How much is 1 USD in VND today?

State Bank USD exchange rate is at 23,996 VND.

Vietcombank USD exchange rate is currently at 24,405 VND - 24,775 VND (buy - sell).

The Euro exchange rate is currently at 25,951 VND - 27,376 VND (buy - sell).

The current Japanese Yen exchange rate is 158.60 VND - 167.87 VND (buy - sell).

The current exchange rate of British Pound is 30,355 VND - 31,647 VND (buy - sell).

Today's Yuan exchange rate is at 3,350 VND - 3,493 VND (buy - sell).

USD price today

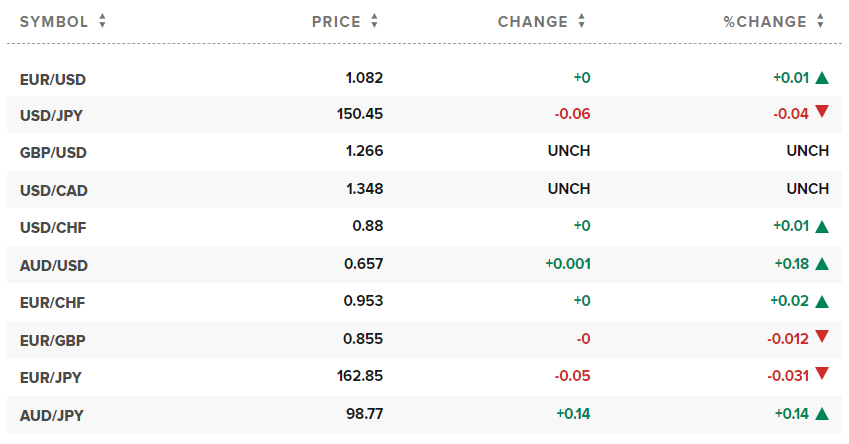

The US Dollar Index (DXY) measures the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recording at 103.95 points.

The dollar fell, but bounced off a three-week low as markets awaited fresh data for clues on when the U.S. Federal Reserve might start cutting interest rates.

The dollar has been on a steady recovery since the start of the year, as inflationary pressures in the US persist. But after hitting a three-month high last week, the US currency has largely consolidated.

The dollar could benefit from divergence with other countries as the US economy remains strong, said Noel Dixon, senior macro strategist at State Street Global Markets.

“However, there is clearly fatigue. For the dollar to break out, more data is needed,” he said.

The U.S. dollar index fell 0.03% to 103.95. On Thursday, the DXY fell to 103.43, its lowest since Feb. 2. The dollar index hit 104.97 on Feb. 14, its highest since Nov. 14.

Next week’s U.S. Personal Consumption Expenditures (PCE) report will be in focus, while minutes from the Fed’s January meeting released on Wednesday showed a majority of policymakers were concerned about the risk of cutting interest rates too soon.

Fed Vice Chairman Philip Jefferson said he would look at a range of economic indicators to further assess the timing of a rate cut, rather than focusing on a single metric.

US jobless claims unexpectedly fell while business activity cooled in February. Home sales rose 3.1% in January to a seasonally adjusted annual rate of 4 million units, the highest since August last year.

The US dollar could also be supported by weakness in other regions, including Canada and Australia, which could prompt central banks in those countries to cut interest rates ahead of the Fed, Dixon said.

The euro rose 0.03% to 1.0820 EUR/USD. Previously, the common currency was at 1.0889 EUR/USD - the highest level since February 2. Economic activity in the EU shows signs of recovery.

The pound rose 0.17% to 1.2656 per dollar. UK economic activity was stronger than expected, pointing to strong growth in services companies. The pound earlier hit 1.2710 GBP/USD - its highest level since February 2.

The Yen exchange rate continued to expand by 0.17% to 150.53 JPY/USD - approaching the 3-month peak of 150.88 (recorded on February 13).

Markets will be watching for any signs of intervention by the Bank of Japan and the country's Ministry of Finance if the yen continues to weaken.

Japan's Finance Minister Shunichi Suzuki said the government has "no line of defense" over the exchange rate, but needs to monitor market volatility.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)