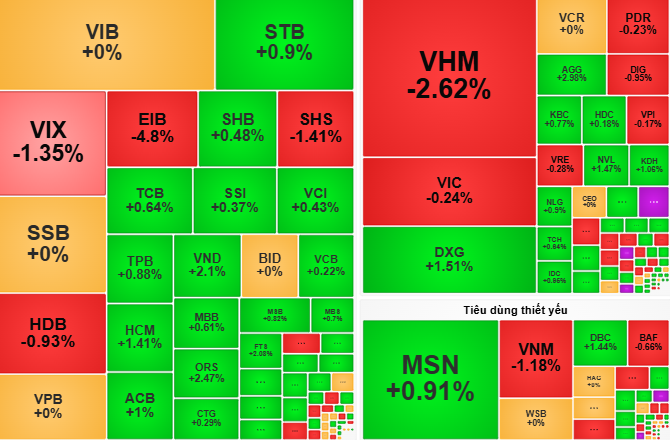

In this session, large-cap stocks and many other groups had a slight recovery. However, near the end of the session, selling pressure and correction pressure in large-cap stocks Vinhomes (VHM) caused the market to fluctuate, before regaining green thanks to the increase in prices of many large stocks.

At the end of the session, the VN-Index closed at 1,254 points, up 2 points, equivalent to 0.16%.

In the group of 30 large stocks, 15 codes increased in price such as PLX (+1.1%), HPG (+1.1%), ACB (+1%), TPB (+0.9%), STB (+0.9%) ... On the contrary, there were 9 codes that closed in red such as VHM (-2.6%), VNM (-1.2%), HDB (-0.9%), VJC (-0.6%), BCM (-0.3%) ...

Some stockbrokers said that liquidity on October 28 dropped sharply, as only 482 million shares were successfully traded. This shows that liquidity has dropped sharply, proving that selling pressure has cooled down, but demand is waiting for signals confirming that stock prices have bottomed out.

With the above developments and comments, VCBS Securities Company recommends that investors can disburse part of their investment in stocks in the real estate, steel, securities industries... that have shown signs of successful bottom price testing.

However, according to Dragon Capital Securities Company (VDSC), the recovery at the end of the session on October 28 is not sustainable because the cash flow is still weak. Therefore, investors need to observe the supply and demand situation, keep the proportion of stock portfolio at a reasonable level, and avoid falling into a state of overbought.

Source: https://nld.com.vn/chung-khoan-ngay-mai-29-10-bat-day-gia-co-phieu-nao-196241028173406351.htm

![[Photo] Vietnamese rescue team shares the loss with people in Myanmar earthquake area](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/ae4b9ffa12e14861b77db38293ba1c1d)

![[Photo] Solemn Hung King's Death Anniversary in France](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/786a6458bc274de5abe24c2ea3587979)

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

Comment (0)