When needing to borrow 1 billion VND, many people often think of borrowing from banks because of their ability to provide large capital and preferential interest rate programs. However, borrowing 1 billion VND is often suitable for mortgage loans (with collateral). Therefore, not everyone can borrow 1 billion VND from banks.

Conditions for borrowing 1 billion VND at the bank

To borrow 1 billion VND from the bank, customers need to meet the following specific conditions:

- Borrowers are Vietnamese citizens living and working in provinces and cities with bank branches that want to borrow.

- Have stable income, able to repay the loan

- Legal collateral, owned by the customer or a third party such as real estate, cars, savings books,...

- No bad debt at any bank or credit institution

- For business households, it is necessary to have a business registration in accordance with the provisions of law, have an effective and feasible production and business plan...

(Illustration)

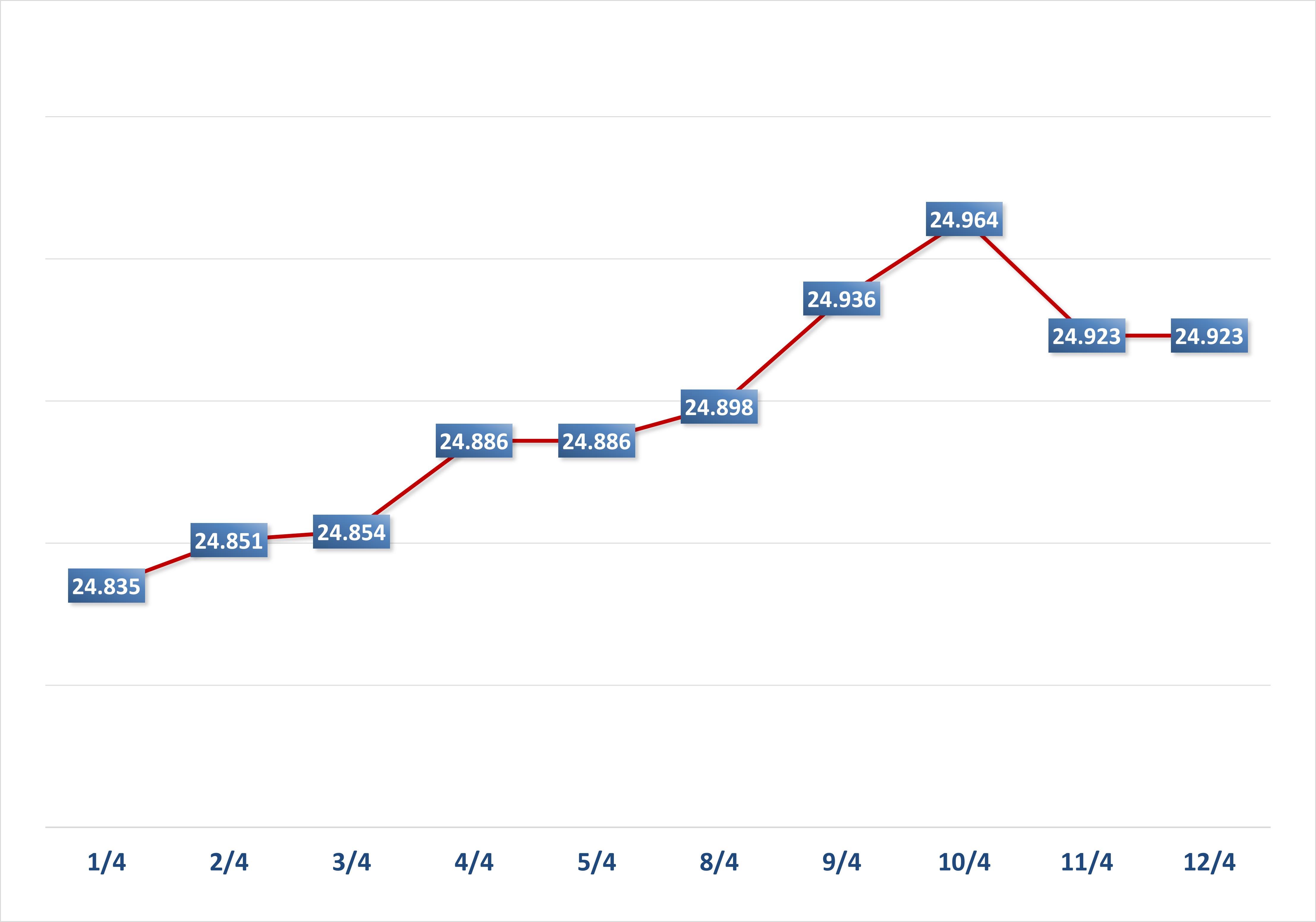

How much interest do I have to pay each month on a 1 billion bank loan?

Each bank has a different lending interest rate. At BIDV, the mortgage interest rate for each loan package is also different. Specifically, home loans have a preferential interest rate of 7.3%/year, car loans have a preferential interest rate of 7.3%/year, study abroad loans have a preferential interest rate of 6%/year, business loans have a preferential interest rate of 6%/year... After the preferential period, the interest rate is floating and is usually 3-4% higher than the preferential interest rate at the beginning.

However, interest rates may change according to BIDV's policy at each period.

Formula for calculating interest on a loan of 1 billion VND

Normally, a loan of 1 billion VND will be in the form of a mortgage loan. Interest is calculated on the decreasing balance and the principal is paid in equal monthly installments.

Monthly principal payment = Loan amount/loan period (months). Monthly interest payment = (Loan amount - principal paid) x interest rate (%/month).

Thus, if borrowing 1 billion VND for a term of 10 years with a preferential interest rate of 7.3%/year, each month the customer will have to pay the following amount:

Principal per month: 8,333,333 VND. Interest payable for the first month: 1 billion X 7.3%/12 = 6,083,333 VND.

Adding the principal, the first month, the customer must pay: 14,416,6666 VND

After 12 months of preferential interest, the interest rate can increase to 11.3%/year, then the interest the customer has to pay is: ((1 billion - (8,333,333 X 12)) X 11.3%)/12 = 8,475,000 VND.

After that, the monthly interest amount will gradually decrease.

Lagerstroemia (synthesis)

Source

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)