Founded in 2010 with the ambition of creating a new working culture, WeWork exploded and then declined in just 9 years and could not recover after the pandemic.

Ten days before the end of 2018, WeWork’s $60 million Gulfstream jet took off from New York bound for Hawaii. On board was co-founder Adam Neumann and a $20 billion secret. It was Project Fortitude, in which SoftBank CEO Masayoshi Son would increase his investment to $10 billion and buy out most of the shares of every investor—except Neumann—for another $10 billion.

The plan ensured WeWork would remain in the Neumann family’s control for generations, backed by a deep-pocketed investor with an increasingly ambitious vision. But within a year, the Gulfstream was up for sale, Neumann was out of office, and WeWork’s value had fallen sevenfold.

After the Covid-19 pandemic and subsequent failed attempts to save its business, WeWork was billions of dollars in debt and late on bond payments. From a darling valued at tens of billions of dollars in the venture capital world, in early November, WSJ reported that this startup was preparing to file for bankruptcy. What happened to WeWork?

The dream of 'changing the world'

In 2010, Adam Neumann and Miguel McKelvey used the proceeds from the sale of their startup Green Desk to co-found WeWork. Their vision was to create a “physical social network” that could attract freelancers and home workers.

WeWork’s business model is to lease office buildings (or individual floors) long-term and then renovate them for rent. Rather than simply providing flexible and short-term seating, they plan to attract customers with luxurious, modern spaces and convenient services for community interaction, entertainment, and dining.

For young people wondering if there’s anything more to life than staring at a computer screen all day, WeWork offers beer, pinball tables, and meditation rooms. Neumann preaches about creating a new work culture and more, everywhere. “We’re here to change the world. There’s nothing more that interests me,” he once said.

Adam Neumann in Shanghai, China on April 12, 2018. Photo: Reuters

In theory, WeWork’s costs, including rent and operating costs, were expected to be lower than those charged to tenants, which would help it turn a profit. Like most startups that burn money in the early years, Neumann pitched the new model and the $2 trillion co-working market — which The Guardian later said was overstated — to attract capital.

He always said that it took SoftBank CEO Masayoshi Son only 28 minutes to decide to invest in WeWork. In 2017, SoftBank and Vision Fund invested $4.4 billion in the startup at a valuation of $20 billion. By 2018, SoftBank committed to invest another $4.25 billion, making WeWork one of the world's top unicorns (startups with a valuation of $1 billion or more).

The valuation 'bubble' bursts

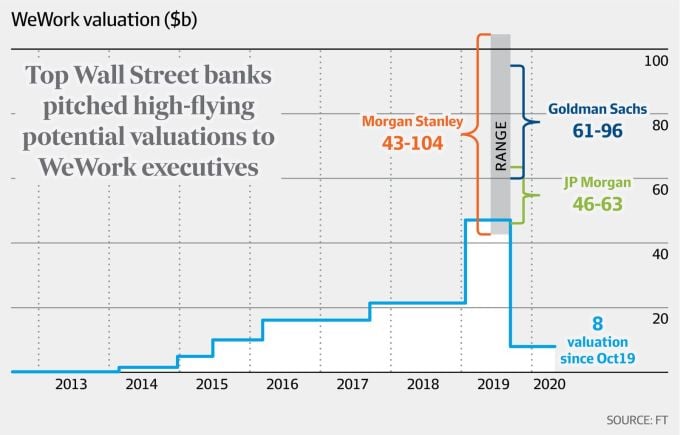

Doubts were already brewing. In 2017, the Wall Street Journal was skeptical of a $20 billion startup that was essentially renting out office space. That’s not to mention the $47 billion valuation it received in a private funding round, or the “huge” $100 billion prediction Morgan Stanley had made.

The glitz didn’t last long. In 2018, when WeWork tapped the bond markets to borrow hundreds of millions of dollars, it had to disclose more about its finances. Documents showed that WeWork had lost $883 million in 2017, despite revenue of about $886 million. A Financial Times leak revealed that the following year, the company lost $1.9 billion on about $1.8 billion in revenue.

By 2019, WeWork had surpassed JPMorgan Chase to become New York’s largest commercial tenant and controlled more square feet in London than anyone except the British government. But investors questioned its shaky financial foundation. That October, the company pulled its IPO plans after investors were reluctant to buy its shares. Banks were also reluctant to lend to WeWork.

Throughout all this, Neumann was Neumann. His private jet trips were allegedly linked to cross-border marijuana shipments. His wife could fire employees if she felt uncomfortable, and the company ended one firing meeting with a musical performance.

