The issue of having to buy insurance when borrowing from banks has once again heated up in recent days as the State Bank is drafting Decree 88 on administrative sanctions for violations in the monetary and banking sector.

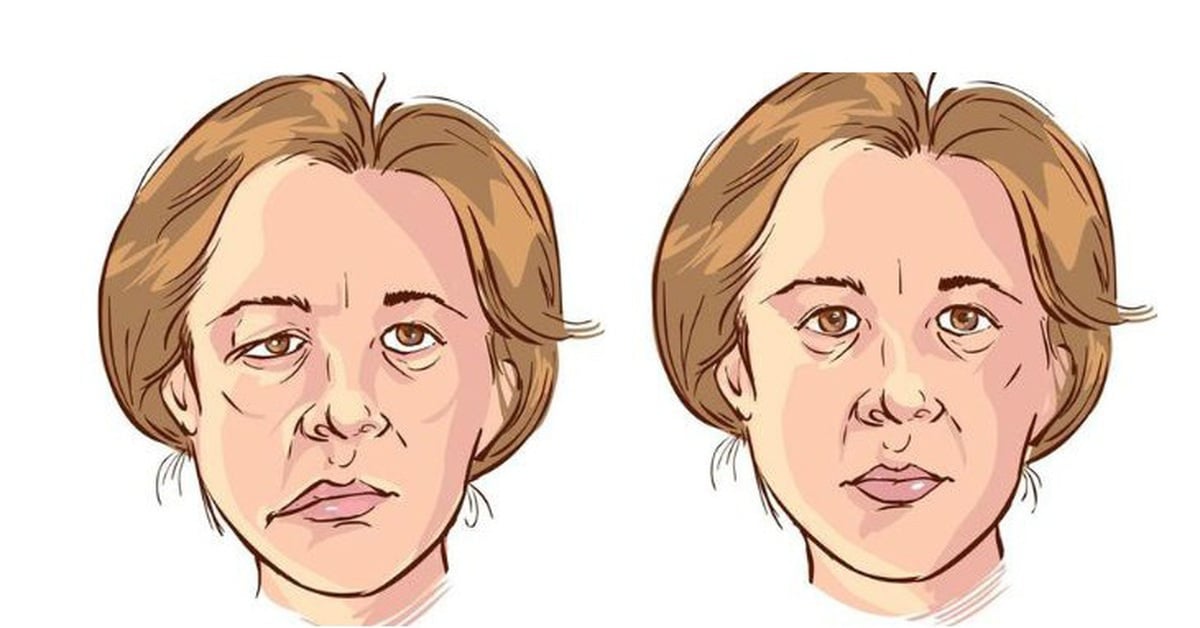

A consultant helps a customer buy a life insurance package with health insurance at a bank in Ho Chi Minh City - Photo: TTD

In particular, the regulation stipulates a fine of 400 - 500 million VND if banks attach non-compulsory insurance products to the provision of products and services in any form.

Notably, this is not the first time the story of being forced to buy insurance when borrowing money has been mentioned. In 2023, this issue was pushed to a climax when a series of customers accused the bank of "trapping" them into a situation where they were forced to buy life insurance, causing the actual cost to be paid when borrowing money to increase.

After that, the authorities intervened with a series of actions such as the State Bank and the Insurance Management and Supervision Department establishing a hotline to receive and handle complaints related to insurance sales activities at banks.

Next, the Ministry of Finance issued Circular 67, prohibiting banks from selling investment-linked insurance before and after 60 days from the date of disbursement of the entire loan to customers.

The National Assembly also voted to pass the Law on Credit Institutions (amended), which prohibits banks from linking the sale of non-compulsory insurance with the provision of banking products and services in any form.

However, as Tuoi Tre reported in recent days, people are still "forced" to buy insurance with many tricks that they say are more sophisticated, such as making excuses for not paying, begging, "asking for support" or letting... relatives stand in their names to circumvent the law.

Not only that, some banks also require borrowers to pay insurance premiums for two consecutive years, not just the first year.

In fact, according to Tuoi Tre's research, although the regulation of a fine of 400 - 500 million VND if banks attach non-mandatory insurance products to the provision of products and services has not been applied in practice, many banks have prepared many response measures.

For example, when signing an insurance contract, the bank invites the customer into a recording room to save evidence, and the customer must also sign a commitment to voluntarily purchase insurance when borrowing money... to avoid the situation where after disbursement, the customer... counter-accuses the bank of forcing the borrower to purchase insurance, demands to cancel the contract and return the money, as well as avoids the bank being fined by the regulatory agency for forcing the borrower to purchase insurance.

So, what is the most likely way to solve this difficult problem? Of course, there will be no perfect solution, but it is advisable to start by preparing the consultation stage.

Buyers must be fully advised of both the advantages and disadvantages of the contract and the bank must have tools to review and even impose sanctions if there is a situation of giving advice for the sake of it, forcing borrowers to buy insurance.

Even banks need to publicly announce the loan interest rates in case borrowers buy and do not buy insurance, listed on the website for them to calculate and consider.

This ensures transparency and banks also avoid borrowers being forced to buy insurance when borrowing capital as happened in the past.

Source: https://tuoitre.vn/lai-noi-ve-chuyen-bi-ep-mua-bao-hiem-2024120908140628.htm

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)