Power transmission is being invested in with billions of dollars in capital.

Nearly 15 billion USD invested in power transmission grid

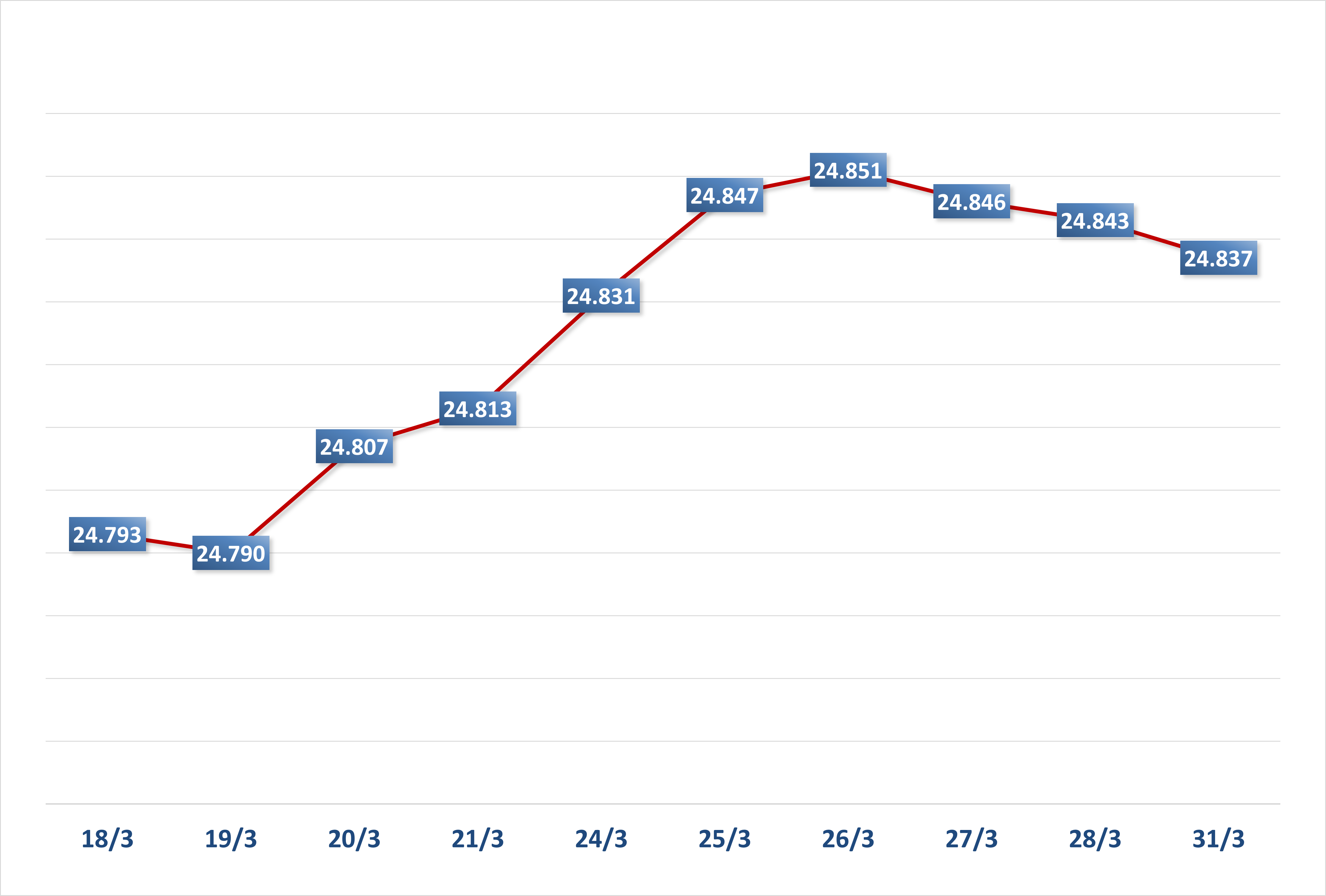

According to the National Power Development Plan for the 2021-2030 period, with a vision to 2050 (Power Plan VIII) approved by the Prime Minister, electricity is an important infrastructure sector, and power development must be one step ahead to create a foundation for promoting rapid and sustainable development. The total investment capital for power sources and transmission grids in the 2021-2030 period in Power Plan VIII is about 134.7 billion USD, of which the power transmission sector alone is 14.9 billion USD. In particular, the investment capital for the power sector in the 2026-2030 period requires about 77.6 billion USD, of which the transmission grid needs 5.9 billion USD.

Regarding the power grid, the Power Planning focuses on investing in 500 kV lines, 500 kV transformer stations, and 220 kV lines and transformer stations.