WeWork’s valuation eventually plummeted from a peak of $47 billion in January 2019 to $7 billion later that year when it was acquired by Japan’s SoftBank. They laid off thousands of employees. Neumann resigned and received more than $700 million from the sale of shares to SoftBank and cash payments.

WeWork valuation fluctuations 2013 - 2020, culminating in financial institutions' estimates ranging from $8 - $104 billion in 2019. Graphic: FT

What transformed WeWork from venture capitalist darling to pariah is unprecedented in any pattern of growth and decline, and it also defies the usual concerns of investors, such as future cash flows, according to a 2019 Bloomberg analysis.

The analysis argues that WeWork’s decline can only be explained in abstract terms, just as founder Neumann convinced investors to pour tens of billions of dollars into the company. It must be admitted that Neumann was able to sell a vision of a startup that could dominate the world, not a company that rents shared offices.

Struggling after Covid-19

When the Neumann dynasty passed, Sandeep Mathrani took over in February 2020. Under Mathrani, WeWork went public in October 2021 through a merger with a special purpose acquisition company (SPAC).

Covid-19 has swept through, creating fears of an economic recession and job cuts in the technology industry, weighing on the demand for co-working space. In the broader context, the office rental market has been struggling after the pandemic as employees are reluctant to return to the office.

Susannah Streeter, head of currencies and markets at Hargreaves Lansdown, said WeWork was already showing signs of “fragility” before the pandemic, with large losses and debt piled up. “But the Covid crisis has put a price on an already fragile business model,” she said.

Faced with these headwinds, WeWork made a concerted effort earlier this year to shore up its finances to weather the downturn. In March, it agreed to a debt restructuring deal with SoftBank as well as several major Wall Street lenders, including King Street Capital Management and Brigade Capital Management.

SoftBank agreed to swap about $1.6 billion of debt for a mix of new debt and equity in WeWork. The transaction reduced the company's debt by more than $1.5 billion.

As part of that deal, WeWork also received an investment from SoftBank’s Rajeev Misra fund, One Investment Management, which provided nearly $500 million in high-yield debt. “The new financing raised and committed in the transaction is expected to fully fund WeWork’s business plan and provide ample liquidity,” the company said at the time.

A WeWork branch in London, UK in October 2019. Photo: Bloomberg

But in May, after overseeing a financial restructuring, Mr. Mathrani abruptly announced his departure. By August, WeWork was raising questions about its ability to stay afloat as it continued to lose money and its cash dwindled.

The company burned through $530 million in the first six months of the year and has about $205 million in cash, according to a securities filing. Meanwhile, it has $2.9 billion in long-term debt and more than $13 billion in rent, amid rising borrowing costs and office leasing difficulties.

The board said at the time that "the losses had led to an increasing number of members leaving.... and there was significant doubt about the company's ability to continue as a going concern."

So WeWork outlined steps to improve liquidity and profitability, including cutting costs by restructuring and renegotiating lease terms, increasing revenue by reducing membership churn and increasing new sales. The company said it would seek additional capital through issuing bonds, shares or selling assets.

Also this month, three members of the board of directors resigned due to major disagreements over governance and strategic direction. Four new directors with expertise in financial restructuring were appointed to act as negotiators with creditors.

Things aren’t looking good. WeWork’s stock has fallen 96% so far this year. As of June, the company operated 777 locations in 39 countries, 30% of which were in the U.S. The company faces an estimated $10 billion in rent payments starting in the second half of this year through the end of 2027, and another $15 billion starting in 2028.

By early November, sources told the WSJ that WeWork could file for Chapter 11 bankruptcy as early as next week, paving the way for the company to restructure its operations and debt. By law, the restructuring plan must be approved by the bankruptcy court and creditors.

But how WeWork will transform is another question. The startup has always described itself as “asset light,” meaning it doesn’t own many physical assets. That has made WeWork truly unique, in two ways.

First, by renting rather than buying or building, they can grow their network quickly, as long as they have enough capital to pay the rent. Second, beyond marketing, they actually use the advantages of space design and working environment to convince customers, whether they are freelancers or fast-growing companies that cannot afford to expand their offices in the traditional way.

But there is a downside to “asset light.” Aswath Damodaran, a finance professor at New York University, was skeptical of WeWork’s business model from the start. “In good times, you fill your building. In bad times, they leave, and you’re left with an empty building and a mortgage,” he said.

Phien An ( summary )

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)