Capital efficiency has become a top priority for startups, along with adjusted expectations from investors.

Coolmate start-up employees work at the warehouse - Photo: COOLMATE

The reality of who can pay

Sharing with Tuoi Tre Online , Mr. Vinnie Lauria, founding partner of Golden Gate Ventures, said that investors are increasingly looking for startups with sustainable business models and a clear path to profit.

Areas like fintech, software as a service, healthcare tech and climate tech are attracting a lot of attention.

Additionally, teams with deep understanding of the local market, a clear vision for regional expansion, and a focus on governance and transparency will be more likely to attract capital.

Compared to Singapore, Mr. Vinnie Lauria assessed that the Vietnamese market offers lower operating costs and access to a rapidly growing middle class.

Although Vietnam's startup ecosystem is young compared to Indonesia's, it is vibrant with significant growth potential in areas such as fintech, healthtech, and real estate tech.

“As the ecosystem matures, we expect to see an increase in both the number and value of transactions,” said Vinnie Lauria.

According to Mr. Pham Chi Nhu - CEO of Coolmate, the biggest strength of Vietnamese startups is a potential domestic market, in terms of scale, purchasing power and labor resources.

"Start-ups can easily assemble a team at a much better cost than other countries in the region. In addition, we have the ability to execute, especially quickly learn new technology trends such as AI, blockchain...", Mr. Nhu said.

Some other founders believe that Vietnam has a "strong and numerous" technology workforce, so the cost of making products is cheap.

They grasp technology quickly and the new generation of startups think globally from the start, instead of just serving domestically like the previous generation.

However, Southeast Asia is a diverse region with many countries with different currencies, regulations, and economies.

This heterogeneity requires investors to understand the complexities of the region in order to develop appropriate strategies.

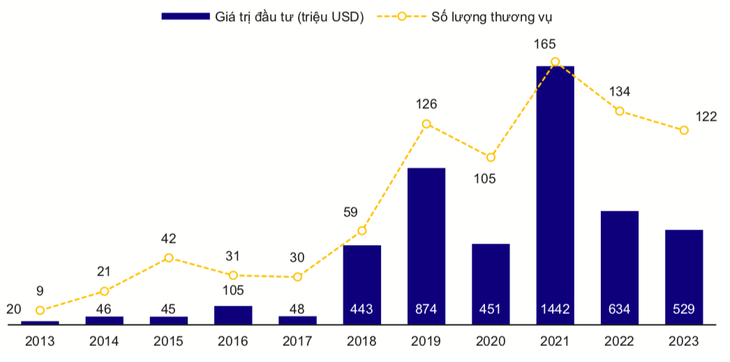

Total investment value and number of investment deals in Vietnamese startups over the past 10 years - Source: DO VENTURES, NIC, CENTO VENTURES.

According to the report “Southeast Asia: Resetting Expectations” released in early October 2024 by Lightspeed Investment Fund, the accessibility and cost of acquiring customers vary between countries due to differences in infrastructure.

For example, more than 40% of the population in Indonesia, Vietnam and the Philippines do not have a bank account, increasing the cost of reaching this segment before being able to serve them.

Reset expectations

Over the past decade, Southeast Asia has attracted tens of billions of dollars in investment into startups thanks to the rise of internet users and a growing middle class.

But according to Lightspeed, the financial performance of startups that are listed or raise capital at a later stage falls short of expectations.

“The boom of the past decade was fueled by unrealistic views, leading to billions of dollars spent on investments that could never be recouped. Many business models were fundamentally unsustainable and valuations were far beyond reality,” the Lightspeed report said.

After three years of struggling to raise capital, the region's startup community is getting used to the new reality.

They spend more sparingly, some start-ups struggle to raise capital and others quietly leave the market.

Investors are less likely to mention their hopes of raising "unicorns" (start-ups valued at over $1 billion), after seeing the reality of leading regional technology companies losing significant value after listing.

“Don’t expect rapid growth or outsized returns from Southeast Asian startups in the short term, as the ecosystem is not yet fully mature,” according to Lightspeed.

According to investors, capital flows will not return quickly and funds will not be as "aggressive" as before.

The top, truly excellent startups will always be able to raise capital, without much difficulty.

The biggest challenge will be in the lower tier companies, meaning not too great but not weak either.

They will have difficulty raising capital and will be forced to become more efficient in using capital through cost reduction and better resource utilization.

Is the 'fundraising winter' over?

Is the 'fundraising winter' over?Source: https://tuoitre.vn/sau-lan-song-tang-gia-ao-gioi-dau-tu-than-trong-rot-tien-vao-start-up-dong-nam-a-20241224152700532.htm

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] Performance of the Air Force Squadron at the 50th Anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/cb781ed625fc4774bb82982d31bead1e)

Comment (0)