Associate Professor Jenny Olson recruited 230 engaged or newlywed couples and followed them for more than two years. The average age was 28, they had known each other for an average of five years, and had been in a relationship for an average of three years. Ten percent of the people surveyed had children.

All couples were divided into three groups: Keeping separate bank accounts, opening a joint bank account, and making their own financial decisions in marriage.

Couples who were required to open a joint bank account reported significantly higher relationship quality two years later than those who maintained separate accounts, Olson said. At the same time, uniting fosters alignment and transparency about financial goals as well as a shared understanding of the marriage.

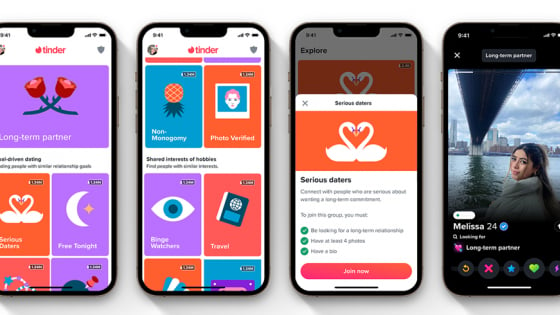

Illustration photo.

People with joint accounts have a higher "level of community" in their marriage than people who keep separate or only partially joint accounts.

“The ‘community level’ means that when couples hold money together, they have a ‘we’ mindset, and they respond to each other’s needs in a ‘I want to help you because you need it, I’m not spying on you,’” Olson says. “They feel more like they’re ‘in it together.’ This is the best evidence we have to date about how couples fare, and the effects over two years are pretty strong evidence of the benefits of holding money together.”

With separate accounts, people in marriage may think it’s easier to leave the relationship, Olson said. Twenty percent of the couples who participated did not complete the study, including a significant percentage who separated after failing to merge their bank accounts. They found no gender differences in the results.

Previously, research by psychologist Dr. Michael Norton, co-author of the book "Happy Money" and lecturer at Harvard Business School, also confirmed that the more money you contribute to the family's common fund, the happier your marriage will be.

Specifically, keeping 5% of income for personal spending and contributing the rest to the family and contributing 100% bring about the same level of happiness.

Illustration

Conversely, the less you contribute, the less happy your marriage is. People who contribute 80% of their income to their family tend to be happier than those who contribute 70%. And those who keep all the income are the least happy.

The above study is considered valid for a number of reasons. You tend to contribute less, keeping money for yourself as a "safe haven" in case of marital problems.

For newlyweds, if they don’t contribute their income, they’ll spend a lot of time arguing about money. Norton says that if a couple doesn’t contribute their income, they’ll spend a lot of time arguing about monthly expenses and deciding how to split the income. In some cases, this can highlight the income gap between the two people. It can also be a good opportunity for arguments about who should pay for what.

Norton's research highlights the importance of sharing. When we spend money on others, we feel happier than when we spend money on ourselves.

-> Husband and wife quarrel because of loud snoring while sleeping

T. Linh (According to Iu.edu)

Source

Comment (0)