The National Power Transmission Corporation (EVNNPT) aims to start 34 projects and complete and energize 74 projects in 2025. The total estimated construction investment value is VND20,670 billion, of which net investment is about VND14,746 billion.

Investment capital for power transmission grids has been boosted along with the recent amendment of the Electricity Law, which will create a boost for businesses operating in the field of power infrastructure and power grids, especially when the decision on investment policies is decentralized to the provincial People's Committees for power grid projects and allows privatization of transmission lines from 220 kV and below.

According to Shinhan Securities, with plans to double the length of transmission lines and substations by 2030, the compound annual growth rate (CAGR) for transmission line and substation construction is 11%/year and 13%/year, respectively. Therefore, businesses operating in this field will benefit.

Optimistic outlook for GEX companies

As a leading enterprise in the electrical equipment industry, Gelex Group Joint Stock Company (stock code: GEX) through its member company GELEX Electric owns 8 subsidiaries, manufacturing and supplying a full range of products in the value chain of the electricity industry from transmission to distribution and civil use. Among them, many brands have a long-standing reputation and have the number 1 market share in Vietnam such as: CADIVI electric cables, THIBIDI transformers, EMIC electrical measuring equipment, etc.

According to securities companies, when investment capital in power grid transmission is boosted and many projects are started, GELEX's electrical equipment businesses benefit greatly, especially when Vietnam Electricity Group (EVN) is the largest customer of two strategic products: electric cables and transformers.

THIBIDI transformers are holding the number 1 market share.

According to a report by SSI Securities Company, in the long term, according to Power Plan VIII, total investment capital for the transmission grid is expected to increase significantly from an average of 1 billion USD/year in the 2011-2020 period to 1.5 billion USD/year in the 2020-2030 period and about 1.7-1.9 billion USD/year in the 2031-2050 period. EVN accounts for about 20% of cable revenue and about 50% of transformer revenue in GELEX Electric's revenue structure.

In addition, the recovery of the real estate and civil electricity markets is also a big boost to the development of revenue and profit for the enterprise. In 2025, GELEX targets a record revenue of VND 37,600 billion - an increase of 11.5% compared to 2024. Of which, the electrical equipment sector contributes nearly 60% to the group's revenue structure. GELEX Electric's net revenue target in 2025 is VND 22,282 billion, consolidated pre-tax profit is VND 1,686 billion.

Previously, in 2024, GELEX's electrical equipment segment also had breakthrough business results when net revenue exceeded VND 21,130 billion, consolidated pre-tax profit reached VND 2,152 billion, up 27.2% and 112.6% respectively compared to 2023.

In particular, GELEX Electric is orienting its member units to promote the production of high-quality, environmentally friendly electrical equipment products for the smart grid; orienting cooperation in research and development of new high-tech products such as: Flame retardant electric cables, fire prevention products, security and monitoring equipment, etc.

ABS Securities Company believes that in 2025, GELEX Electric's electrical equipment business will continue to grow positively, however, the energy sector may be affected when it divests from a number of projects.

"In the long term, we assess that GELEX Electric will be positive because according to the development plan of the electrical equipment manufacturing industry approved by the Government for the period of 2015-2025, the electrical equipment industry in 2025 must produce and supply complete sets of electrical equipment for power line projects, transformer stations, 50-60% of the demand for 110-220 KV transformers and meet 60-70% of domestic demand for all kinds of electric meters, electrical instruments and grid safety monitoring and recording systems, complete sets of power station equipment and export 19-20% of production value, focusing on high-quality electric wires and cables with export turnover increasing by 35.5%/year.

The strong growth in renewable energy also requires more investment in electricity infrastructure, specifically transformers and cables to avoid grid overload. There is a large demand for electrical equipment from transport projects to reduce congestion. Investment plans in the telecommunications sector also boost growth in the manufacturing of electrical wires and equipment," ABS said.

According to ABS, the company's energy sector also benefits greatly from the Power Plan VIII and the gradual completion of the legal framework. The company's debt is on a sharp decline, thereby helping to reduce financial costs and improve profit margins.

GELEX Electric is assessed by many securities companies as having positive long-term prospects.

VCBS Securities Company believes that GELEX's electrical equipment segment is benefiting in the long term from the VIII Power Plan as well as Vietnam's green energy transition.

In addition, some power construction and installation enterprises such as PC1 and TV2 on the stock exchange will also benefit when the number of power grid projects and works is accelerated in the coming period. In 2024, PC1's revenue will also skyrocket to VND10,078 billion, while TV2's revenue will increase to VND1,336 billion.

Minh Ngoc

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)